UNITED STATES DISTRICT COURT

SOUTHERN DISTRICT OF NEW YORK

FEDERAL HOUSING FINANCE AGENCY,

AS CONSERVATOR FOR THE FEDERAL

N

ATIONAL MORTGAGE ASSOCIATION

AND THE FEDERAL HOME LOAN

MORTGAGE CORPORATION,

Plaintiff,

-against-

MERRILL LYNCH & CO., INC.; MERRILL

LYNCH, PIERCE, FENNER & SMITH INC.;

MERRILL LYNCH MORTGAGE

LENDING, INC.; MERRILL LYNCH

MORTGAGE CAPITAL INC.; FIRST

FRANKLIN FINANCIAL CORP.; MERRILL

LYNCH MORTGAGE INVESTORS, INC.;

MERRILL LYNCH GOVERNMENT

SECURITIES, INC.; MATTHEW WHALEN;

BRIAN T. SULLIVAN; MICHAEL M.

MCGOVERN; DONALD J. PUGLISI; PAUL

PARK; and DONALD C. HAN,

Defendants.

___ CIV. ___ (___)

COMPLAINT

JURY TRIAL DEMANDED

i

TABLE OF CONTENTS

NATURE OF ACTION ...................................................................................................................1

PARTIES .........................................................................................................................................8

The Plaintiff and the GSEs ...................................................................................................8

The Defendants ....................................................................................................................9

The Non-Party Originators ................................................................................................12

JURISDICTION AND VENUE ....................................................................................................12

FACTUAL ALLEGATIONS ........................................................................................................13

I. THE SECURITIZATIONS ................................................................................................13

A. Residential Mortgage-Backed Securitizations In General .....................................13

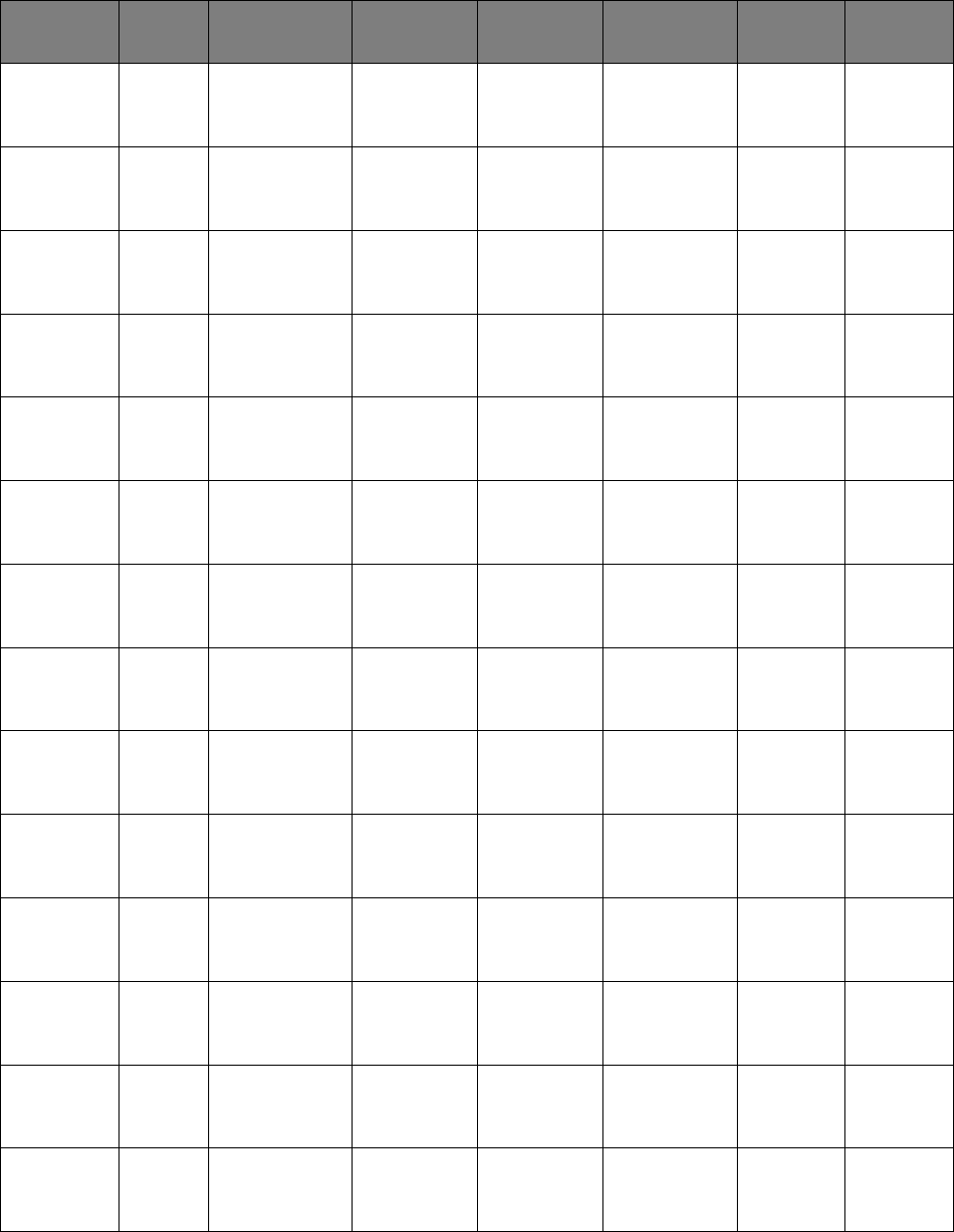

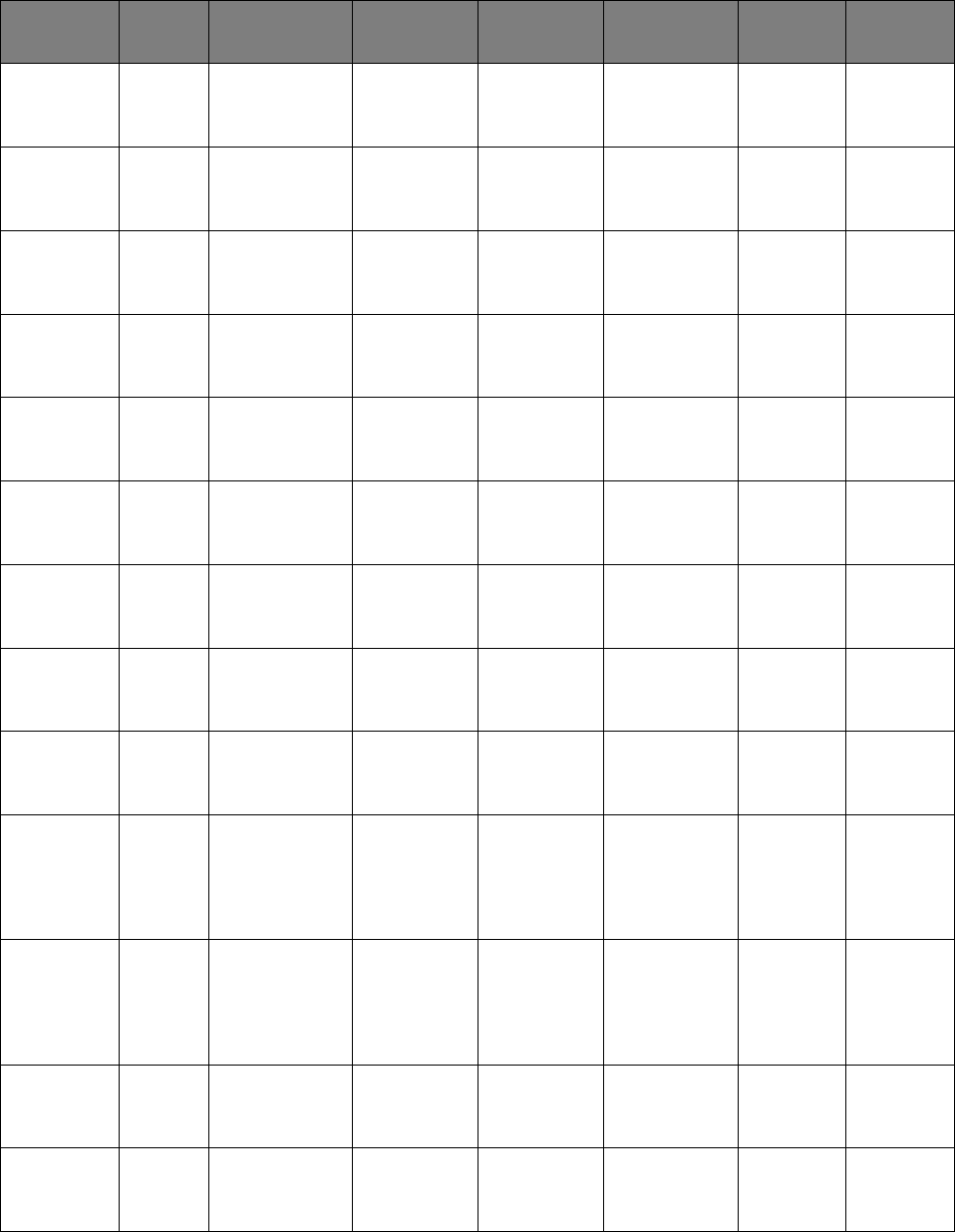

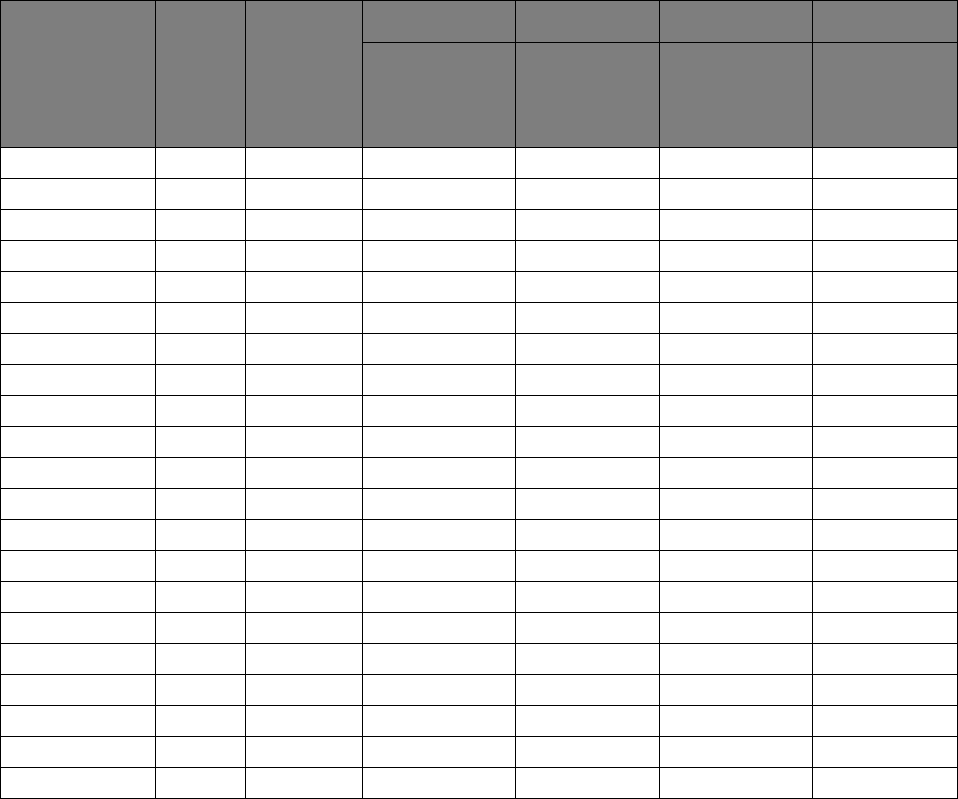

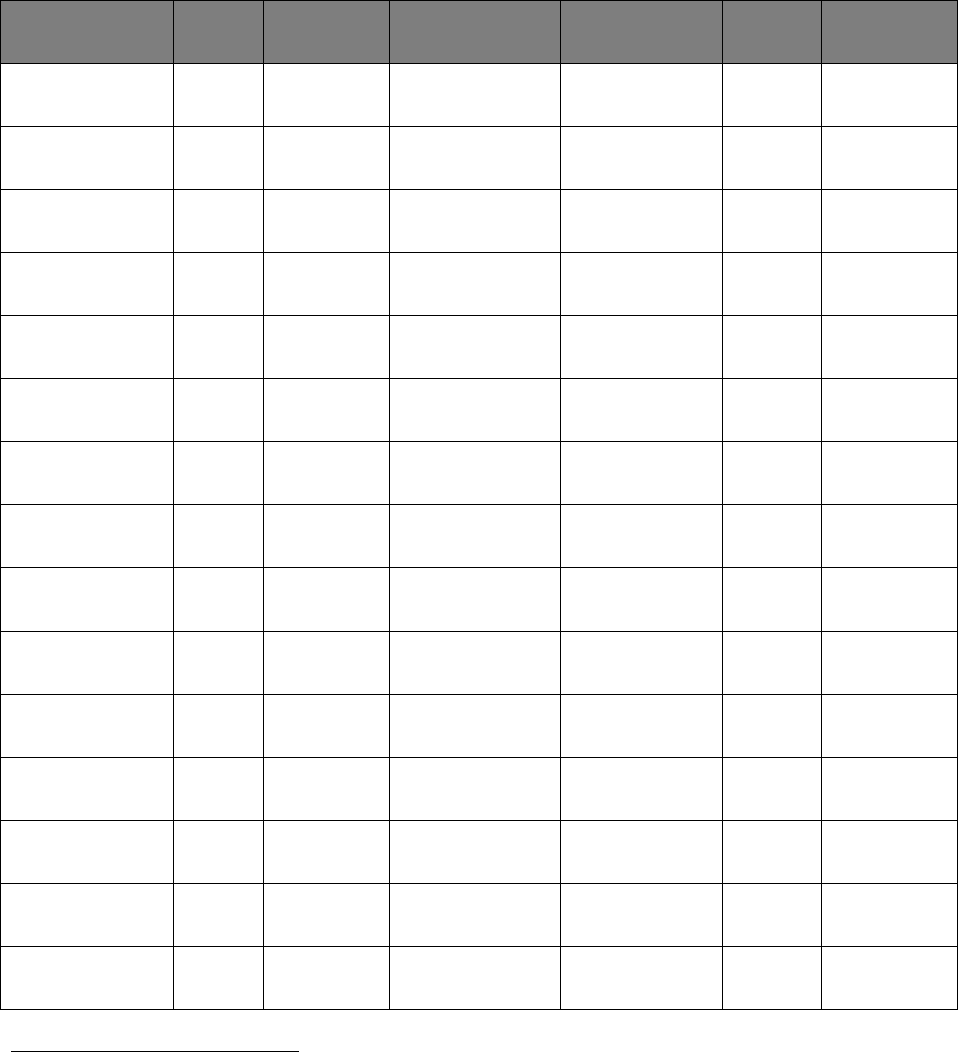

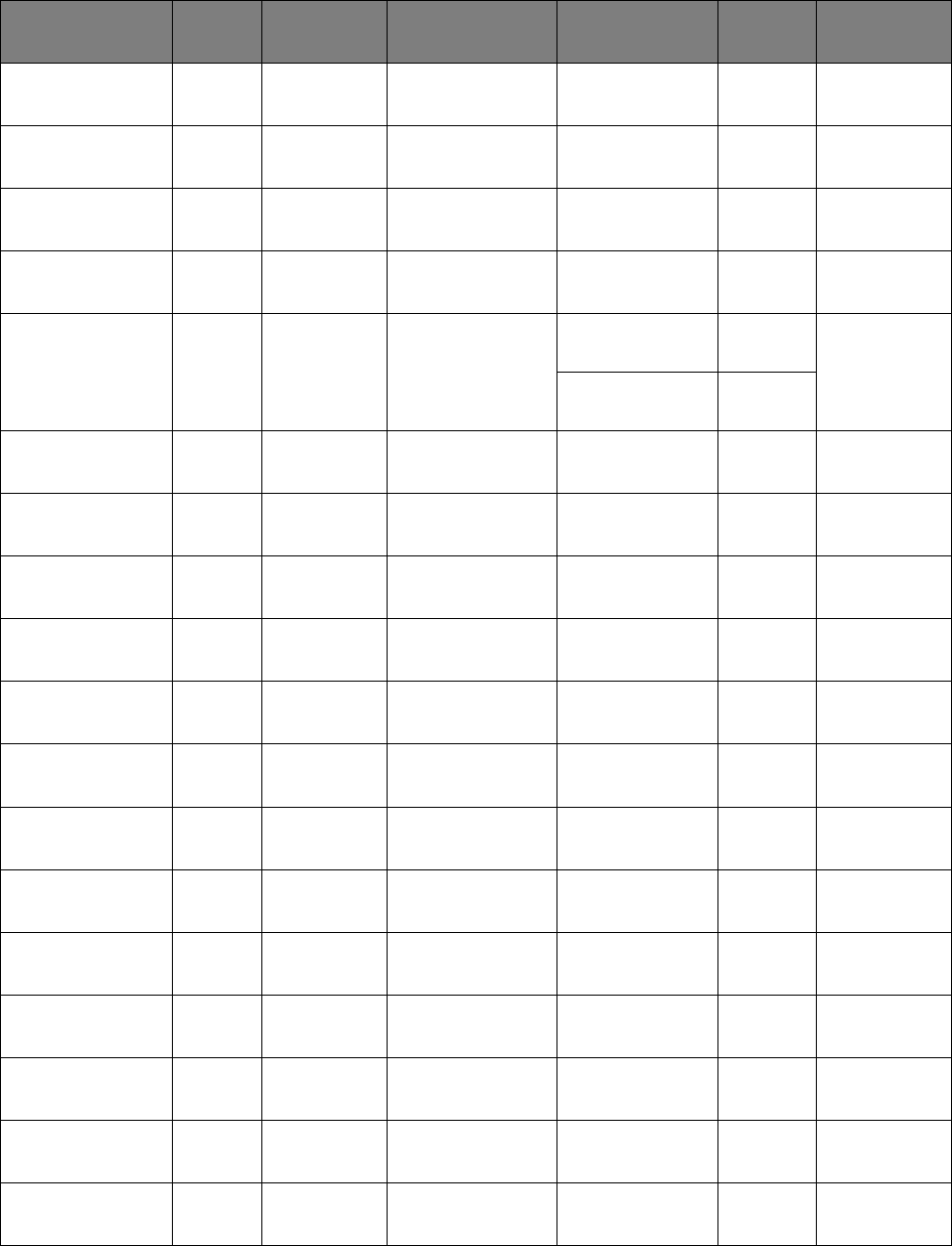

B. The Securitizations At Issue In This Case .............................................................15

C. The Securitization Process .....................................................................................22

1. Merrill Lynch Mortgage Lending, Merrill Lynch Mortgage

Capital, and First Franklin Financial Grouped Mortgage Loans in

Special Purpose Trusts ...............................................................................22

