kpmg.com.cy

March 2017

7

th

edition

A summary of the significant factors

and major drivers of the real estate

market in Cyprus.

Cyprus Real

Estate Market

Report

1Cyprus Real Estate Market Report | March 2017

Table of contents

Overview 2

Cypriot economy 4

The Real Estate Sector 12

Overseas Comparisons 19

Other Matters 20

Who we are 28

How can KPMG help 29

Overview

The Cypriot economy has experienced positive growth rates

in 2016 and the expectations are that this trend will continue

in 2017. Fiscal indicators are improving, the yields of the

Cyprus Bonds have dropped to historically low levels, while

the interest for investments is rebounding.

Services including tourism, professional services, shipping

and real estate are considered as the backbone of the Cypriot

economy, contributing significantly to the country’s GDP.

Despite the problems and challenges which still remain for

the property sector, 2016 was a good year based on statistical

information. In particular, one of the largest increases of the

decade (43%) was noted in the total property sales contracts

submitted at the Land Registry in 2016, with December 2016

exhibiting an increase of 121% compared to December 2015.

This is an important indicator that confidence in the real

estate market is improving.

It must be noted that some contracts of sale concern loan

restructurings (exchange of debt with mortgaged immovable

property) as well as company/corporate group restructurings.

The interest of foreign investors in Cyprus’ real estate

market keeps growing, since over one quarter of the deeds

of sale submitted in 2016 involve overseas buyers. This is

primarily due to the Cypriot government’s initiative regarding

the Cypriot Citizenship Program, the permanent residency

program as well as the various tax incentives offered.

All of the above are arguably related to the improvement

of the economic environment and the performance of the

Cypriot economy, as well as the incentives provided by the

government. The three figure increase (121%) exhibited in

December 2016, is owed to the fact that many buyers have

accelerated their decisions in order to take advantage of the

legislation of non-taxation of capital profits, which ended at

the end of December 2016.

During the period January-November 2016, 4.900 building

permits were issued compared to 4.581 in the corresponding

period of 2015. The total value of these permits increased by

12,3% while the total area increased by 16,8%. The number

of dwelling units recorded an increase of 10,5%. Building

permits constitute a leading indicator of future activity in the

construction sector.

In order to stimulate growth in the economy and, in

particular, in the real estate sector, it is important to increase

the financing from financial institutions and attract new

investment that will finance new projects, as well as existing

projects whose development has been postponed as a result

of the recession.

The property market has been stimulated by various

incentives offered to investors by the government: For

example, in mid-2015, a law amendment was adopted

according to which the profit made upon the sale in the

future, of properties acquired by 31

st

December 2016, will not

be subject to capital gains tax. Additionally, as far as transfer

fees are concerned, it is pointed out that incentives provided

have become permanent. This means that there will be no

transfer fees for property purchases subject to VAT, while for

other purchases, transfer fees will be reduced to 50%, as

estimated based on the provisions of the current legislation.

Moreover, the legislation that was adopted in the Autumn of

2015 dealing with the long-standing problem of the inability

to issue title deeds in the name of purchasers who have paid

the amount due in full to the land developer, has enhanced

the credibility of the Cypriot real estate market.

Purchases of land, plots and second hand buildings are

not subject to VAT. Immovable property bought as new is

subject to 19% VAT, except for the case where it concerns

a permanent residence, where the coefficient is reduced

to 5%. Recently, the Parliament has adopted legislation

under which the maximum size that a residence should

have in order to fall within the reduced coefficient has been

abolished. More specifically, the first 200 square meters for

all permanent residences are subject to 5% VAT. As far as the

immovable property tax is concerned, this has been abolished

for 2017 onwards, while the municipality fees will continue to

be computed based on the values of 1980.

Importantly, in 2017, large-scale projects for residential,

commercial and hotel units as well as marinas have been

planned to start. As a result of the incentives offered by the

Cypriot government regarding urban planning permissions,

there are currently 30 applications for hotel expansion or

renovation before the Cyprus Tourism Organisation for

review. At the same time there are 6 pending building

permit applications for new hotels in Paphos, Limassol and

Famagusta districts. It is estimated that over half a billion euro

has been invested for the renovation or upgrading of hotels in

Cyprus over the past few years.