2. The Trusts Issue Securities Backed by the Loans ......................................23

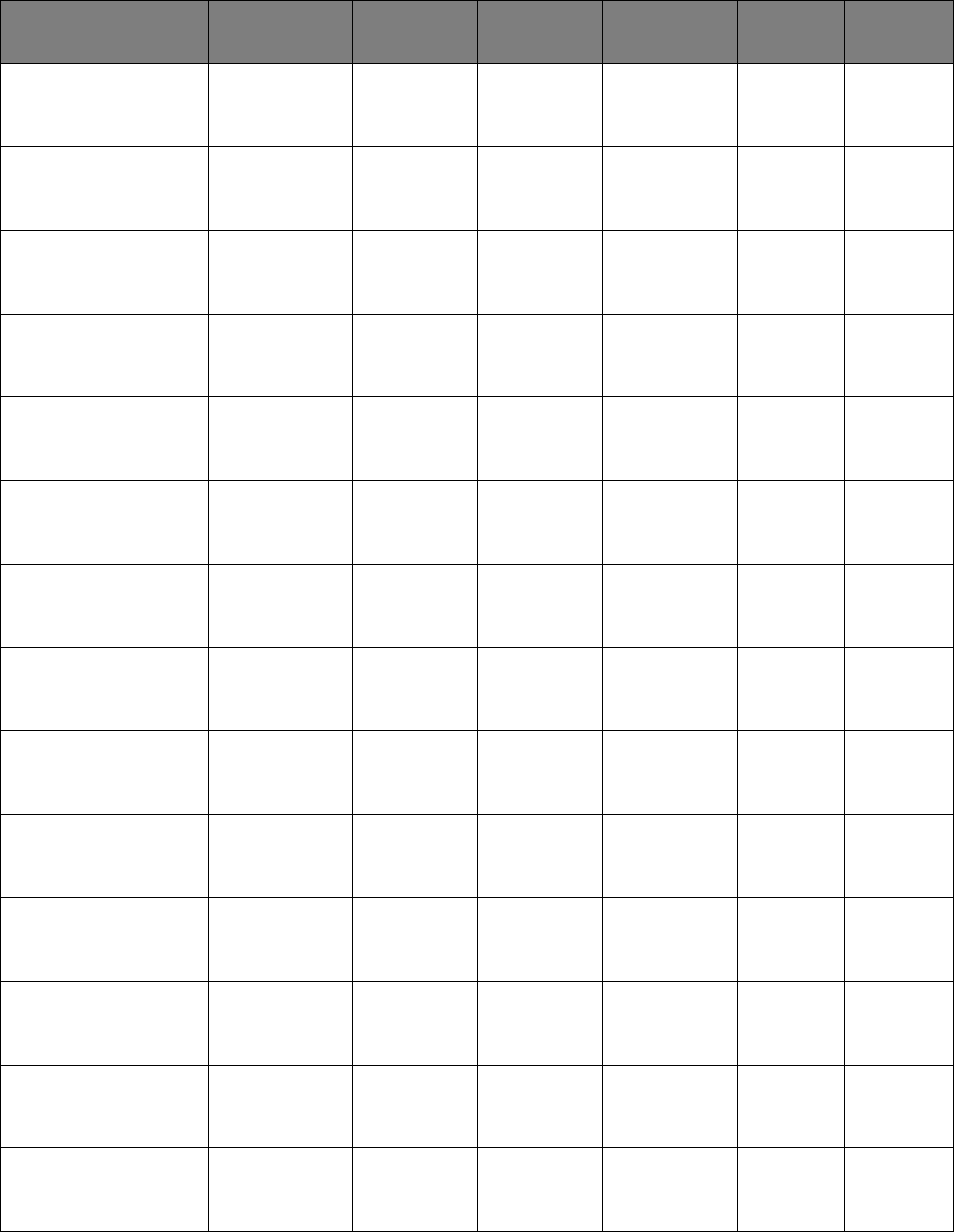

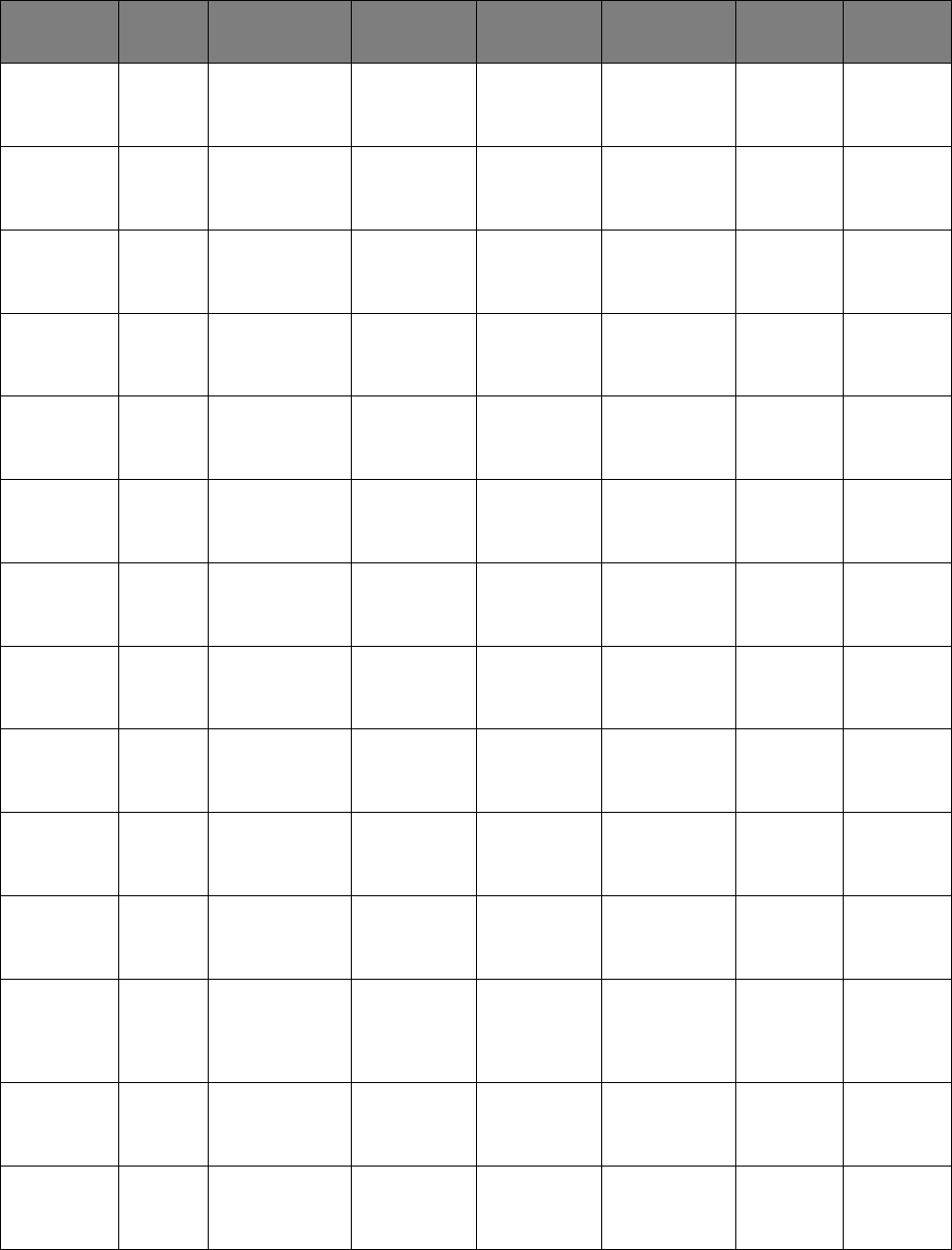

II. THE DEFENDANTS’ PARTICIPATION IN THE SECURITIZATION

PROCESS ..........................................................................................................................30

A. The Role of Each of the Defendants ......................................................................30

1. First Franklin Financial ..............................................................................31

2. Merrill Lynch Mortgage Capital ................................................................32

3. Merrill Lynch Mortgage Lending ..............................................................33

4. Merrill Lynch Mortgage Investors .............................................................34

5. Merrill Lynch, Pierce, Fenner & Smith .....................................................34

6. Merrill Lynch Government Securities .......................................................35

7. Merrill Lynch & Co. ..................................................................................35

ii

8. The Individual Defendants .........................................................................36

B. Defendant’s Failure To Conduct Proper Due Diligence ........................................38

III. THE REGISTRATION STATEMENTS AND THE PROSPECTUS

SUPPLEMENTS................................................................................................................41

A. Compliance With Underwriting Guidelines ..........................................................41

B. Statements Regarding Occupancy Status of Borrower ..........................................44

C. Statements Regarding Loan to Value Ratios .........................................................48

D. Statements Regarding Credit Ratings ....................................................................52

IV. FALSITY OF STATEMENTS IN THE REGISTRATION STATEMENTS AND

PROSPECTUS SUPPLEMENTS ......................................................................................57

A. The Statistical Data Provided in the Prospectus Supplements Concerning

Owner Occupancy and LTV Ratios Was Materially False ....................................57

1. Owner Occupancy Data Was Materially False ..........................................57

2. Loan to Value Data Was Materially False .................................................61

B. The Originators of the Underlying Mortgage Loans Systematically

Disregarded Their Underwriting Guidelines .........................................................66

1. Government Investigations Have Confirmed That the Originators

of the Loans in the Securitizations Systematically Failed to Adhere

to Their Underwriting Guidelines ..............................................................67

2. The Collapse of the Certificates’ Credit Ratings Further Indicates

that the Mortgage Loans were not Originated in Adherence to the

Stated Underwriting Guidelines .................................................................74

3. The Surge in Mortgage Delinquency and Default Further

Demonstrates that the Mortgage Loans Were Not Originated in

Adherence to the Stated Underwriting Guidelines ....................................77

V. MERRILL LYNCH KNEW THAT ITS REPRESENTATIONS WERE FALSE ............80

A. Evidence Regarding Merrill Lynch’s Due Diligence ............................................81

1. Merrill Lynch’s Due Diligence Benefitted From a Direct Window

Into the Originators’ Practices ...................................................................81

2. Merrill Lynch Mortgage Lending, Merrill Lynch Mortgage

Capital, First Franklin Financial, Merrill Lynch Mortgage

iii

Investors, Merrill Lynch, Pierce, Fenner & Smith, and Merrill

Lynch Government Securities Intentionally Misrepresented the

Risks Inherent in the Securitizations ..........................................................84

3. Merrill Lynch Recognized the Problems With Its RMBS and

Developed “De-Risking” and “Mitigation” Strategies While

Marketing Similar Securitizations to the GSEs .........................................91

VI. THE GSES JUSTIFIABLY RELIED ON MERRILL LYNCH’S

REPRESENTATIONS ......................................................................................................93

VII. FANNIE MAE’S AND FREDDIE MAC’S PURCHASES OF THE GSE

CERTIFICATES AND THE RESULTING DAMAGES .................................................95

FIRST CAUSE OF ACTION ......................................................................................................102

SECOND CAUSE OF ACTION .................................................................................................106

THIRD CAUSE OF ACTION .....................................................................................................110

FOURTH CAUSE OF ACTION .................................................................................................114

FIFTH CAUSE OF ACTION ......................................................................................................117

SIXTH CAUSE OF ACTION .....................................................................................................121

SEVENTH CAUSE OF ACTION ...............................................................................................125

EIGHTH CAUSE OF ACTION ..................................................................................................129

NINTH CAUSE OF ACTION .....................................................................................................133

TENTH CAUSE OF ACTION ....................................................................................................136

PRAYER FOR RELIEF ..............................................................................................................139

JURY TRIAL DEMANDED .......................................................................................................140

1

Plaintiff Federal Housing Finance Agency (“FHFA”), as conservator of The Federal

National Mortgage Association (“Fannie Mae”) and The Federal Home Loan Mortgage

Corporation (“Freddie Mac”), by its attorneys, Quinn Emanuel Urquhart & Sullivan, LLP, for its

Complaint herein against Merrill Lynch & Co., Inc. (“Merrill Lynch & Co.”), Merrill Lynch,

Pierce, Fenner & Smith Inc. (“Merrill Lynch, Pierce, Fenner & Smith”), Merrill Lynch Mortgage

Lending, Inc. (“Merrill Lynch Mortgage Lending”), Merrill Lynch Mortgage Capital Inc.

(“Merrill Lynch Mortgage Capital”), First Franklin Financial Corp. (“First Franklin Financial”),

Merrill Lynch Mortgage Investors, Inc. (“Merrill Lynch Mortgage Investors”), Merrill Lynch

Government Securities, Inc. (“Merrill Lynch Government Securities”) (collectively, “Merrill

Lynch”), Matthew Whalen, Brian T. Sullivan, Michael M. McGovern, Donald J. Puglisi, Paul

Park, and Donald C. Han (the “Individual Defendants”) (together with Merrill Lynch, the

“Defendants”) alleges as follows:

NATURE OF ACTION

1. This action arises out of Defendants’ actionable conduct in connection with the

offer and sale of certain residential mortgage-backed securities to Fannie Mae and Freddie Mac

(collectively, the “Government Sponsored Enterprises” or “GSEs”). These securities were sold

pursuant to registration statements, including prospectuses and prospectus supplements that

formed part of those registration statements, which contained materially false or misleading

statements and omissions. Defendants falsely represented that the underlying mortgage loans

complied with certain underwriting guidelines and standards, including representations that

significantly overstated the ability of the borrowers to repay their mortgage loans. These

representations were material to the GSEs, as reasonable investors, and their falsity violates

Sections 11, 12(a)(2), and 15 of the Securities Act of 1933, 15 U.S.C. § 77a et seq., Section 13.1-

522(A)(ii) and 13.1-522(C) of the Virginia Code, Sections 31-5606.05(a)(1)(B) and

2

31.5606.05(c) of the District of Columbia Code, and constitutes negligent misrepresentation,

common law fraud, and aiding and abetting fraud.

2. Between September 29, 2005 and October 10, 2007, Fannie Mae and Freddie Mac

purchased over $24.853 billion in residential mortgage-backed securities (the “GSE

Certificates”) issued in connection with 72 Merrill Lynch related entity-sponsored and/or Merrill

Lynch, Pierce, Fenner & Smith underwritten securitizations.

1

The GSE Certificates purchased

by Fannie Mae, along with the date and amount of the purchases, are listed infra in Table 12.

The GSE Certificates purchased by Freddie Mac, along with the date and amount of the

purchases, are listed infra in Table 13. The 72 securitizations (from which the GSEs purchased a

total of 88 Certificates) at issue are:

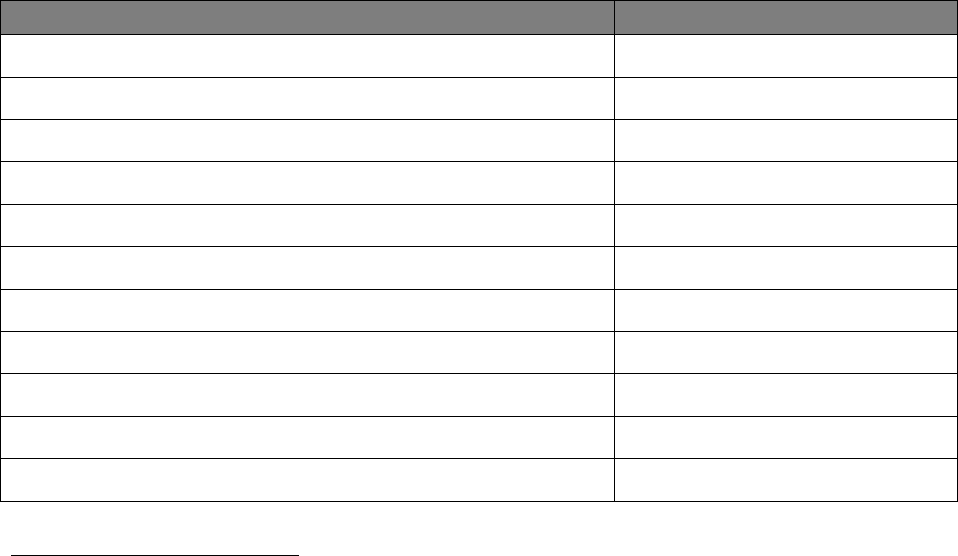

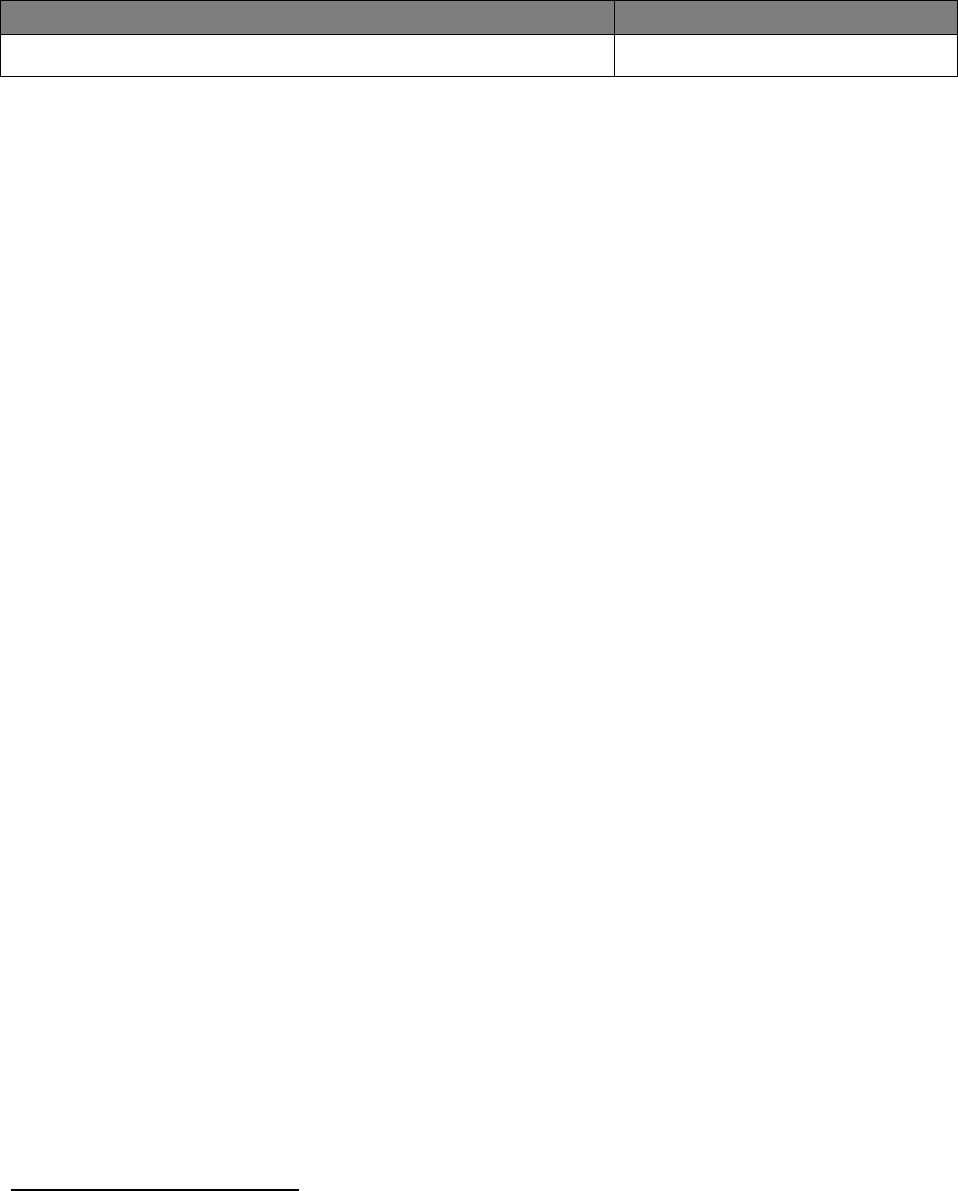

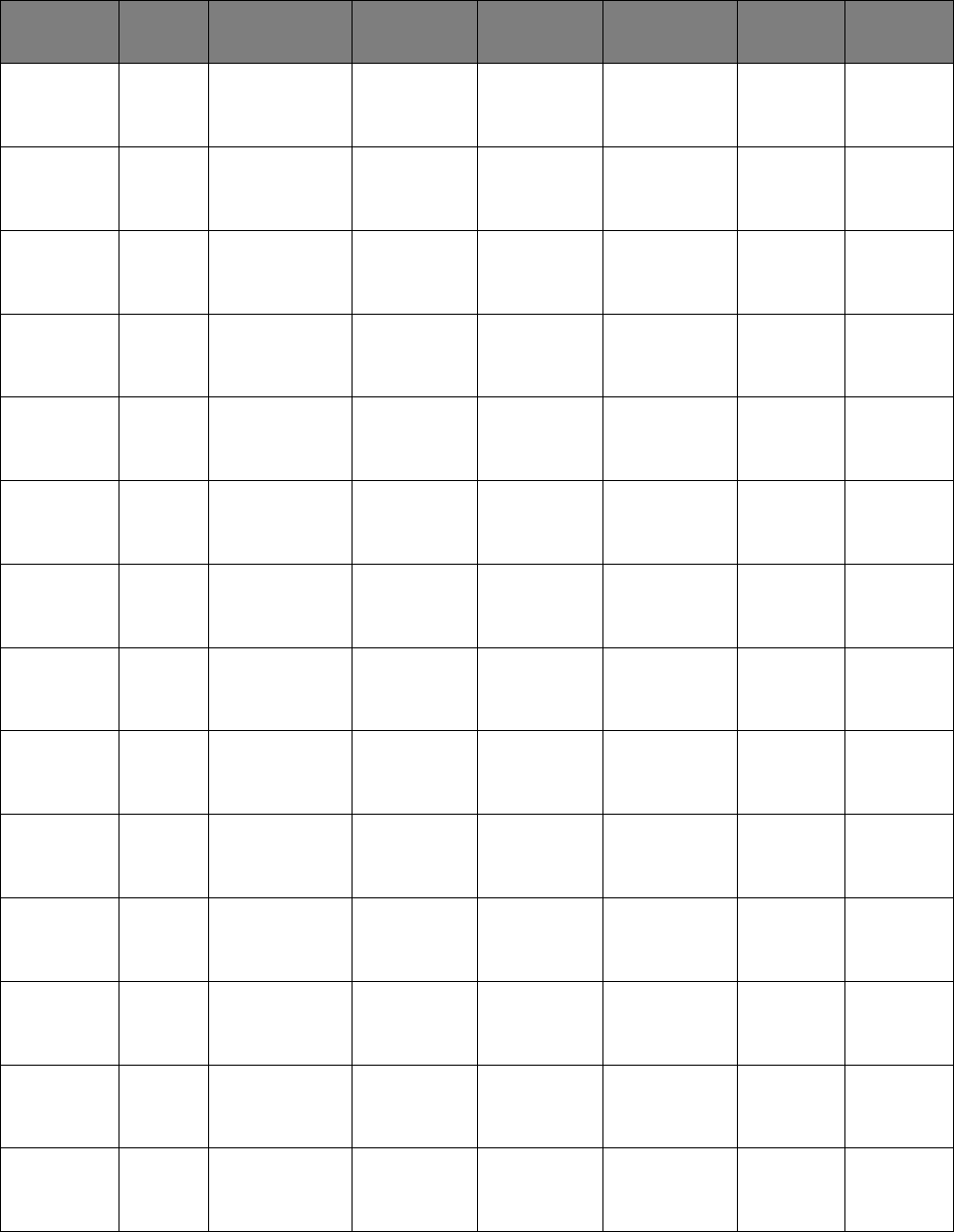

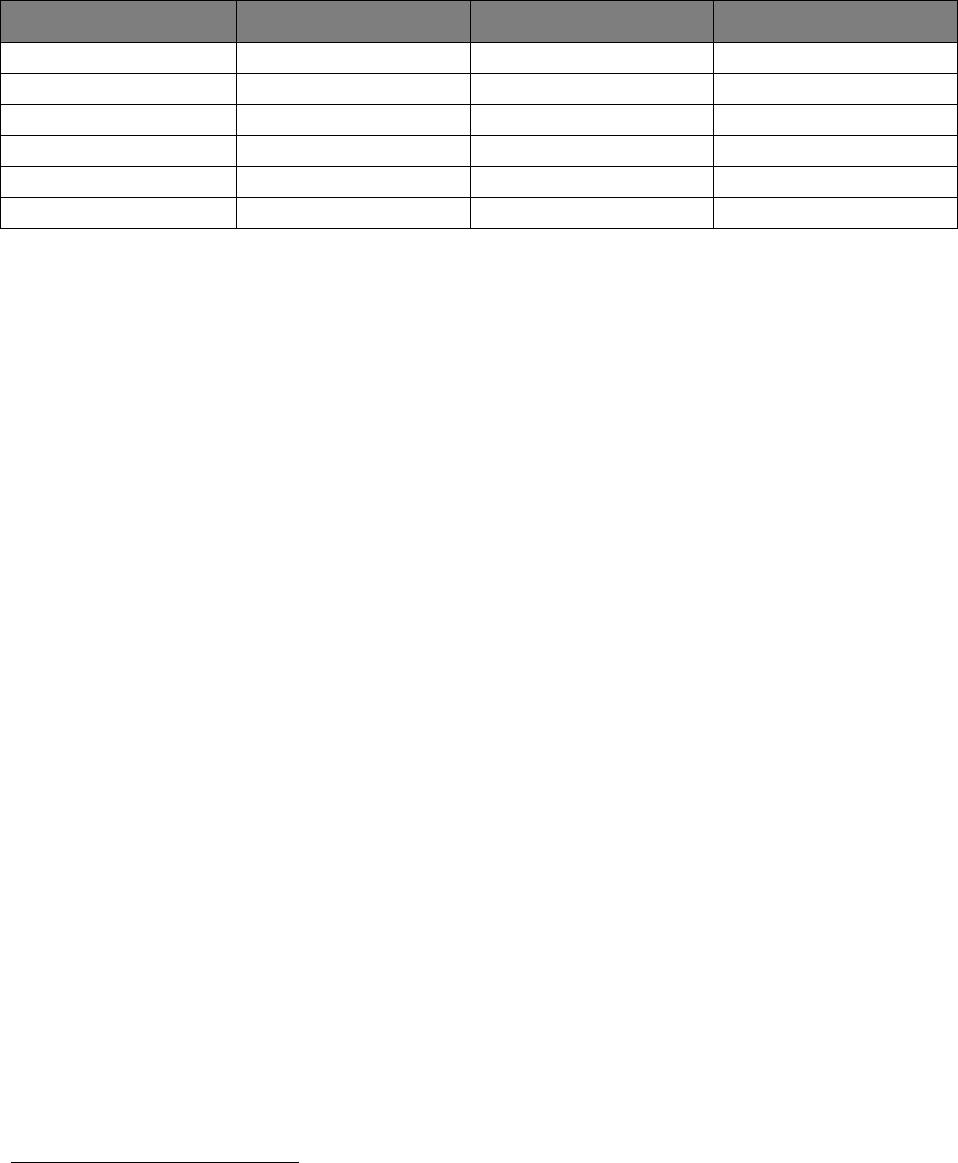

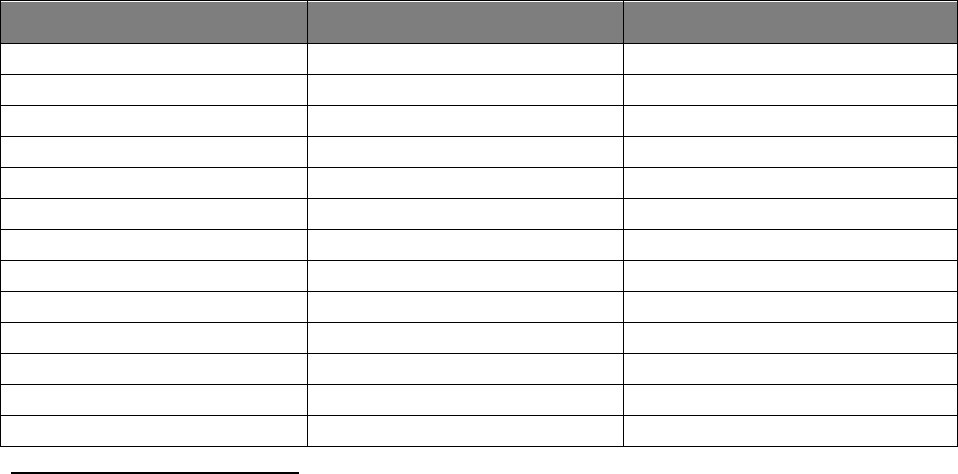

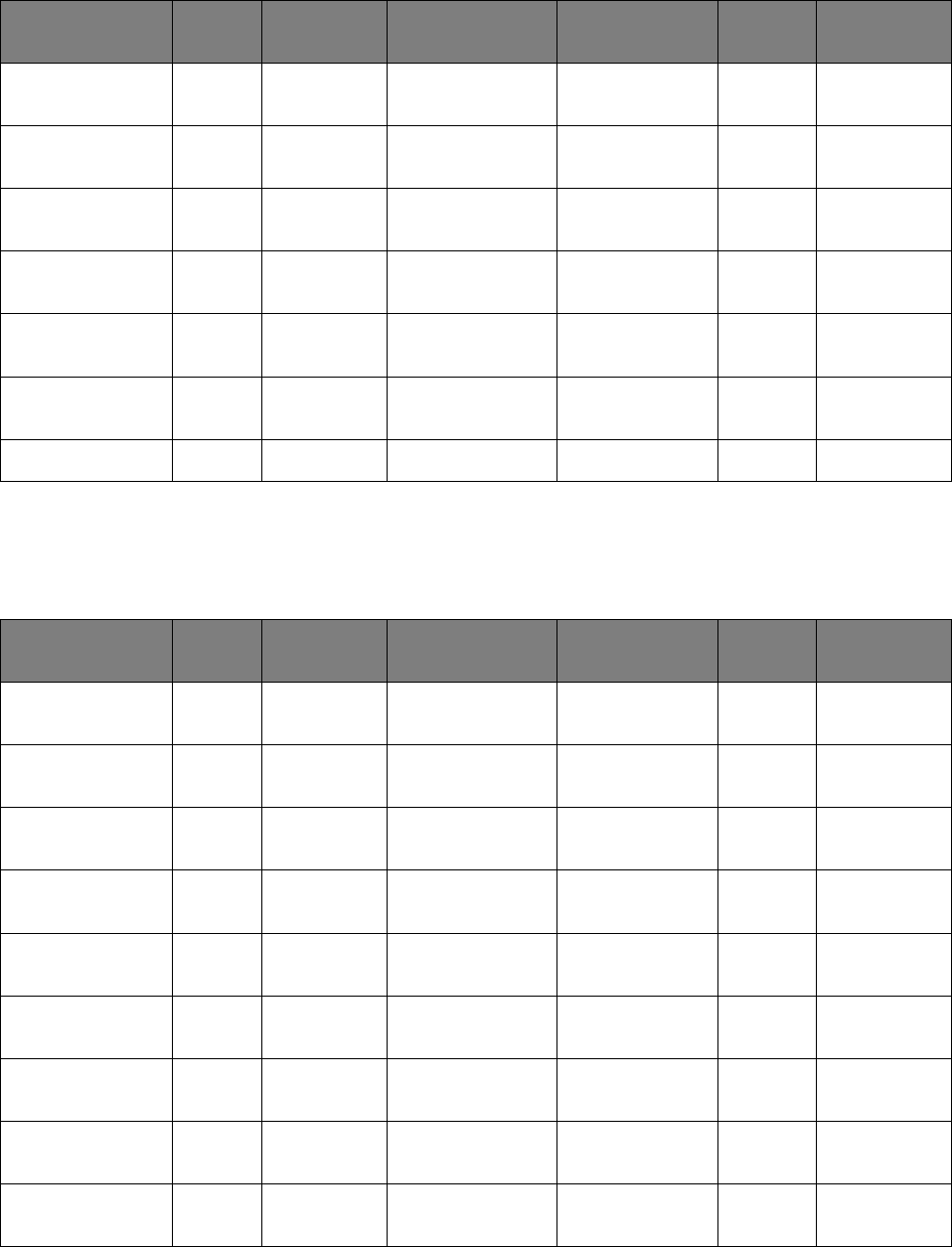

Table 1

Full Name Abbreviation

ARGENT SECURITIES INC., ASSET-BACKED PASS-THROUGH

CERTIFICATES, SERIES 2005-W4

ARSI 2005-W4

ARGENT SECURITIES INC., ASSET-BACKED PASS-THROUGH

CERTIFICATES, SERIES 2006-M1

ARSI 2006-M1

C-BASS MORTGAGE LOAN ASSET-BACKED CERTIFICATES, SERIES

2006-CB8

CBASS 2006-CB8

MERRILL LYNCH FIRST FRANKLIN MORTGAGE LOAN TRUST

MORTGAGE LOAN ASSET - BACKED CERTIFICATES, SERIES 2007-1

FFMER 2007-1

MERRILL LYNCH FIRST FRANKLIN MORTGAGE LOAN TRUST

MORTGAGE LOAN ASSET - BACKED CERTIFICATES, SERIES 2007-2

FFMER 2007-2

MERRILL LYNCH FIRST FRANKLIN MORTGAGE LOAN TRUST

MORTGAGE LOAN ASSET - BACKED CERTIFICATES, SERIES 2007-3

FFMER 2007-3

MERRILL LYNCH FIRST FRANKLIN MORTGAGE LOAN TRUST,

MORTGAGE LOAN ASSET - BACKED CERTIFICATES, SERIES 2007-4

FFMER 2007-4

MERRILL LYNCH FIRST FRANKLIN MORTGAGE LOAN TRUST

MORTGAGE LOAN ASSET - BACKED CERTIFICATES, SERIES 2007-5

FFMER 2007-5

MERRILL LYNCH FIRST FRANKLIN MORTGAGE LOAN TRUST

MORTGAGE LOAN ASSET - BACKED CERTIFICATES, SERIES 2007-H1

FFMER 2007-H1

FIRST FRANKLIN MORTGAGE LOAN TRUST MORTGAGE LOAN

ASSET-BACKED CERTIFICATES, SERIES 2005-FF12

FFML 2005-FF12

FIRST FRANKLIN MORTGAGE LOAN TRUST MORTGAGE LOAN

ASSET-BACKED CERTIFICATES, SERIES 2006-FF18

FFML 2006-FF18

1

For purposes of this Complaint, the securities issued under the Registration Statements

(as defined in note 3 below) are referred to as “Certificates,” while the particular Certificates that

Fannie Mae and Freddie Mac purchased are referred to as the “GSE Certificates.” Holders of

Certificates are referred to as “Certificateholders.”