3Cyprus Real Estate Market Report | March 2017

In addition, the tender process for the luxurious integrated

casino resort is at the final stage of being approved and the

government is expected to officially grant the casino license

to the multinational consortium consisting of the companies

Melco-Hard Rock and Cyprus Phassouri (Zakaki) Limited. The

relevant legislation adopted in July 2015, provides for the

development of a resort of international standards; including

a hotel or hotels exceeding the requirements for a five-star

establishment with at least 500 luxury rooms, 100 gaming

tables and 1.000 gaming machines. Moreover, the legal

framework provides for the operation of four “satellite” units

in other locations. The casino resort, whose construction is

scheduled to begin soon, will certainly attract quality tourism

and contribute to the tackling of the seasonality witnessed in

the Cypriot tourism market.

In the energy sector, energy giants Exxon Mobil and Qatar

Petroleum as well as major European companies Eni and Total

were selected by Cyprus` Government within the framework

of the 3rd licensing round for offshore hydrocarbons

exploration in Blocks 6,8, and 10 in the Exclusive Economic

Zone (EEZ) of Cyprus.

Currently, dealing with non-performing loans is a top priority

for credit institutions. Their efforts are further facilitated by

the legislation regulating the sale of credit facilities, the

initiation of the first foreclosure proceedings, as well as the

introduction of incentives for acquisition of mortgages in the

context of restructurings. Figures obtained from the Central

Bank of Cyprus show a positive outlook for Non-Performing

Loans (NPLs). Specifically, the total amount of non-performing

loans held by all Cypriot banks decreased by €600m in the

third quarter of 2016. In October, NPLs further decreased

by €37,6 million to €24,08 billion, constituting 48,5% of total

loans (€49,63 billion).

Cyprus’ credit profile is further enhanced and the access of

the country to the international markets has been restored.

The seven-year 3,75% €1 billion bond was priced at the

lowest coupon rate achieved by Cyprus for a euro benchmark

bond and was realized without support from the European

Central Bank’s bond-buying scheme. Bids for the Republic of

Cyprus’ 7-year bond under the EMNT programme reached

€2.463 million, exceeding by two and a half times the original

target of the Ministry of Finance, with an average yield of

3,33% during 2016.

It shall be noted that for 2016, the average yield of the 10-year

government bond was 3,76%, while in January 2017 it has

reached the lowest ever level with an average yield of 3,45%.

Graph 1

As previously mentioned, the development of the property

sector in 2016 showed positive growth, but challenges

still remain. Banking institutions, taking advantage of the

tax exemptions, have recovered many properties against

the loans that they should gradually sell, while interest for

foreclosures remains low. Many companies in the property

sector are highly leveraged, something which creates

obstacles to the planning of new projects.

While the number of deeds of sale submitted at the Land

Registry has increased, it is still significantly below the

record number exhibited in 2007. An important statistic,

which for the time being remains unknown, is the value of

sales contracts. This is essential, since contracts connected

to investors’ naturalization programme are worth millions,

something which was not the case in 2007 when contract

values were lower.

It shall also be stressed out that permits for taller buildings

have also increased, since developers are taking advantage

of the extra building coefficient incentives provided by the

Government.

2017 is expected to be another year presenting challenges

for the economy as well as for the property sector and it will

indicate whether the process of stabilization and gradual

recovery will be reinforced or not. Nevertheless, the expected

construction of new projects is expected to support the

sector and the efforts for reduction of the unemployment

rates.

3

3,2

3,4

3,6

3,8

4

4,2

4,4

Yield (%)

Yield Curve of Cyprus' 10-year Government

bond

Economic update

Fiscal reforms

Following the progress made

over the past year, the European

Commission, in its Autumn Report,

significantly revised its spring

forecasts in relation to the economy

of Cyprus as set out in Table1 below.

Table 1

Source: European Commission (9 November 2016)

Real GDP growth is expected

to reach 2.5% in 2017 and then

moderate gradually to 2.3% by

2018. An important factor taken

into account by the European

Commission was the improved

outlook for investment based on the

stabilizing housing market in Cyprus.

A second significant factor was the

increase in private consumption.