3

Full Name Abbreviation

FIRST FRANKLIN MORTGAGE LOAN TRUST MORTGAGE LOAN ASSET

- BACKED CERTIFICATES, SERIES 2007-FF1

FFML 2007-FF1

FIRST FRANKLIN MORTGAGE LOAN TRUST MORTGAGE LOAN

ASSET-BACKED CERTIFICATES, SERIES 2006-FF2

FFML 2007-FF2

FIELDSTONE MORTGAGE INVESTMENT TRUST MORTGAGE-BACKED

NOTES, SERIES 2006-3

FMIC 2006-3

INDYMAC INDX MORTGAGE LOAN TRUST MORTGAGE PASS-

THROUGH CERTIFICATES, SERIES 2005-AR33

INDX 2005-AR33

INDYMAC INDX MORTGAGE LOAN TRUST MORTGAGE PASS-

THROUGH CERTIFICATES, SERIES 2006-AR5

INDX 2006-AR5

INDYMAC INDX MORTGAGE LOAN TRUST MORTGAGE PASS-

THROUGH CERTIFICATES, SERIES 2006-AR7

INDX 2006-AR7

INDYMAC INDX MORTGAGE LOAN TRUST, SERIES 2007-FLX4 INDX 2007-FLX4

INDYMAC INDX MORTGAGE LOAN TRUST, SERIES 2007-FLX5 INDX 2007-FLX5

INDYMAC INDX MORTGAGE LOAN TRUST, SERIES 2007-FLX6 INDX 2007-FLX6

MERRILL LYNCH ALTERNATIVE NOTE ASSET TRUST, SERIES 2007-A1 MANA 2007-A1

MERRILL LYNCH ALTERNATIVE NOTE ASSET TRUST, SERIES 2007-A2 MANA 2007-A2

MERRILL LYNCH ALTERNATIVE NOTE ASSET TRUST, SERIES 2007-A3 MANA 2007-A3

MERRILL LYNCH MORTGAGE INVESTORS TRUST, MORTGAGE LOAN

ASSET-BACKED CERTIFICATES, SERIES 2005-A8

MLMI 2005-A8

MERRILL LYNCH MORTGAGE INVESTORS TRUST MORTGAGE LOAN

ASSET BACKED CERTIFICATES, SERIES 2005-AR-1

MLMI 2005-AR1

MERRILL LYNCH MORTGAGE INVESTORS TRUST MORTGAGE LOAN

ASSET BACKED CERTIFICATES, SERIES 2005-HE2

MLMI 2005-HE2

MERRILL LYNCH MORTGAGE INVESTORS TRUST MORTGAGE LOAN

ASSET BACKED CERTIFICATES, SERIES 2005-HE3

MLMI 2005-HE3

MERRILL LYNCH MORTGAGE INVESTORS TRUST MORTGAGE PASS-

THROUGH CERTIFICATES, SERIES 2006-A3

MLMI 2006-A3

MERRILL LYNCH MORTGAGE INVESTORS TRUST MORTGAGE PASS-

THROUGH CERTIFICATES, SERIES 2006-AF2

MLMI 2006-AF2

MERRILL LYNCH MORTGAGE INVESTORS TRUST MORTGAGE LOAN

ASSET-BACKED CERTIFICATES, SERIES 2006-AHL1

MLMI 2006-AHL1

MERRILL LYNCH MORTGAGE INVESTORS TRUST MORTGAGE LOAN

ASSET-BACKED CERTIFICATES, SERIES 2006-AR1

MLMI 2006-AR1

MERRILL LYNCH MORTGAGE INVESTORS TRUST MORTGAGE LOAN

ASSET-BACKED CERTIFICATES, SERIES 2006-FF1

MLMI 2006-FF1

MERRILL LYNCH MORTGAGE INVESTORS TRUST MORTGAGE LOAN

ASSET-BACKED CERTIFICATES, SERIES 2006-FM1

MLMI 2006-FM1

MERRILL LYNCH MORTGAGE INVESTORS TRUST MORTGAGE LOAN

ASSET-BACKED CERTIFICATES, SERIES 2006-HE1

MLMI 2006-HE1

MERRILL LYNCH MORTGAGE INVESTORS TRUST MORTGAGE LOAN

ASSET-BACKED CERTIFICATES, SERIES 2006-HE4

MLMI 2006-HE4

MERRILL LYNCH MORTGAGE INVESTORS TRUST MORTGAGE LOAN

ASSET-BACKED CERTIFICATES, SERIES 2006-HE5

MLMI 2006-HE5

MERRILL LYNCH MORTGAGE INVESTORS TRUST MORTGAGE LOAN

ASSET-BACKED CERTIFICATES, SERIES 2006-HE6

MLMI 2006-HE6

MERRILL LYNCH MORTGAGE INVESTORS TRUST MORTGAGE LOAN

ASSET-BACKED CERTIFICATES, SERIES 2006-MLN1

MLMI 2006-MLN1

MERRILL LYNCH MORTGAGE INVESTORS TRUST MORTGAGE LOAN

ASSET-BACKED CERTIFICATES, SERIES 2006-OPT1

MLMI 2006-OPT1

MERRILL LYNCH MORTGAGE INVESTORS TRUST MORTGAGE LOAN

ASSET -- BACKED CERTIFICATES, SERIES 2006-RM1

MLMI 2006-RM1

MERRILL LYNCH MORTGAGE INVESTORS TRUST MORTGAGE LOAN

ASSET -- BACKED CERTIFICATES, SERIES 2006-RM2

MLMI 2006-RM2

MERRILL LYNCH MORTGAGE INVESTORS TRUST MORTGAGE LOAN

ASSET -- BACKED CERTIFICATES, SERIES 2006-RM3

MLMI 2006-RM3

4

Full Name Abbreviation

MERRILL LYNCH MORTGAGE INVESTORS TRUST MORTGAGE LOAN

ASSET -- BACKED CERTIFICATES, SERIES 2006-RM4

MLMI 2006-RM4

MERRILL LYNCH MORTGAGE INVESTORS TRUST MORTGAGE LOAN

ASSET -- BACKED CERTIFICATES, SERIES 2006-RM5

MLMI 2006-RM5

MERRILL LYNCH MORTGAGE INVESTORS TRUST MORTGAGE LOAN

ASSET-BACKED CERTIFICATES, SERIES 2006-WMC1

MLMI 2006-WMC1

MERRILL LYNCH MORTGAGE INVESTORS TRUST MORTGAGE LOAN

ASSET-BACKED CERTIFICATES, SERIES 2006-WMC2

MLMI 2006-WMC2

MERRILL LYNCH MORTGAGE INVESTORS TRUST MORTGAGE LOAN

ASSET BACKED CERTIFICATES, SERIES 2007-HE1

MLMI 2007-HE1

MERRILL LYNCH MORTGAGE INVESTORS TRUST MORTGAGE LOAN

ASSET BACKED CERTIFICATES, SERIES 2007-HE2

MLMI 2007-HE2

MERRILL LYNCH MORTGAGE INVESTORS TRUST MORTGAGE LOAN

ASSET BACKED CERTIFICATES, SERIES 2007-MLN1

MLMI 2007-MLN1

OPTION ONE MORTGAGE LOAN TRUST ASSET-BACKED

CERTIFICATES, SERIES 2007-1

OOMLT 2007-1

OWNIT MORTGAGE LOAN TRUST MORTGAGE LOAN ASSET BACKED

CERTIFICATES, SERIES 2005-4

OWNIT 2005-4

OWNIT MORTGAGE LOAN TRUST MORTGAGE LOAN ASSET BACKED

CERTIFICATES, SERIES 2005-5

OWNIT 2005-5

OWNIT MORTGAGE LOAN TRUST LOAN ASSET-BACKED

CERTIFICATES, SERIES 2006-1

OWNIT 2006-1

OWNIT MORTGAGE LOAN TRUST MORTGAGE LOAN ASSET-BACKED

CERTIFICATES, SERIES 2006-2

OWNIT 2006-2

OWNIT MORTGAGE LOAN TRUST MORTGAGE LOAN ASSET-BACKED

CERTIFICATES, SERIES 2006-3

OWNIT 2006-3

OWNIT MORTGAGE LOAN TRUST MORTGAGE LOAN ASSET-BACKED

CERTIFICATES, SERIES 2006-4

OWNIT 2006-4

OWNIT MORTGAGE LOAN TRUST MORTGAGE LOAN ASSET-BACKED

CERTIFICATES, SERIES 2006-5

OWNIT 2006-5

OWNIT MORTGAGE LOAN TRUST MORTGAGE LOAN ASSET-BACKED

CERTIFICATES, SERIES 2006-6

OWNIT 2006-6

OWNIT MORTGAGE LOAN TRUST MORTGAGE LOAN ASSET-BACKED

CERTIFICATES, SERIES 2006-7

OWNIT 2006-7

SPECIALTY UNDERWRITING AND RESIDENTIAL FINANCE TRUST

MORTGAGE LOAN ASSET-BACKED CERTIFICATES, SERIES 2005- AB3

SURF 2005-AB3

SPECIALTY UNDERWRITING AND RESIDENTIAL FINANCE TRUST

MORTGAGE LOAN ASSET-BACKED CERTIFICATES, SERIES 2005- BC3

SURF 2005-BC3

SPECIALTY UNDERWRITING AND RESIDENTIAL FINANCE TRUST

MORTGAGE LOAN ASSET-BACKED CERTIFICATES, SERIES 2005- BC4

SURF 2005-BC4

SPECIALTY UNDERWRITING AND RESIDENTIAL FINANCE TRUST

MORTGAGE LOAN ASSET-BACKED CERTIFICATES, SERIES 2006-AB2

SURF 2006-AB2

SPECIALTY UNDERWRITING AND RESIDENTIAL FINANCE TRUST

MORTGAGE LOAN ASSET-BACKED CERTIFICATES, SERIES 2006- AB3

SURF 2006-AB3

SPECIALTY UNDERWRITING AND RESIDENTIAL FINANCE TRUST

MORTGAGE LOAN ASSET-BACKED CERTIFICATES, SERIES 2006- BC1

SURF 2006-BC1

SPECIALTY UNDERWRITING AND RESIDENTIAL FINANCE TRUST

MORTGAGE LOAN ASSET-BACKED CERTIFICATES, SERIES 2006- BC2

SURF 2006-BC2

SPECIALTY UNDERWRITING AND RESIDENTIAL FINANCE TRUST

MORTGAGE LOAN ASSET-BACKED CERTIFICATES, SERIES 2006- BC3

SURF 2006-BC3

SPECIALTY UNDERWRITING AND RESIDENTIAL FINANCE TRUST

MORTGAGE LOAN ASSET-BACKED CERTIFICATES, SERIES 2006- BC4

SURF 2006-BC4

SPECIALTY UNDERWRITING AND RESIDENTIAL FINANCE TRUST

MORTGAGE LOAN ASSET-BACKED CERTIFICATES, SERIES 2006- BC5

SURF 2006-BC5

SPECIALTY UNDERWRITING AND RESIDENTIAL FINANCE TRUST

MORTGAGE LOAN ASSET-BACKED CERTIFICATES, SERIES 2007- AB1

SURF 2007-AB1

SPECIALTY UNDERWRITING AND RESIDENTIAL FINANCE TRUST

MORTGAGE LOAN ASSET-BACKED CERTIFICATES, SERIES 2007- BC1

SURF 2007-BC1

5

Full Name Abbreviation

SPECIALTY UNDERWRITING AND RESIDENTIAL FINANCE TRUST

MORTGAGE LOAN ASSET-BACKED CERTIFICATES, SERIES 2007- BC2

SURF 2007-BC2

(collectively, the “Securitizations”).

3. The Certificates were offered for sale pursuant to one of ten shelf registration

statements (the “Shelf Registration Statements”) filed with the Securities and Exchange

Commission (the “SEC”). Defendant Merrill Lynch Mortgage Investors filed three Shelf

Registration Statements that pertained to 62 of the 72 Securitizations at issue in this action. The

Individual Defendants signed one or more of the three Shelf Registration Statements, and, the

amendments thereto. Argent Securities Inc., IndyMac MBS Inc., Fieldstone Mortgage

Investment Corp., and Option One Mortgage Acceptance Corp. each filed one or more of the

seven remaining Shelf Registration Statements. With respect to all of the Securitizations, Merrill

Lynch, Pierce, Fenner & Smith was the lead underwriter or co-lead underwriter. With respect to

the Certificates purchased by Freddie Mac, all but one were purchased from Merrill Lynch,

Pierce, Fenner & Smith; and, with respect to the Certificates purchased by Fannie Mae, all but

one were purchased from Merrill Lynch Government Securities.

4. For each Securitization, a prospectus (“Prospectus”) and prospectus supplement

(“Prospectus Supplement”) were filed with the SEC as part of the Registration Statement

2

for

that Securitization. The GSE Certificates were marketed and sold to Fannie Mae and Freddie

Mac pursuant to the Registration Statements, including the Shelf Registration Statements and the

corresponding Prospectuses and Prospectus Supplements.

2

The term “Registration Statement,” as used herein, incorporates the Shelf Registration

Statement, the Prospectus, and the Prospectus Supplement for each referenced Securitization,

except where otherwise indicated.

6

5. The Registration Statements contained statements about the characteristics and

credit quality of the mortgage loans underlying the Securitizations, the creditworthiness of the

borrowers of those underlying mortgage loans, and the origination and underwriting practices

used to make and approve the loans. Such statements were material to a reasonable investor’s

decision to invest in mortgage-backed securities by purchasing the Certificates. Unbeknownst to

Fannie Mae and Freddie Mac, these statements were materially false, as significant percentages

of the underlying mortgage loans were not originated in accordance with the represented

underwriting standards and origination practices, and had materially poorer credit quality than

what was represented in the Registration Statements.

6. The Registration Statements also contained statistical summaries of the groups of

mortgage loans in each Securitization, such as the percentage of loans secured by owner-

occupied properties and the percentage of the loan group’s aggregate principal balance with

loan-to-value ratios within specified ranges. This information was also material to reasonable

investors. However, a loan level analysis of a sample of loans for each Securitization – a review

that encompassed thousands of mortgages across all of the Securitizations – has revealed that

these statistics were also false and omitted material facts due to widespread falsification of

borrowers’ incomes and debts, inflated property values and misstatements of other key

characteristics of the mortgage loans.

7. For example, the percentage of owner-occupied properties is a material risk factor

to the purchasers of Certificates, such as Fannie Mae and Freddie Mac, since a borrower who

lives in a mortgaged property is generally less likely to stop paying his or her mortgage and more

likely to take better care of the property. The loan level review reveals that the true percentage

of owner-occupied properties for the loans supporting the GSE Certificates was materially lower

7

than what was stated in the Prospectus Supplements. Likewise, the Prospectus Supplements

misrepresented other material factors, including the true value of the mortgaged properties

relative to the amount of the underlying loans, and the actual ability of the individual mortgage

holders to satisfy their debts.

8. Defendants Merrill Lynch, Pierce, Fenner & Smith (which lead underwrote or co-

lead underwrote the Certificates, and sold the Certificates to Freddie Mac), Merrill Lynch

Government Securities (which sold the Certificates to Fannie Mae), Merrill Lynch Mortgage

Investors (which acted as the depositor in 62 of the Securitizations), and the Individual

Defendants (who signed the Registration Statements with respect to 62 of the Securitizations) are

directly responsible for the misstatements and omissions of material fact contained in the

Registration Statements because they prepared, signed, filed, and/or used these documents to

market and sell the Certificates to Fannie Mae and Freddie Mac.

9. Defendants Merrill Lynch Mortgage Lending, Merrill Lynch Mortgage Capital,

First Franklin Financial, and Merrill Lynch & Co. are also responsible for the misstatements and

omissions of material fact contained in the Registration Statements by virtue of their direction

and control over Defendants Merrill Lynch, Pierce, Fenner & Smith, Merrill Lynch Government

Securities, and Merrill Lynch Mortgage Investors. Merrill Lynch & Co. directly participated in

and exercised dominion and control over the business operations of Defendants Merrill Lynch,

Pierce, Fenner & Smith, Merrill Lynch Government Securities, and Merrill Lynch Mortgage

Investors.

10. Fannie Mae and Freddie Mac purchased over $24.853 billion of the Certificates

pursuant to the Registration Statements filed with the SEC. These documents contained

misstatements and omissions of material facts concerning the quality of the underlying mortgage

8

loans, the creditworthiness of the borrowers, and the practices used to originate such loans. As a

result of Defendants’ misstatements and omissions of material fact, Fannie Mae and Freddie Mac

have suffered substantial losses as the value of their holdings has significantly deteriorated.

11. FHFA, as Conservator of Fannie Mae and Freddie Mac, brings this action against

the Defendants for violations of Sections 11, 12(a)(2), and 15 of the Securities Act of 1933, 15

U.S.C. §§ 77k, 77(a)(2), 77o, Section 13.1-522(A)(ii) and 13.1-522(C) of the Virginia Code,

Sections 31-5606.05(a)(1)(B) and 31-5606.05(c) of the District of Columbia Code, and for

negligent misrepresentation, common law fraud, and aiding and abetting fraud.

PARTIES

The Plaintiff and the GSEs

12. The Federal Housing Finance Agency is a federal agency located at 1700 G

Street, NW in Washington, D.C. FHFA was created on July 30, 2008 pursuant to the Housing

and Economic Recovery Act of 2008 (“HERA”), Pub. L. No. 110-289, 122 Stat. 2654 (2008)

(codified at 12 U.S.C. § 4617), to oversee Fannie Mae, Freddie Mac, and the Federal Home Loan

Banks. On September 6, 2008, under HERA, the Director of FHFA placed Fannie Mae and

Freddie Mac into conservatorship and appointed FHFA as conservator. In that capacity, FHFA

has the authority to exercise all rights and remedies of the GSEs, including but not limited to, the

authority to bring suits on behalf of and/or for the benefit of Fannie Mae and Freddie Mac. 12

U.S.C. § 4617(b)(2).

13. Fannie Mae and Freddie Mac are government-sponsored enterprises chartered by

Congress with a mission to provide liquidity, stability and affordability to the United States

housing and mortgage markets. As part of this mission, Fannie Mae and Freddie Mac invested in

residential mortgage-backed securities. Fannie Mae is located at 3900 Wisconsin Avenue, NW

in Washington, D.C. Freddie Mac is located at 8200 Jones Branch Drive in McLean, Virginia.

9

The Defendants

14. Defendant Merrill Lynch & Co., is the ultimate parent corporation of all of the

Merrill Lynch Defendants. It is a Delaware corporation with its principal executive office

located at 4 World Financial Center, 250 Vesey Street, New York, New York 10080. It is a

holding company that, through its subsidiaries, purports to be a leading global trader and

underwriter of securities and derivatives across a broad range of asset classes and serves as a

strategic advisor to corporations, governments, institutions and individuals worldwide. On

January 1, 2009, Merrill Lynch & Co. became a wholly owned subsidiary of Bank of America

Corporation.

15. Defendant Merrill Lynch Mortgage Lending, is a Delaware corporation with its

principal place of business located at 4 World Financial Center, 250 Vesey Street, New York,

New York 10080. It is a wholly owned subsidiary of Merrill Lynch Mortgage Capital. It is

engaged in the business of, among other things, acquiring residential mortgage loans and selling

those loans through Securitization programs. It acted as the sponsor or co-sponsor for 55 of the

Securitizations at issue.

16. Defendant Merrill Lynch Mortgage Capital is a Delaware corporation with its

principal place of business located at One Bryant Park, New York, New York 10036. It is a

wholly owned subsidiary of Merrill Lynch & Co. It is engaged in the business of, among other

things, acquiring residential mortgage loans and selling those loans through Securitization

programs. It acted as the co-sponsor for one of the Securitizations at issue in this action.

17. Defendant First Franklin Financial is a Georgia corporation with its principal

place of business located at 2150 North 1

st

Street, San Jose, California 95131. It is a wholly

owned subsidiary of Merrill Lynch Mortgage Capital. First Franklin Financial regularly engaged

in business in New York including, without limitation, extending loans. It is engaged in the

10

business of, among other things, acquiring residential mortgage loans and selling those loans

through Securitization programs. It acted as the sponsor for five of the Securitizations at issue in

this action.

18. Defendant Merrill Lynch, Pierce, Fenner & Smith is a Delaware corporation and

registered broker-dealer with its principal place of business located at 4 World Financial Center,

250 Vesey Street, New York, New York 10080. Merrill Lynch, Pierce, Fenner & Smith acted as

the lead underwriter or co-lead underwriter for each Securitization, and as the underwriter

participated in the drafting and dissemination of the Offering Materials pursuant to which the

Certificates were sold to Fannie Mae and Freddie Mac. Defendant Merrill Lynch, Pierce, Fenner

& Smith was the lead underwriter or co-lead underwriter for each of the 72 Securitizations, and

was intimately involved in the offerings. Furthermore, Freddie Mac purchased 47 of the GSE

Certificates from Merrill Lynch, Pierce, Fenner & Smith.

19. Defendant Merrill Lynch Mortgage Investors, is a Delaware corporation and an

indirect subsidiary of Merrill Lynch & Co., with its principal place of business located at 4

World Financial Center, 250 Vesey Street, New York, New York 10080. It was the depositor for

62 of the Securitizations at issue here, the registrant for three of the Registration Statements filed

with the SEC, and the issuer for certain of the offerings at issue in this action. The depositor is

considered the issuer of the Certificates within the meaning of Section 2(a)(4) of the Securities

Act of 1933, 15 U.S.C. § 77b(a)(4), and in accordance with Section 11(a), 15 U.S.C. § 77k(a).

Merrill Lynch Mortgage Investors, as depositor, was also responsible for preparing and filing

reports required under the Securities Exchange Act of 1934.

20. Defendant Merrill Lynch Government Securities, is a Delaware corporation with

its principal place of business located at One Bryant Park, New York, NY 10036. It is a wholly

11

owned subsidiary of Merrill Lynch & Co. Fannie Mae purchased 39 of the GSE Certificates

from Merrill Lynch Government Securities.

3

21. Defendant Matthew Whalen served at the time of the Securitizations as President

and Chairman of the Board of Directors of Merrill Lynch Mortgage Investors, and worked in

New York. Defendant Whalen signed two of the Shelf Registration Statements and the

amendments thereto that are at issue in this action, and did so in New York.

22. Defendant Brian T. Sullivan served at the time of the Securitizations as the Vice

President, Treasurer (Principal Financial Officer), and Controller of Merrill Lynch Mortgage

Investors, and worked in New York. Defendant Sullivan signed three of the Shelf Registration

Statements and two of the amendments thereto that are at issue in this action, and did so in New

York.

23. Defendant Michael M. McGovern served at the time of the Securitizations as a

Director of Merrill Lynch Mortgage Investors and Senior Counsel of Merrill Lynch, and worked

in New York. Defendant McGovern signed three of the Shelf Registration Statements and the

amendments thereto that are at issue in this action, and did so in New York.

24. Defendant Donald J. Puglisi served at the time of the Securitizations as a Director

of Merrill Lynch Mortgage Investors, and worked in New York. Defendant Puglisi signed three

of the Shelf Registration Statements and the amendments thereto that are at issue in this action,

and did so in New York.

25. Defendant Paul Park served at the time of the Securitizations as the President and

Chairman of the Board of Directors of Merrill Lynch Mortgage Investors, and worked in New

3

The two remaining GSE Certificates were purchased by Fannie Mae and Freddie Mac

from Lehman Brothers, Inc.

12

York. Defendant Park signed one of the Shelf Registration Statements and the amendments

thereto that are at issue in this action, and did so in New York.

26. Defendant Donald C. Han served at the time of the Securitizations as the

Treasurer of Merrill Lynch Mortgage Investors, and worked in New York. Defendant Han

signed one of the Shelf Registration Statements that is at issue in this action., and did so in New

York

The Non-Party Originators

27. The loans underlying the Certificates were acquired by the sponsor for each

Securitization from non-party mortgage originators.

4

The originators principally responsible for

the loans underlying the Certificates were First NLC Financial Services, LLC. (“First NLC”);

ResMAE Mortgage Corporation (“ResMAE”); WMC Mortgage Corp. (“WMC”); GreenPoint

Mortgage Funding, Inc. (“GreenPoint”); Fremont Investment & Loan (“Fremont”); National City

Mortgage Co. (“National City”); and Option One Mortgage Corporation (“Option One”).

JURISDICTION AND VENUE

28. Jurisdiction of this Court is founded upon 28 U.S.C. § 1345, which gives federal

courts original jurisdiction over claims brought by FHFA in its capacity as conservator of Fannie

Mae and Freddie Mac.

29. Jurisdiction of this Court is also founded upon 28 U.S.C. § 1331 because the

Securities Act claims asserted herein arise under Sections 11, 12(a)(2), and 15 of the Securities

4

Defendants Merrill Lynch Mortgage Lending, Merrill Lynch Mortgage Capital, and

First Franklin Financial were the sponsors for 60 of the 72 Securitizations. The remaining 12

Securitizations had sponsors who are not parties. Ameriquest Mortgage Company, Credit-Based

Asset Servicing and Securitization LLC, Fieldstone Investment Corp., IndyMac Bank F.S.B, and

Option One Mortgage Corp. each were the sponsors for one or more of those 12 Securitizations.

13

Act of 1933, 15 U.S.C. §§ 77k, 77l(a)(2), and 77o. This Court further has jurisdiction over the

Securities Act claims pursuant to Section 22 of the Securities Act of 1933, 15 U.S.C. § 77v.

30. This Court has jurisdiction over the statutory claims of violations of Sections

13.1-522(A)(ii) and 13.1-522(C) of the Virginia Code and Sections 31-5606.05(a)(1)(B) and 31-

5606.05(c) of the District of Columbia Code pursuant to this Court’s supplemental jurisdiction

under 28 U.S.C. § 1367(a). This Court also has jurisdiction over the common law claims of

negligent misrepresentation, fraud, and aiding and abetting fraud pursuant to this Court’s

supplemental jurisdiction under 28 U.S.C. § 1367(a).

31. Venue is proper in this district pursuant to Section 22 of the Securities Act of

1933, 15 U.S.C. § 77v, and 28 U.S.C. § 1391(b). The Merrill Lynch Defendants do business in

or derive substantial revenue from activities carried out in New York and all but one of the

Merrill Lynch Defendants, including the parent company Merrill Lynch & Co., have their

principal place of business in the state. Many of the acts and transactions alleged herein,

including the preparation and dissemination of the Registration Statements, occurred in

substantial part in the State of New York. Additionally, the GSE Certificates were actively

marketed and sold from this State, and several of the Defendants can be found and transact

business in this District. Defendants are also subject to personal jurisdiction in this District.

FACTUAL ALLEGATIONS

I. THE SECURITIZATIONS

A. Residential Mortgage-Backed Securitizations In General

32. Asset-backed securitization distributes risk by pooling cash-producing financial

assets and issuing securities backed by those pools of assets. In residential mortgage-backed

securitizations, the cash-producing financial assets are residential mortgage loans.

14

33. The most common form of securitization of mortgage loans involves a sponsor –

the entity that acquires or originates the mortgage loans and initiates the securitization – and the

creation of a trust, to which the sponsor directly or indirectly transfers a portfolio of mortgage

loans. The trust is established pursuant to a Pooling and Servicing Agreement entered into by,

among others, the “depositor” for that securitization. In many instances, the transfer of assets to

a trust “is a two-step process: the financial assets are transferred by the sponsor first to an

intermediate entity, often a limited purpose entity created by the sponsor . . . and commonly

called a depositor, and then the depositor will transfer the assets to the [trust] for the particular

asset-backed transactions.” Asset-Backed Securities, Securities Act Release No. 33-8518,

Exchange Act Release No. 34-50905, 84 SEC Docket 1624 (Dec. 22, 2004).

34. Residential mortgage-backed securities are backed by the underlying mortgage

loans. Some residential mortgage-backed securitizations are created from more than one cohort

of loans called collateral groups, in which case the trust issues securities backed by different

groups. For example, a securitization may involve two groups of mortgages, with some

securities backed primarily by the first group, and others primarily by the second group.

Purchasers of the securities acquire an ownership interest in the assets of the trust, which in turn

owns the loans. Within this framework, the purchasers of the securities acquire rights to the

cash-flows from the designated mortgage group, such as homeowners’ payments of principal and

interest on the mortgage loans held by the related trust.

35. Residential mortgage-backed securities are issued pursuant to registration

statements filed with the SEC. These registration statements include prospectuses, which explain

the general structure of the investment, and prospectus supplements, which contain detailed

descriptions of the mortgage groups underlying the certificates. Certificates are issued by the

15

trust pursuant to the registration statement and the prospectus and prospectus supplement.

Underwriters sell the certificates to investors.

36. A mortgage servicer is necessary to manage the collection of proceeds from the

mortgage loans. The servicer is responsible for collecting homeowners’ mortgage loan

payments, which the servicer remits to the trustee after deducting a monthly servicing fee. The

servicer’s duties include making collection efforts on delinquent loans, initiating foreclosure

proceedings, and determining when to charge off a loan by writing down its balance. The

servicer is required to report key information about the loans to the trustee. The trustee (or trust

administrator) administers the trust’s funds and delivers payments due each month on the

certificates to the investors.

B. The Securitizations At Issue In This Case

37. This case involves the 72 Securitizations listed in paragraph 2 supra, 60 of which

were sponsored by Merrill Lynch Mortgage Lending, Merrill Lynch Mortgage Capital, and First

Franklin Financial Corporation and all of which were underwritten by Merrill Lynch, Pierce,

Fenner & Smith. For each of the 72 Securitizations, Table 2 identifies: (1) the sponsor; (2) the

depositor; (3) the lead underwriter; (4) the principal amount issued for the tranches

5

purchased

by the GSEs; (5) the date of issuance; and (6) the loan group or groups backing the GSE

Certificate for that Securitization (referred to as the “Supporting Loan Groups”).