The European Commission noted

the growth in the tourism sector

and expects it to continue, albeit

at a slower pace, contributing to

job creation while exerting upward

pressure on wages and unit labour

costs.

HICP (Harmonised Index of

Consumer Prices) inflation is

expected to increase and return to

positive territory in 2017, although

it is expected to remain moderate

as profit margins are forecast to

narrow further, thus limiting the pass-

through of higher unit labour costs

to consumer prices. As a result, less

Cypriot economy

As of 31st of March 2016, Cyprus

has successfully completed its

Economic Adjustment Programme,

three years after its commencement.

Cyprus benefited from the Economic

Adjustment Programme, during

which it emerged from recession,

stabilised its financial sector, and

consolidated its public finances.

Cyprus’ economy emerged from

recession in 2015, with real GDP

growth reaching 1,6%. In 2015,

nominal spending by households

stabilised but declining consumer

prices allowed households to

consume more in real terms,

providing a significant boost to real

GDP growth.

The Cypriot banking system in

particular has undergone a deep

transformation. The ground covered

since March 2013 has been

significant and the reform measures,

which have been executed or are

underway, are essential to restoring

the Cypriot financial system to

viability.

The Cypriot economy has been

steadily recovering and economic

activity in 2016 has been better

than initially projected, whereas

fiscal targets have been met with

substantial margins. The economy of

Cyprus expanded by 2,9% year-on-

year in the third quarter of 2016,

compared to 2,7% in the previous

quarter.

The restoration of the banking

system continues and debt

restructuring is picking up. However,

the percentage of non-performing

facilities (“NPFs”) remains high

and the pace of lending is subdued,

despite the fact that demand for

loans is slowly increasing.

support for real GDP growth will be

provided.

Meanwhile, the “more pronounced”

domestic private demand growth is

expected to slow down owing to the

ongoing deleveraging and continued

loan restructuring efforts by banks

combined with weak lending

activities. Consequently, investments

will continue having to be financed

mainly from retained profits and

savings.

On the upside, the European

Commission stated that consumption

could be enhanced and FDI could

perform better than anticipated as

a result of the lagged effects from

declining energy prices and stronger

labour incomes. Moreover, the

strong performance in the tourism

sector could continue without losing

its momentum.

On the other hand, the report raises

the challenges and riks stemming

from Brexit which can turn out to

impact Cyprus’ economic outlook.

Nevertheless, as a member of the

commonwealth, Cyprus maintains

an advantage over other EU member

states in repelling any negative

effects from the referendum.

Additionally, the slow reduction in

non-performing loans could lead to a

more prolonged period of tight credit

conditions, which would dampen the

recovery.

With regards to the primary balance

of the general government, the

European Commission expects it to

improve further, reaching a surplus

of 2,3% of GDP. However, there are

also additional factors beyond the

control of the government weighing

on the revenue, notably new location

rules regarding VAT on e-commerce

services and a decrease in dividend

5Cyprus Real Estate Market Report | March 2017

income from the Central Bank of Cyprus (CBC) due

to a decrease in the emergency liquidity assistance.

Furthermore, the government’s primary balance will

be negatively affected by the significant reduction

in property tax and the partial switch to professional

soldiers that took place in November 2016. In parallel

with the primary balance, the headline balance also

improved recording a deficit of 0,3% of GDP (from -1,1%

of GDP in 2015).

In 2017, the general government primary surplus

is forecast to decrease marginally to 2,0% of GDP

The Commission also noted the abolition without

compensatory measures of the immovable property tax

paid to the central government as of 1/1/2017. In addition,

the European Commission pointed to the special payroll

contribution levied in response to the crisis which expired

at the end of 2016. In 2018, the small improvement in

the general government primary surplus is largely based

on the improving economic outlook. Despite the stable

headline balance, the structural balance is expected to

worsen over the forecast horizon.

Lastly, public debt is expected to decline to 100,6%

of GDP in 2018. The debt path is slightly better than

envisaged in the spring, mainly due to higher nominal

GDP.

Credit ratings

Ratings agency Standard & Poor`s upgraded on the 16

th

of

September its assessment of Cyprus to BB. The outlook is

positive. S&P expects the Cypriot economy to expand by

about 2.7% this year, surpassing their March 2016 forecast,

with annual growth at about 2.5% in real terms in 2017-2019.