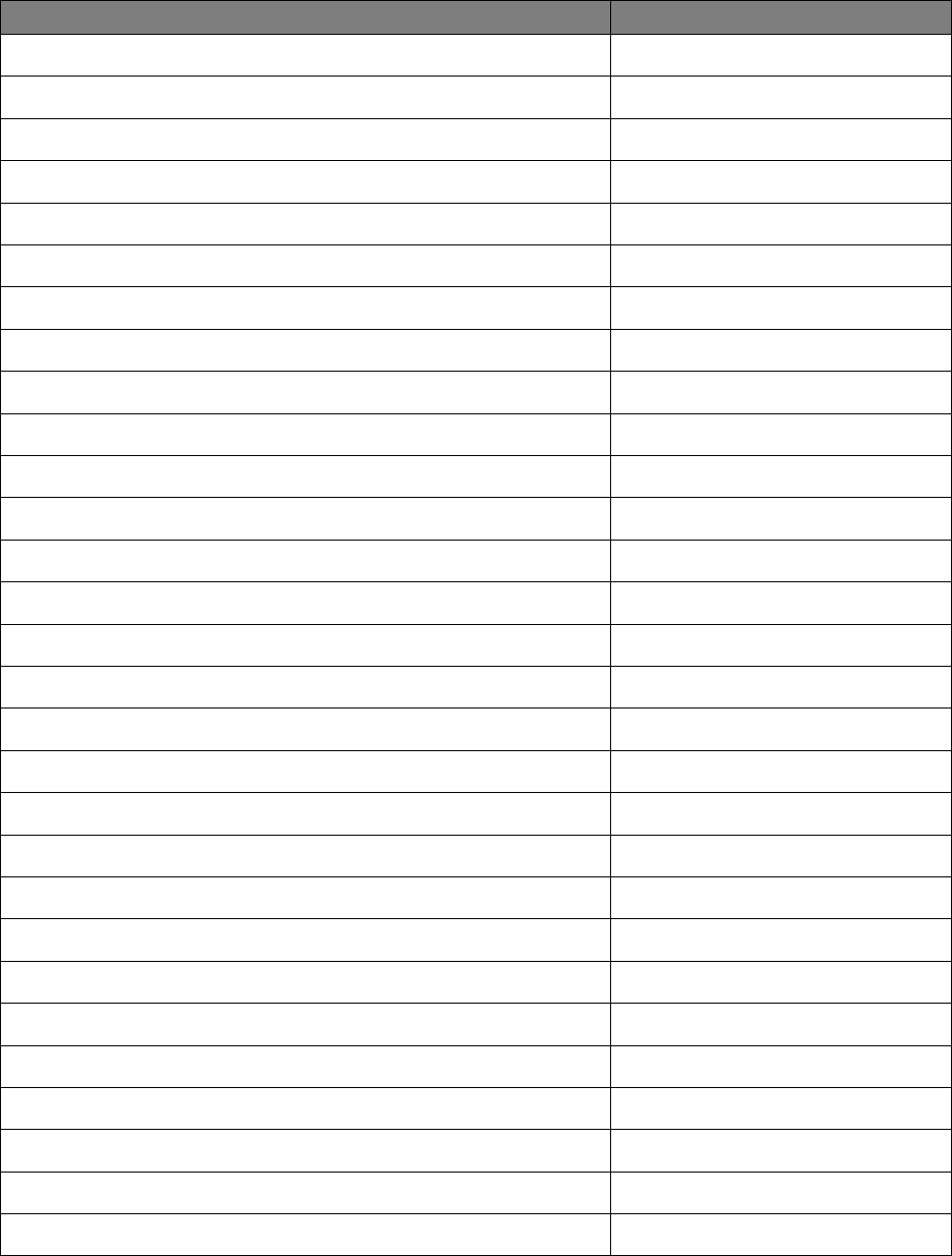

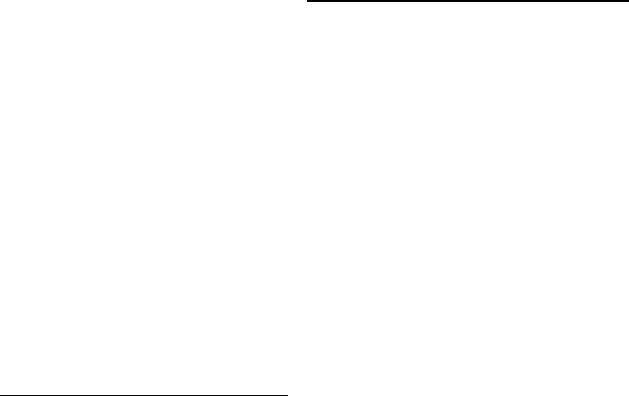

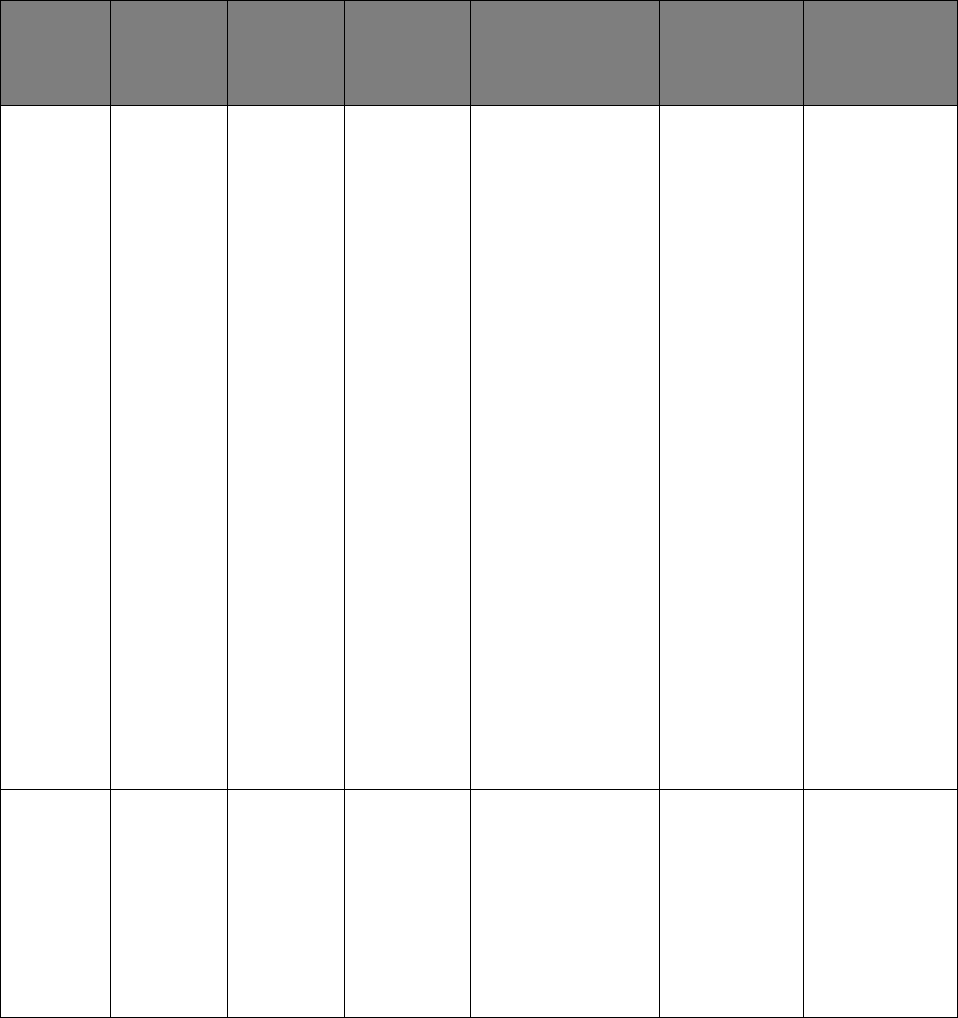

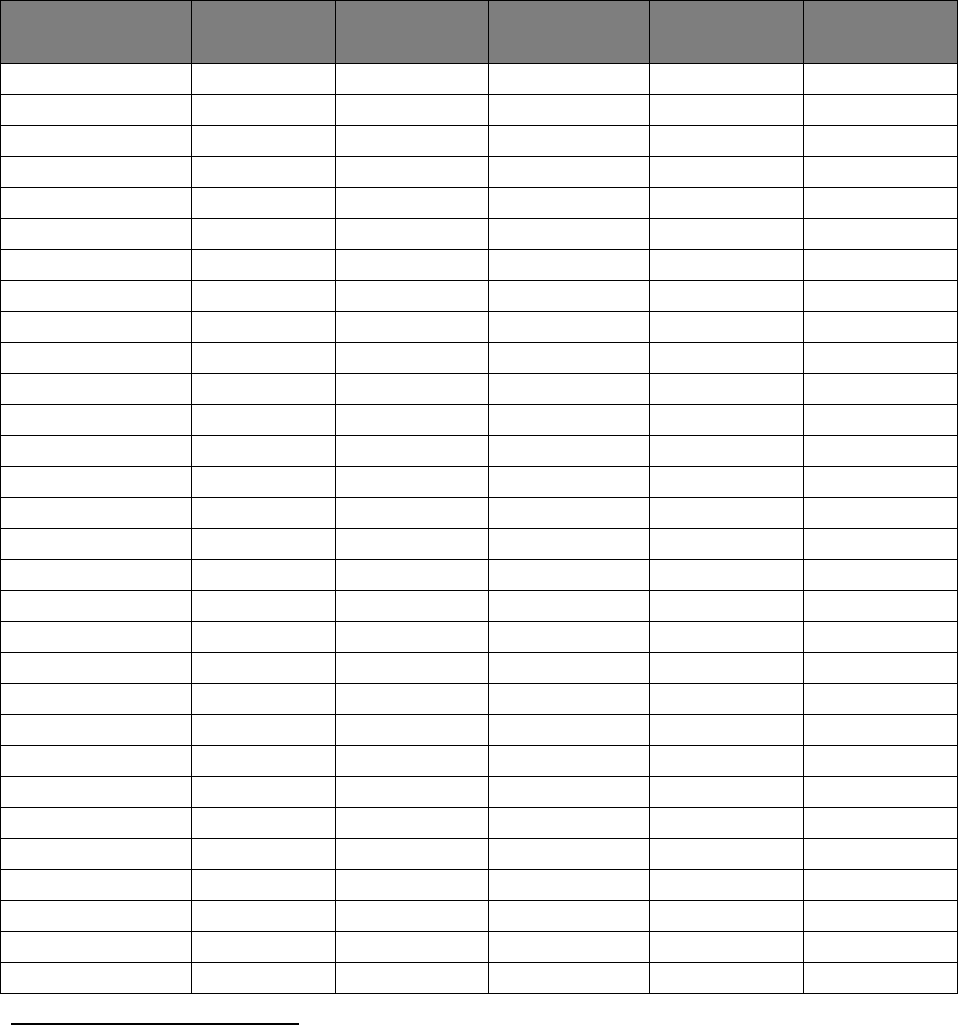

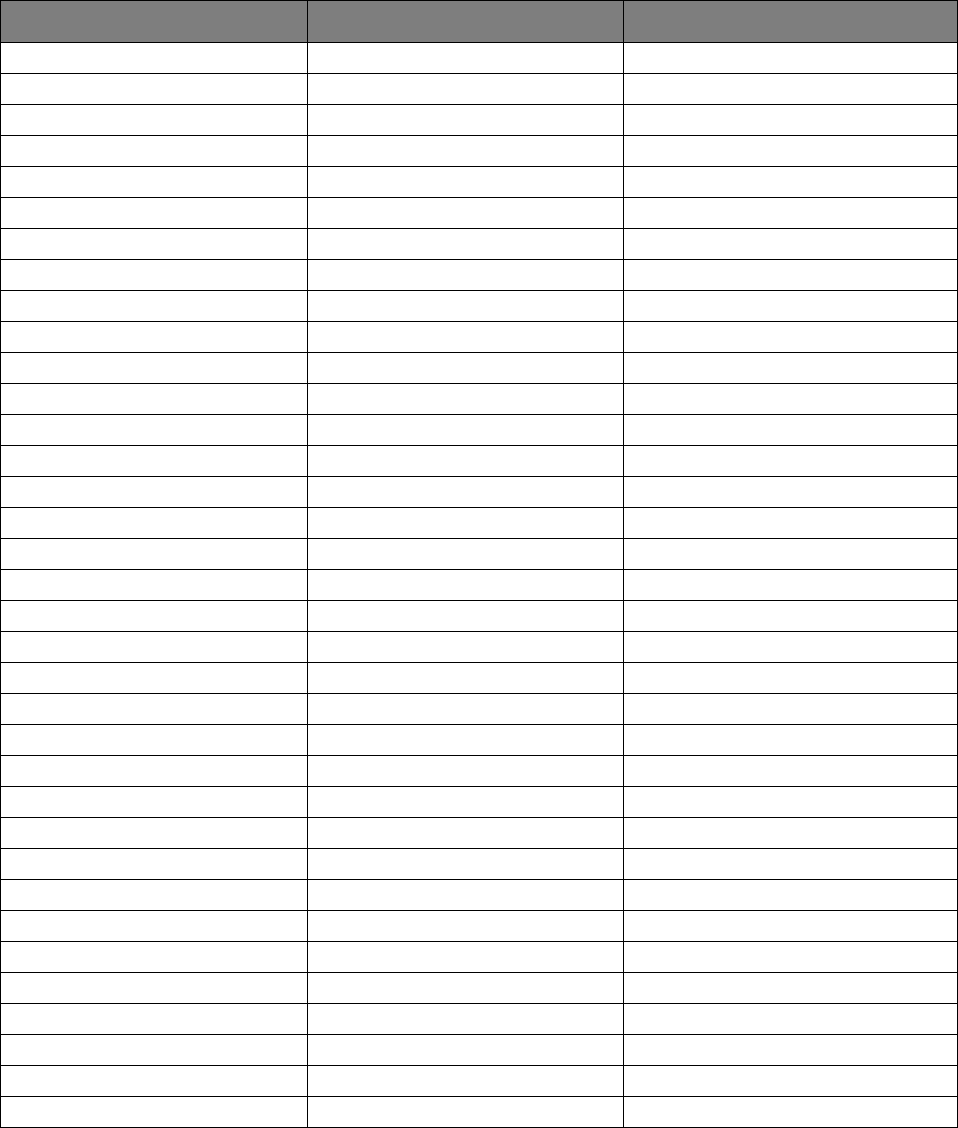

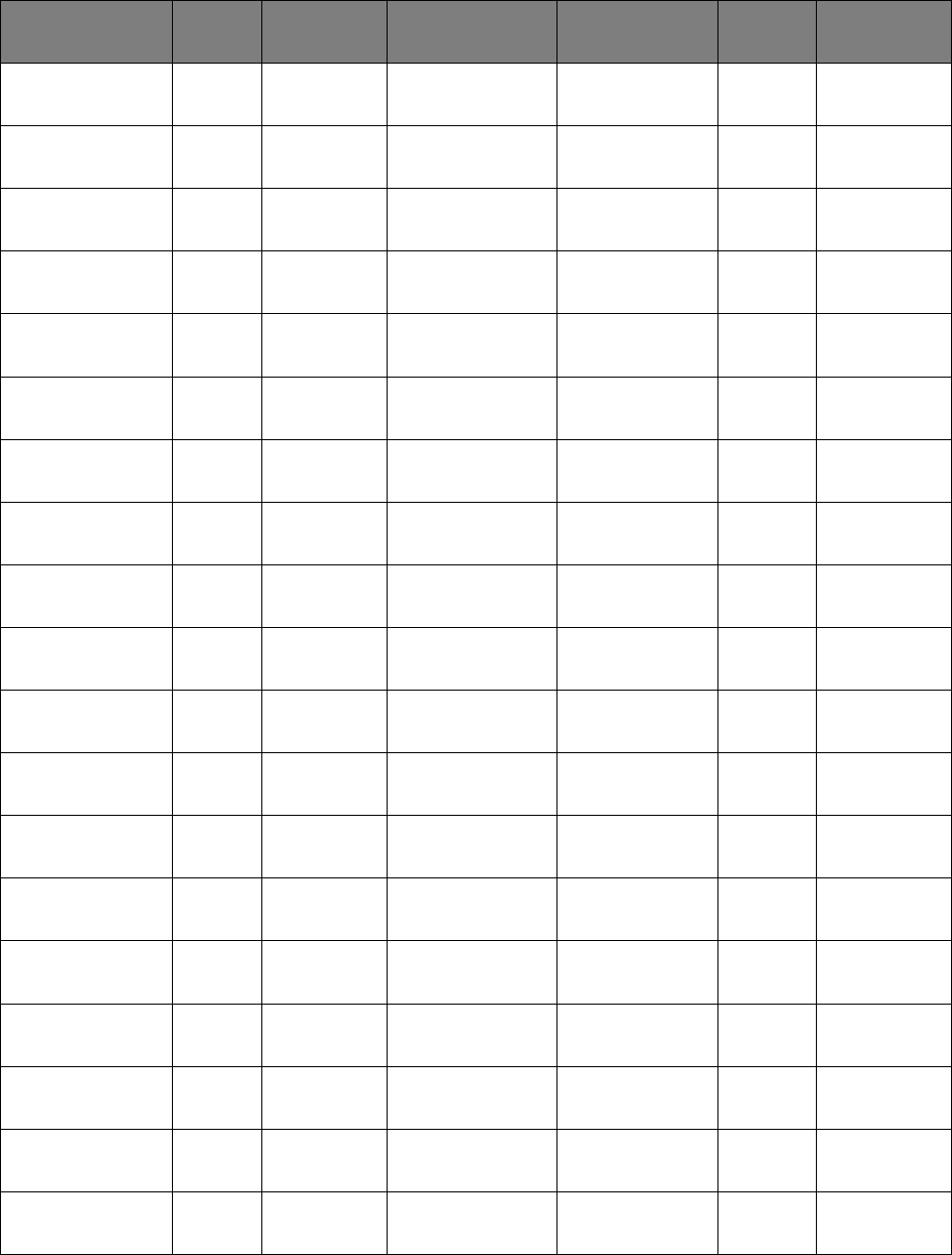

Table 2

Transaction Tranche Sponsor/Seller Depositor Lead

Underwriter

Principal

Amount

Issued ($)

Date of

Issuance

Supporting

Loan

Group(s)

ARSI 2005-

W4

A1B Ameriquest

Mortgage

Company

Argent

Securities,

Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$344,465,000 November

22, 2005

Group 1

5

A tranche is one of a series of certificates or interests created and issued as part of the

same transaction.

16

Transaction Tranche Sponsor/Seller Depositor Lead

Underwriter

Principal

Amount

Issued ($)

Date of

Issuance

Supporting

Loan

Group(s)

ARSI 2005-

W4

A1A2 Ameriquest

Mortgage

Company

Argent

Securities,

Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$687,112,000 November

22, 2005

Group 1

ARSI 2005-

W4

A1A3 Ameriquest

Mortgage

Company

Argent

Securities,

Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$151,807,000 November

22, 2005

Group 1

ARSI 2006-

M1

A1 Ameriquest

Mortgage

Company

Argent

Securities,

Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$1,401,905,000 June 28,

2006

Group 1

CBASS

2006-CB8

A1 Credit-Based

Asset Servicing

and

Securitization,

LLC

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$183,951,000 October 30,

2006

Group I

FFMER

2007-1

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$725,544,000 On or about

March 27,

2007

Group I

FFMER

2007-2

A1 First Franklin

Financial

Corporation

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$588,366,000 April 26,

2007

Group I

FFMER

2007-3

A1A First Franklin

Financial

Corporation

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$285,760,000 May 30,

2007

Group I

FFMER

2007-3

A1C First Franklin

Financial

Corporation

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$205,174,000 May 30,

2007

Group I

FFMER

2007-3

A1D First Franklin

Financial

Corporation

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$33,199,000 May 30,

2007

Group I

FFMER

2007-3

M11 First Franklin

Financial

Corporation

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$35,135,000 May 30,

2007

Group I

FFMER

2007-3

M21 First Franklin

Financial

Corporation

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$28,590,000 May 30,

2007

Group I

FFMER

2007-3

M31 First Franklin

Financial

Corporation

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$7,922,000 May 30,

2007

Group I

FFMER

2007-3

M41 First Franklin

Financial

Corporation

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$9,989,000 May 30,

2007

Group I

FFMER

2007-4

1A First Franklin

Financial

Corporation

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$509,625,000 June 26,

2007

Group I

17

Transaction Tranche Sponsor/Seller Depositor Lead

Underwriter

Principal

Amount

Issued ($)

Date of

Issuance

Supporting

Loan

Group(s)

FFMER

2007-4

1M1 First Franklin

Financial

Corporation

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$34,062,000 June 26,

2007

Group I

FFMER

2007-4

1M2 First Franklin

Financial

Corporation

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$23,356,000 June 26,

2007

Group I

FFMER

2007-4

1M3 First Franklin

Financial

Corporation

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$12,327,000 June 26,

2007

Group I

FFMER

2007-5

1A First Franklin

Financial

Corporation

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$241,175,000 October 10,

2007

Group I

FFMER

2007-H1

1A1 First Franklin

Financial

Corporation

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$295,640,000 October 9,

2007

Group I

FFML 2005-

FF12

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$663,543,000 December

28, 2005

Group I

FFML 2006-

FF18

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$689,394,000 December

28, 2006

Group I

FFML 2007-

FF1

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$608,774,000 January 26,

2007

Group I

FFML 2007-

FF2

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$1,021,839,000 February

28, 2007

Group I

FMIC 2006-

3

1A Fieldstone

Investment

Corporation

Fieldstone

Mortgage

Investment

Corporation

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$221,277,000 October 27,

2006

Group 1

INDX 2005-

AR33

2A1 IndyMac Bank,

F.S.B

IndyMac

MBS, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$234,872,000 December

29, 2005

Group 2

INDX 2006-

AR5

1A1 IndyMac Bank,

F.S.B

IndyMac

MBS, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$210,047,000 March 30,

2006

Group 1

INDX 2006-

AR7

2A1 IndyMac Bank,

F.S.B

IndyMac

MBS, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$341,217,000 March 30,

2006

Group 2

INDX 2007-

FLX4

1A1 IndyMac Bank,

F.S.B

IndyMac

MBS, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$127,861,000 May 30,

2007

Group 1

18

Transaction Tranche Sponsor/Seller Depositor Lead

Underwriter

Principal

Amount

Issued ($)

Date of

Issuance

Supporting

Loan

Group(s)

INDX 2007-

FLX5

1A1 IndyMac Bank,

F.S.B

IndyMac

MBS, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$96,711,000 June 27,

2007

Group 1

INDX 2007-

FLX6

1A1 IndyMac Bank,

F.S.B

IndyMac

MBS, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$94,391,000 July 30,

2007

Group 1

MANA

2007-A1

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$68,226,000 February 9,

2007

Group I

MANA

2007-A2

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$180,475,000 March 30,

2007

Group I

MANA

2007-A2

A2A Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$165,226,000 March 30,

2007

Group 2

MANA

2007-A3

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$189,695,000 April 30,

2007

Group 1

MLMI 2005-

A8

A2A Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$182,596,000 November

15, 2005

Group 2

MLMI 2005-

A8

A2B1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$178,723,000 November

15, 2005

Group 2

MLMI 2005-

AR1

A2 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$250,727,000 September

29, 2005

Group 2

MLMI 2005-

HE2

A1A Merrill Lynch

Mortgage

Capital, Inc. and

Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$236,060,000 November

30, 2005

Group 1

MLMI 2005-

HE2

A1B Merrill Lynch

Mortgage

Capital, Inc. and

Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$59,015,000 November

30, 2005

Group 1

MLMI 2005-

HE3

A1A Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$335,591,000 December

28, 2005

Group 1

MLMI 2006-

A3

IIA1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$89,730,000 May 31,

2006

Group 2

19

Transaction Tranche Sponsor/Seller Depositor Lead

Underwriter

Principal

Amount

Issued ($)

Date of

Issuance

Supporting

Loan

Group(s)

MLMI 2006-

AF2

AV1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$125,408,000 October 30,

2006

Group 2

MLMI 2006-

AHL1

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$160,748,000 June 29,

2006

Group I

MLMI 2006-

AR1

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$333,038,000 April 27,

2006

Group I

MLMI 2006-

FF1

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$1,098,020,000 December

27, 2006

Group I

MLMI 2006-

FM1

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$204,693,000 June 30,

2006

Group I

MLMI 2006-

HE1

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$355,063,000 February 7,

2006

Group I

MLMI 2006-

HE4

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$125,624,000 July 25,

2006

Group I

MLMI 2006-

HE5

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$169,018,000 September

28, 2006

Group I

MLMI 2006-

HE6

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$250,830,000 December

28, 2006

Group I

MLMI 2006-

MLN1

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$316,858,000 September

29, 2006

Group I

MLMI 2006-

OPT1

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$469,721,000 September

26, 2006

Group I

MLMI 2006-

RM1

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$171,181,000 March 21,

2006

Group I

MLMI 2006-

RM2

A1A Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$411,649,000 May 31,

2006

Group I

MLMI 2006-

RM3

A1A Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$227,029,000 June 30,

2006

Group I

20

Transaction Tranche Sponsor/Seller Depositor Lead

Underwriter

Principal

Amount

Issued ($)

Date of

Issuance

Supporting

Loan

Group(s)

MLMI 2006-

RM4

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$176,227,000 September

27, 2006

Group I

MLMI 2006-

RM5

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$138,699,000 October 27,

2006

Group I

MLMI 2006-

WMC1

A1A Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$419,318,000 On or about

February

14, 2006

Group I

MLMI 2006-

WMC2

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$493,651,000 March 30,

2006

Group I

MLMI 2007-

HE1

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$354,933,000 March 8,

2007

Group 1

MLMI 2007-

HE2

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$431,956,000 March 30,

2007

Group 1

MLMI 2007-

MLN1

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$415,943,000 April 26,

2007

Group 1

OOMLT

2007-1

IA2 Option One

Mortgage

Corporation

Option One

Mortgage

Acceptance

Corporation

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$ 259,609,000 January 24,

2007

Group 1

OOMLT

2007-1

IA1 Option One

Mortgage

Corporation

Option One

Mortgage

Acceptance

Corporation

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$ 259,610,000 January 24,

2007

Group 1

OWNIT

2005-4

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$285,517,000 October 28,

2005

Group 1

OWNIT

2005-5

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$205,391,000 December

28, 2005

Group 1

OWNIT

2006-1

AV Credit-Based

Asset Servicing

and

Securitization,

LLC

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$225,112,000 January 30,

2006

Group 1

OWNIT

2006-2

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$221,310,000 March 9,

2006

Group 1

OWNIT

2006-3

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$180,115,000 On or about

April 13,

2006

Group 1

21

Transaction Tranche Sponsor/Seller Depositor Lead

Underwriter

Principal

Amount

Issued ($)

Date of

Issuance

Supporting

Loan

Group(s)

OWNIT

2006-4

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$243,564,000 June 26,

2006

Group 1

OWNIT

2006-5

A1B Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$27,738,000 July 27,

2006

Group 1

OWNIT

2006-5

A1A Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$110,953,000 July 27,

2006

Group 1

OWNIT

2006-6

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$113,153,000 September

28, 2006

Group 1

OWNIT

2006-7

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$184,746,000 November

3, 2006

Group 1

SURF 2005-

AB3

A1A Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$135,861,000 December

28, 2005

Group 1

SURF 2005-

BC3

A1A Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$302,990,000 September

29, 2005

Group 1

SURF 2005-

BC4

A1A Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$470,632,000 December

20, 2005

Group 1

SURF 2006-

AB2

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$194,773,000 May 31,

2006

Group I

SURF 2006-

AB3

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$190,723,000 September

26, 2006

Group 1

SURF 2006-

BC1

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$583,827,000 On or about

February

21, 2006

Group 1

SURF 2006-

BC2

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$173,248,000 March 30,

2006

Group 1

SURF 2006-

BC3

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$384,110,000 June 27,

2006

Group 1

SURF 2006-

BC4

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$439,858,000 September

27, 2006

Group 1

22

Transaction Tranche Sponsor/Seller Depositor Lead

Underwriter

Principal

Amount

Issued ($)

Date of

Issuance

Supporting

Loan

Group(s)

SURF 2006-

BC5

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$258,105,000 November

28, 2006

Group 1

SURF 2007-

AB1

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$127,954,000 March 26,

2007

Group 1

SURF 2007-

BC1

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$294,133,000 January 24,

2007

Group 1

SURF 2007-

BC2

A1 Merrill Lynch

Mortgage

Lending, Inc.

Merrill Lynch

Mortgage

Investors, Inc.

Merrill

Lynch,

Pierce, Fenner

& Smith, Inc.

$174,640,000 April 24,

2007

Group 1

C. The Securitization Process

1. Merrill Lynch Mortgage Lending, Merrill Lynch Mortgage Capital,

and First Franklin Financial Grouped Mortgage Loans in Special

Purpose Trusts

38. As the sponsors for 60 of the 72 Securitizations, Merrill Lynch Mortgage

Lending, Merrill Lynch Mortgage Capital, and First Franklin Financial purchased the mortgage

loans underlying the Certificates for those 60 Securitizations after the loans were originated,

either directly from the originators or through affiliates of the originators.

6

39. Merrill Lynch Mortgage Lending, Merrill Lynch Mortgage Capital, and First

Franklin Financial then sold the mortgage loans for the 60 Securitizations that they sponsored to

a depositor, which was a Merrill Lynch affiliated entity: Merrill Lynch Mortgage Investors.

With respect to two of the remaining 12 Securitizations, non-party sponsor Credit-Based Asset

Servicing and Securitization LLC sold the mortgage loans to Defendant Merrill Lynch Mortgage

Investors, as depositor. With respect to the remaining ten Securitizations, non-party sponsors

6

Non-party sponsors Ameriquest Mortgage Company, Credit-Based Asset Servicing

and Securitization LLC, Fieldstone Investment Corp., IndyMac Bank F.S.B, and Option One

Mortgage Corp. were each a Sponsor of one or more of the remaining 12 Securitizations. The

sponsor for each Securitization is included in Table 2, supra at paragraph 37.

23

sold the mortgage loans to non-party depositors, as reflected in Table 2, supra at paragraph 37;

Defendant Merrill Lynch, Pierce, Fenner & Smith was the lead underwriter or co-lead

underwriter for those ten Securitizations and sold three of those Securitizations to Freddie Mac,

while Defendant Merrill Lynch Government Securities sold seven of those ten Securitizations to

Fannie Mae.

7

40. Merrill Lynch Mortgage Investors, is a wholly-owned, subsidiary of Merrill

Lynch & Co. The sole purpose of Merrill Lynch Mortgage Investors as depositor was to act as a

conduit through which loans acquired by the sponsors can be securitized and interests in those

loans sold to investors.

41. As depositors for 62 of the Securitizations, Merrill Lynch Mortgage Investors,

transferred the relevant mortgage loans to the trusts. As part of each of the Securitizations, the

trustee, on behalf of the Certificateholders, executed a Pooling and Servicing Agreement

(“PSA”) with the relevant depositor and the parties responsible for monitoring and servicing the

mortgage loans in that Securitization. The trust, administered by the trustee, held the mortgage

loans pursuant to the related PSA and issued Certificates, including the GSE Certificates, backed

by such loans. The GSEs purchased the GSE Certificates, through which they obtained an

ownership interest in the assets of the trust including the mortgage loans.

2. The Trusts Issue Securities Backed by the Loans

42. Once the mortgage loans were transferred to the trusts in accordance with the

PSAs, each trust issued Certificates backed by the underlying mortgage loans. The Certificates

were then sold to investors like Fannie Mae and Freddie Mac, which thereby acquired an

ownership interest in the assets of the corresponding trust. Each Certificate entitles its holder to

7

The two remaining GSE Certificates were purchased by Fannie Mae and Freddie Mac

from Lehman Brothers, Inc.

24

a specified portion of the cashflows from the underlying mortgages in the Supporting Loan

Group. The level of risk inherent in the Certificates is a function of the capital structure of the

related transaction and the credit quality of those underlying mortgages.

43. The Certificates were issued pursuant to one of ten Shelf Registration Statements

filed with the SEC on a Form S-3. The Shelf Registration Statements were amended by one or

more Forms S-3/A filed with the SEC. Each Individual Defendant signed one or more of the

three Shelf Registration Statements, including any amendments thereto, which were filed by

Merrill Lynch Mortgage Investors. The SEC filing number, registrants, signatories and filing

dates for the ten Shelf Registration Statements and amendments thereto, as well as the

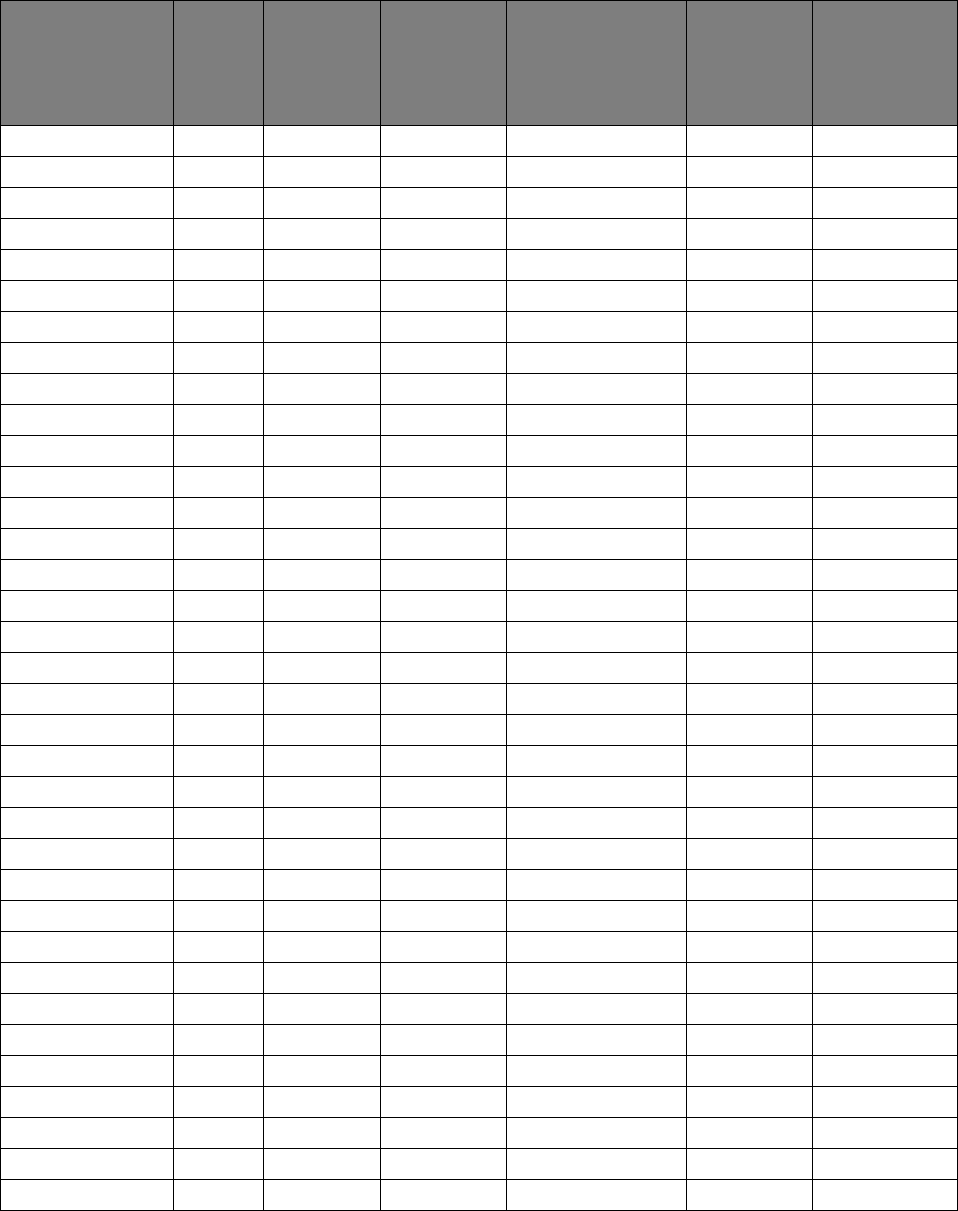

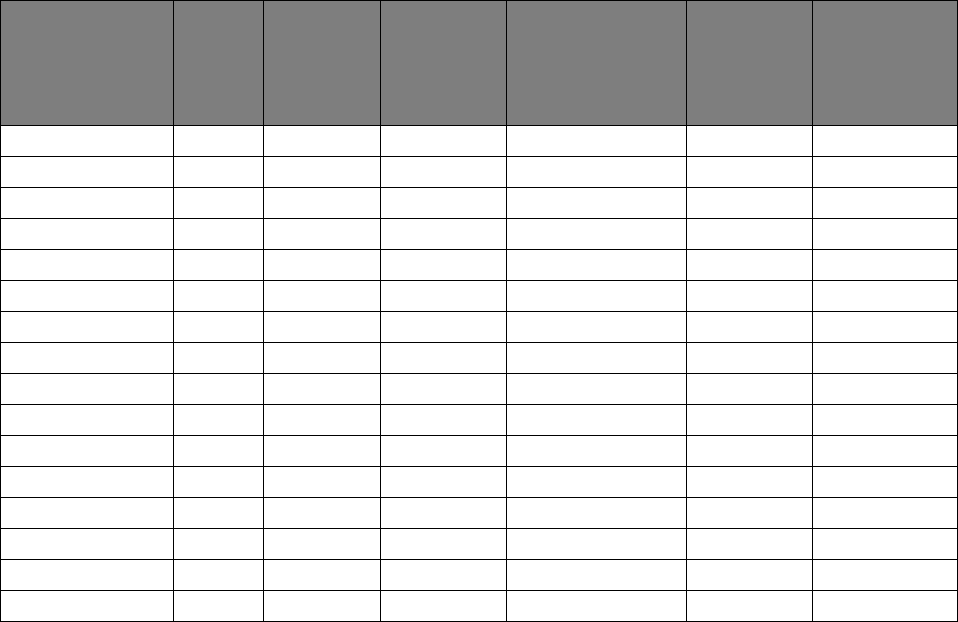

Certificates covered by each Shelf Registration Statement, are reflected in Table 3 below.

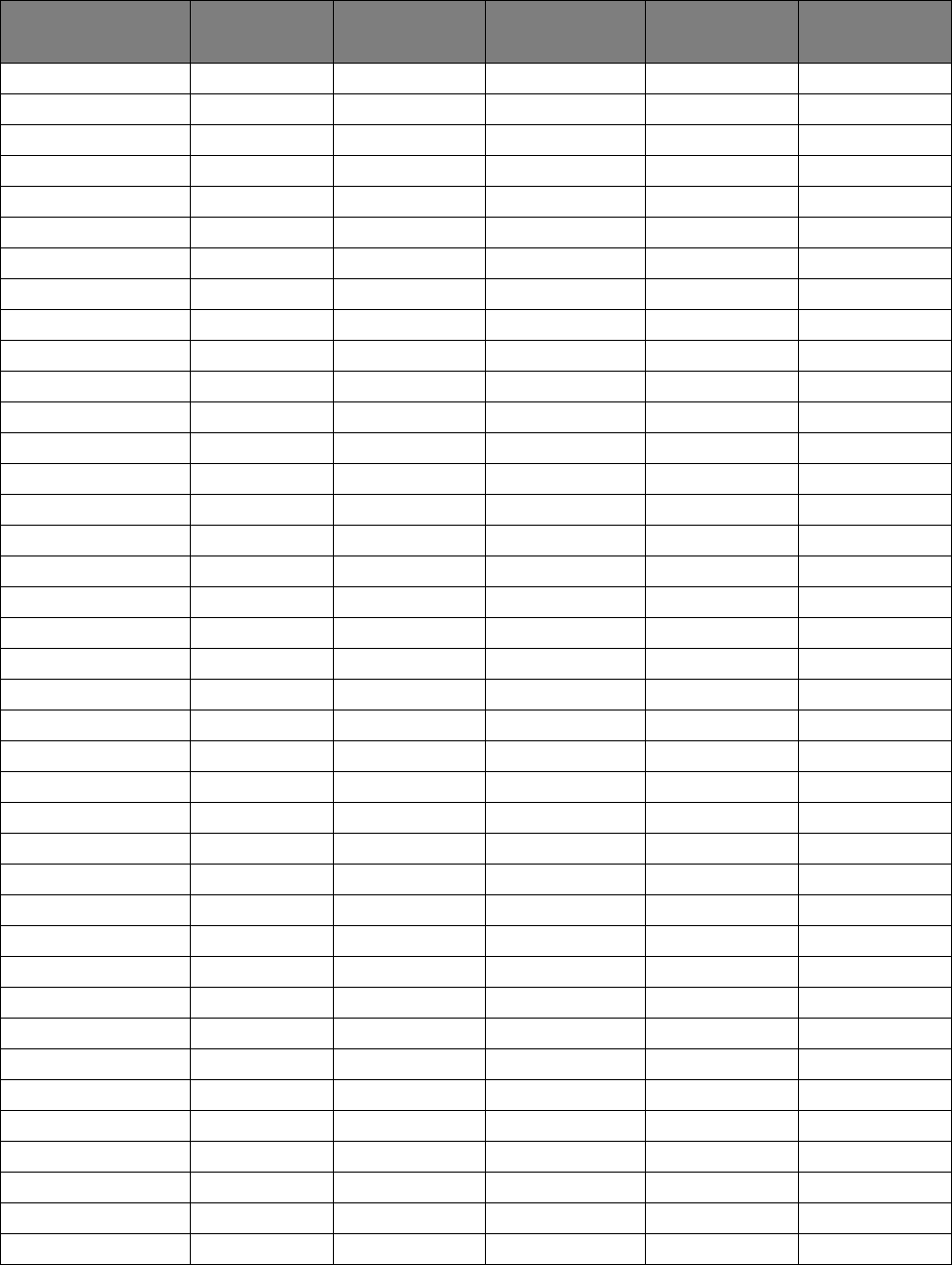

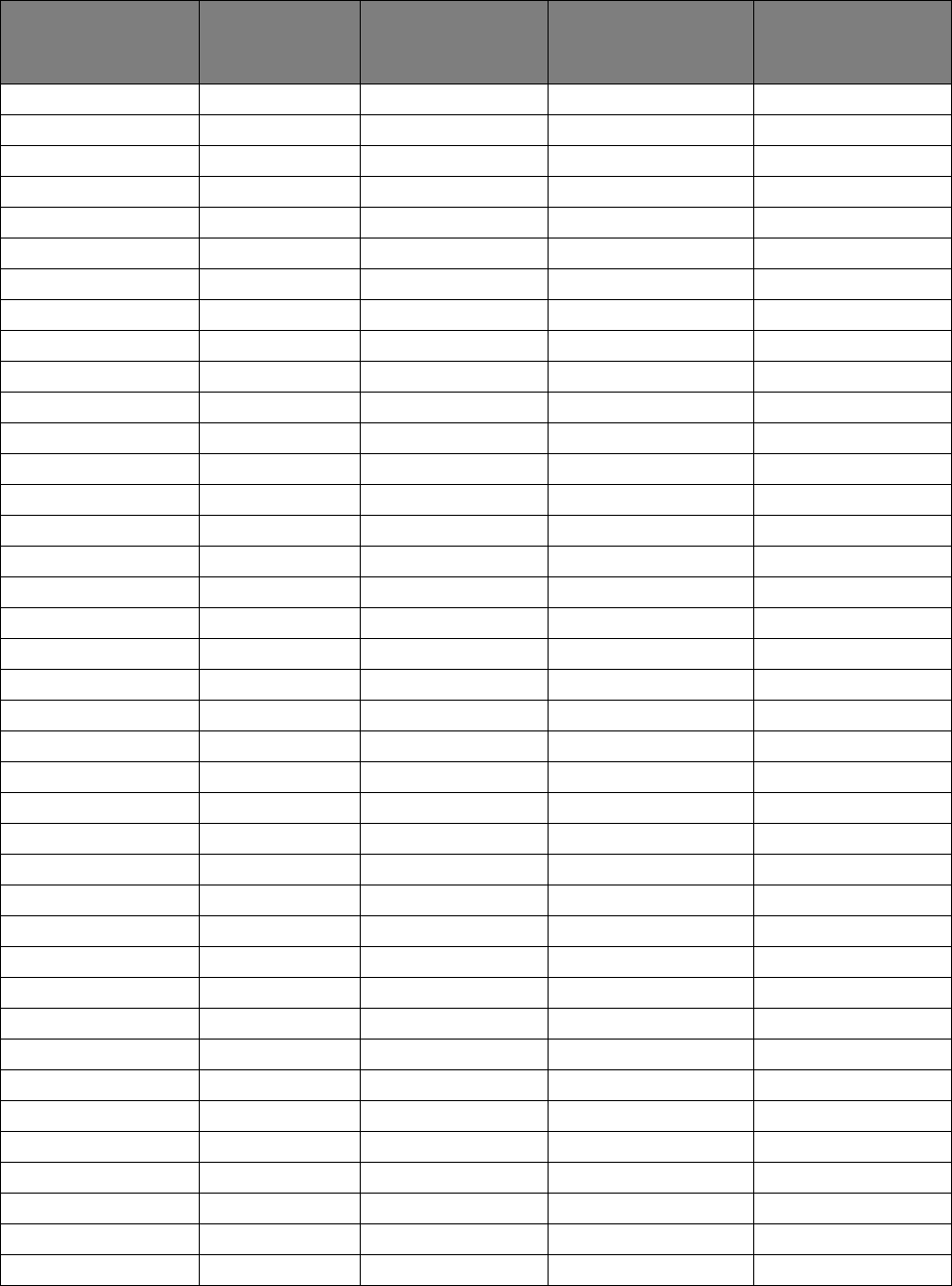

25

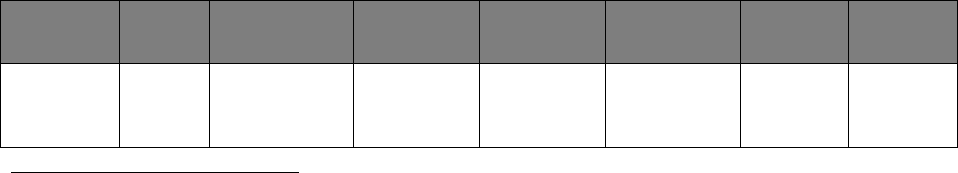

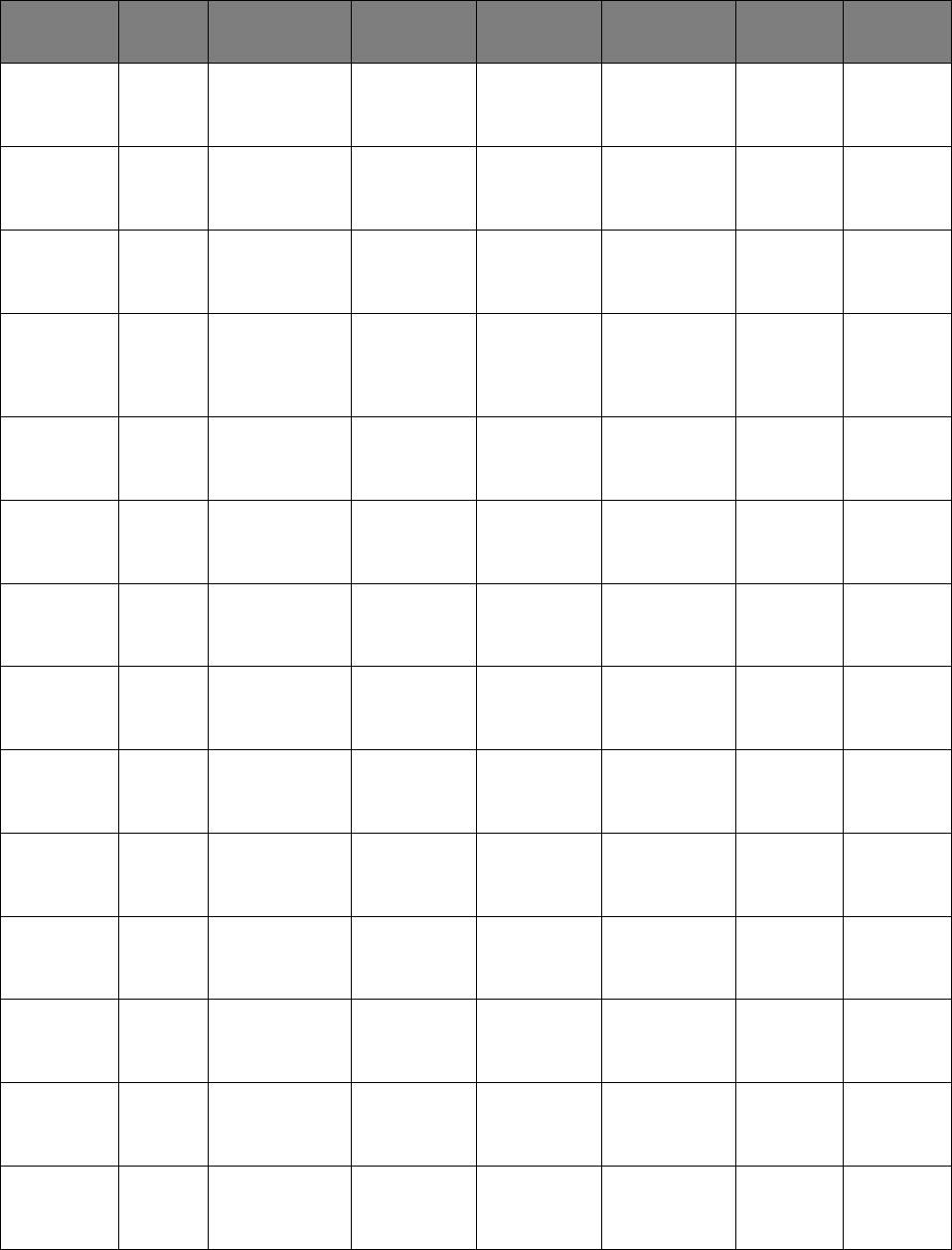

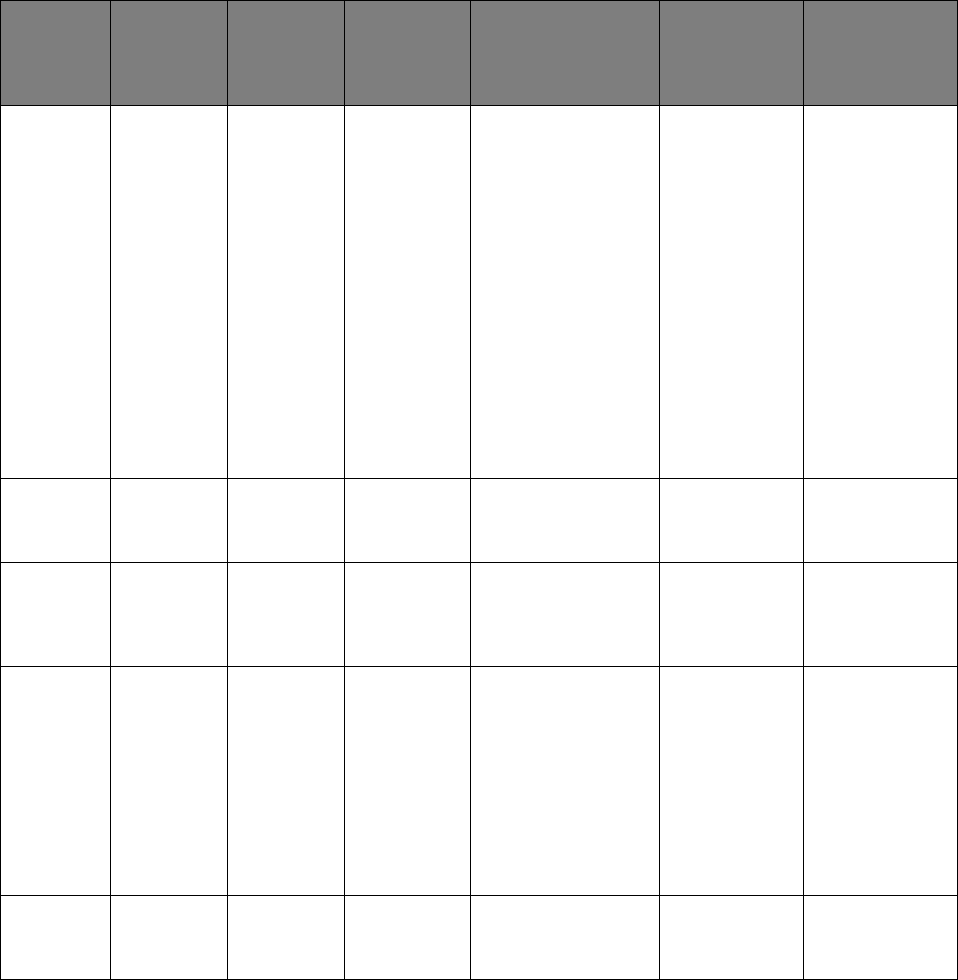

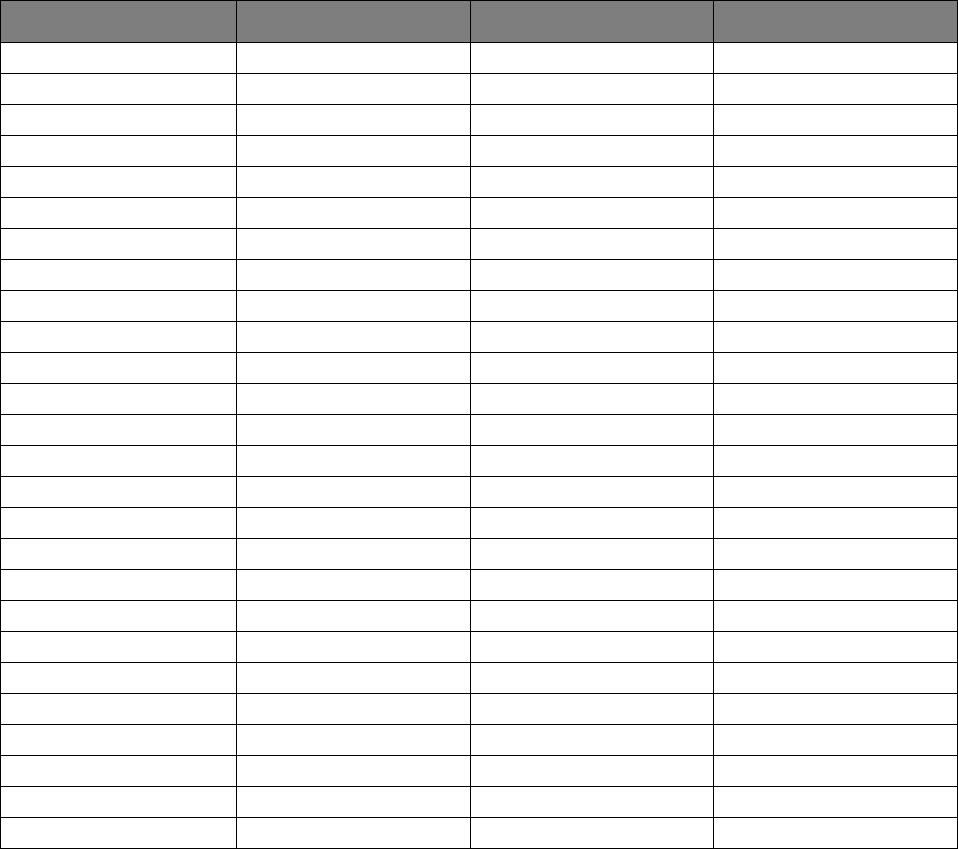

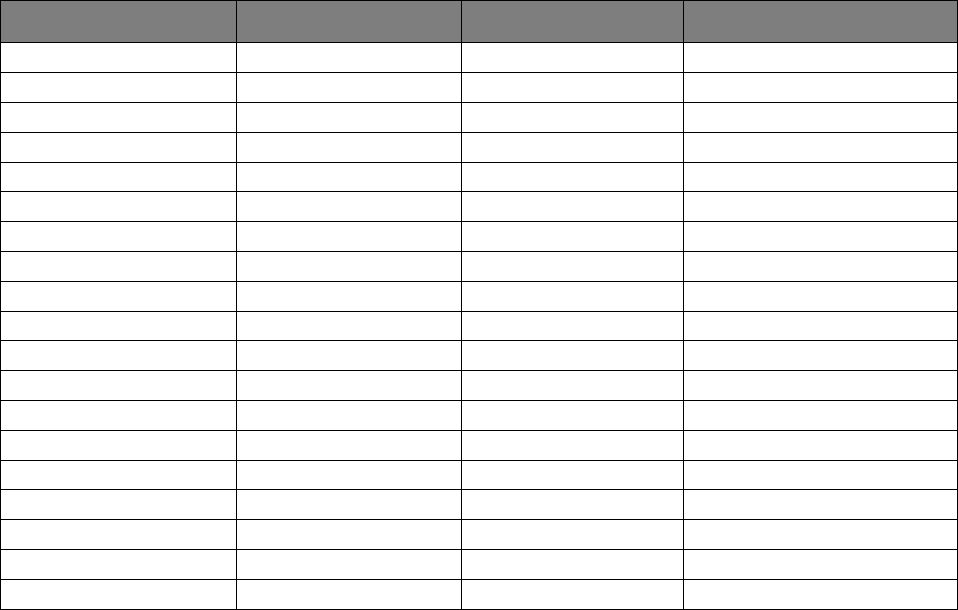

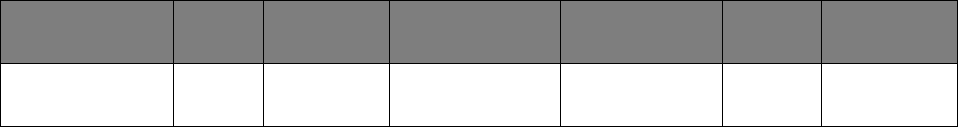

Table 3

SEC File

Number

Date

Registration

Statement

Filed

Date(s)

Amended

Registration

Statements

Filed

Registrant(s) Covered Certificates Signatories of

Registration

Statement

Signatories of

Amendments

333-130545 12/21/2005 2/24/2006,

3/21/2006,

3/28/2006

Merrill Lynch

Mortgage

Investors, Inc.

CBASS 2006-CB8,

FFML 2006-FF18,

FFML 2007-FF1,

FFML 2007-FF2,

MANA 2007-A1,

MLMI 2006-A3,

MLMI 2006-AF2,

MLMI 2006-AHL1,

MLMI 2006-AR1,

MLMI 2006-FF1,

MLMI 2006-FM1,

MLMI 2006-HE4,

MLMI 2006-HE5,

MLMI 2006-HE6,

MLMI 2006-MLN1,

MLMI 2006-OPT1,

MLMI 2006-RM2,

MLMI 2006-RM3,

MLMI 2006-RM4,

MLMI 2006-RM5,

MLMI 2007-HE1,

OWNIT 2006-3,

OWNIT 2006-4,

OWNIT 2006-5,

OWNIT 2006-6,

OWNIT 2006-7,

SURF 2006-AB2,

SURF 2006-AB3,

SURF 2006-BC3,

SURF 2006-BC4,

SURF 2006-BC5,

SURF 2007-AB1,

SURF 2007-BC1

Matthew

Whalen, Brian

T. Sullivan,

Michael M.

McGovern,

Donald J.

Puglisi

Matthew Whalen,

Brian T. Sullivan,

Michael M.

McGovern,

Donald J. Puglisi

333-140436 2/2/2007 3/7/2007 Merrill Lynch

Mortgage

Investors, Inc.

FFMER 2007-1,

FFMER 2007-2,

FFMER 2007-3,

FFMER 2007-4,

FFMER 2007-5,

FFMER 2007-H1,

MANA 2007-A2,

MANA 2007-A3,

MLMI 2007-HE2,

MLMI 2007-MLN1,

SURF 2007-BC2

Paul Park, Brian

T. Sullivan,

Michael M.

McGovern,

Donald J.

Puglisi

Paul Park, Brian

T. Sullivan,

Michael M.

McGovern,

Donald J. Puglisi

26

SEC File

Number

Date

Registration

Statement

Filed

Date(s)

Amended

Registration

Statements

Filed

Registrant(s) Covered Certificates Signatories of

Registration

Statement

Signatories of

Amendments

333-127233 8/5/2005 8/17/2005 Merrill Lynch

Mortgage

Investors, Inc.

FFML 2005-FF12,

MLMI 2005-A8,

MLMI 2005-AR1,

MLMI 2005-HE2,

MLMI 2005-HE3,

MLMI 2006-HE1,

MLMI 2006-RM1,

MLMI 2006-WMC1,

MLMI 2006-WMC2,

OWNIT 2005-4,

OWNIT 2005-5,

OWNIT 2006-1,

OWNIT 2006-2,

SURF 2005-AB3,

SURF 2005-BC3,

SURF 2005-BC4,

SURF 2006-BC1,

SURF 2006-BC2

Matthew

Whalen, Donald

C. Han, Michael

M. McGovern,

Donald J.

Puglisi

Matthew Whalen,

Brian T. Sullivan,

Michael M.

McGovern,

Donald J. Puglisi

333-131895 2/16/2006 3/17/2006 Argent

Securities,

Inc.

ARSI 2006-M1 Adam J. Bass,

John P. Grazer

and Andrew L.

Stidd

Adam J. Bass,

John P. Grazer

and Andrew L.

Stidd

333-127556 8/15/2005 Not

applicable

IndyMac

MBS, Inc.

INDX 2006-AR5,

INDX 2005-AR33,

INDX 2006-AR7

John Olinski, S.

Blair Abernathy,

Lynnette Antosh

and Samir

Grover

Not applicable

333-132444 3/15/2006 5/8/2006,

5/31/2006

Fieldstone

Mortgage

Investment

Corporation

FMIC 2006-3 John C. Kendall,

Michael J.

Sonnenfeld,

Nayan V.

Kisnadwala

5/8/2006: John C.

Kendall, Michael

J. Sonnenfeld,

Nayan V.

Kisnadwala;

5/31/2006: John

C. Kendall,

Michael J.

Sonnenfeld,

Nayan V.

Kisnadwala

333-121782 12/30/2004 1/12/2006 Argent

Securities,

Inc.

ARSI 2005-W4 Adam J. Bass,

John P. Grazer,

and Andrew L.

Stidd

Adam J. Bass,

John P. Grazer,

and Andrew L.

Stidd

27

SEC File

Number

Date

Registration

Statement

Filed

Date(s)

Amended

Registration

Statements

Filed

Registrant(s) Covered Certificates Signatories of

Registration

Statement

Signatories of

Amendments

333-132042 2/24/2006 3/29/2006,

4/13/2006,

6/5/2007

IndyMac

MBS, Inc.

INDX 2007-FLX4 John Olinski, S.

Blair Abernathy,

Raphael Bostic,

Samir Grover

and Victor H.

Woodworth

3/29/2006: Simon

Heyrick, Victor

H. Woodworth,

John Olinski, S.

Blair Abernathy

and Raphael

Bostic;

4/13/2006: Victor

H. Woodworth,

John Olinski, S.

Blair Abernathy,

Simon Heyrick

and Raphael

Bostic; 6/5/2007

Victor H.

Woodworth, John

Olinski, S. Blair

Abernathy, Simon

Heyrick and

Raphael Bostic

333-140726 2/14/2007 3/1/2007,

6/6/2007,

6/19/2007

IndyMac

MBS, Inc.

INDX 2007-FLX5,

INDX 2007-FLX6

John Olinski, S.

Blair Abernathy,

Raphael Bostic,

Simon Heyrick,

Victor H.

Woodworth

John Olinski, S.

Blair Abernathy,

Raphael Bostic,

Simon Heyrick,

Victor H.

Woodworth

333-130870 1/5/2006 3/31/2006,

3/30/2006,

3/17/2006,

3/02/2006,

2/10/2006

Option One

Mortgage

Acceptance

Corporation

OOMLT 2007-1 Robert E.