S&P continued by stating that Cyprus’ recovery is supported

by resilient business services, tourism, gradually reviving

private consumption and construction. The restructuring

in the financial sector is making progress, but the Agency

expects it will be a few years before the sector contributes

to economic growth. S&P further expects the sovereign`s

budgetary position to continue improving over the next

few years, standing at close to balance or in surplus, with

gradually declining government debt. S&P finally added that

the positive outlook supports its view that it could upgrade

Cyprus within the next 12 months if its reduction of currently

high levels of nonperforming loans accelerates, indicating

a convergence of Cyprus` credit and monetary conditions

(including the monetary transmission mechanism) with those

of the Eurozone.

7Cyprus Real Estate Market Report | March 2017

According to Moody’s November 2016 issue, Cyprus’ debt

remains highly affordable, reflecting the very large share of

official sector creditors in the total debt stock (63% as of

the third quarter of 2016). The agency further suggests a

prevailing low interest rate environment among other factors

mitigate liquidity risks quite effectively. Moreover, it expects

fiscal discipline to be sustained in spite of the ending of

Cyprus` programme with the European Stability Mechanism

(ESM) and the International Monetary Fund (IMF) in March

2016, which should support investor confidence.

The Fitch Ratings report released in October, highlights the

fact that other developments which could lead to an upgrade

of the sovereign rating include further stabilisation in the

banking sector, a track record of economic recovery and

a reduction in private sector indebtedness, narrowing the

current account deficit and continuing fiscal adjustment.

Finally, according to Fitch, Cyprus’ great natural environment

of beaches and mountains, its highly developed infrastructure,

the growing tourism market, the low property tax and the

climate, make Cyprus ideal for property investment. Added

to this, is the benefit of obtaining the Cypriot citizenship as a

result of such or similar investment.

Non-performing loans

Significant progress has been made in the financial

sector as a result of the recapitalisation and restructuring

of credit institutions. However, the key challenge involves

dealing with the high level of NPLs, in order to restore

the country’s creditworthiness, economic growth and the

creation of new jobs.

According to the data published by the Central Bank of

Cyprus, the total amount of non-performing loans held by

all Cypriot banks decreased by €600m in the third quarter

of 2016. In October, NPLs further decreased by €37,6

million to €24,08 billion, constituting 48,5% of the total

loans(€49,63 billion). Banks are concentrating their efforts

to speed up the restructuring of NPLs and according to

CBC data, agreed restructurings have followed an upward

trend. In order to further facilitate the reduction of NPLs

and offer credit institutions the necessary tools in order

to effectively address this challenge, the legislature

has adopted in November 2015, a law regulating the

sale of credit facilities. In particular, this legislation sets

out the criteria of eligible purchasers of bank loans and

regulates the activities of such purchasers. Further

legislative reform aiming to facilitate loan restructurings

dictates that assets acquired by a financial institution

in the context of such restructuring will be considered

tax neutral transactions and no fees will be attached.

Moreover, the first foreclosures took place within the

first half of 2016 which primarily focused on commercial

buildings and land plots rather than primary residences.

Loans and deposits

Cyprus` bank deposits decreased in December this year

as shown by the data released by the country’s Central

Bank. Total deposits in December 2016 recorded a net

decrease of €74,9 million, compared to a net increase of

€358 million in November 2016.

The annual growth rate stood at 6,2% in December

compared with 6,8% in November 2016. The outstanding

amount of deposits reached €49,0 billion in December

2016.

Deposits increased by €5,27 billion from last March when

they reached the lowest level of the past nine years. Last

March, deposits dell to €45,73 billion, the lowest level

since April 2007, when they amounted to €44,52 billion.

Cyprus Central Bank’s data show that Cyprus residents’

deposits recorded a net increase in December 2016 by

€168,2 million to €36,529 billion, whereas deposits of

EU residents increased by €61,1 million to €3,259 billion.

Deposits of Third Countries’ residents decreased by

€218,0 million to €9,221 billion in December 2016.

On the other hand total loans in December 2016

exhibited a net decrease of €98,0 million, compared

with a net decrease of €29,1 million in November 2016.

The annual change rate stood at -11,0%, compared with

-10,4% in November 2016. The outstanding amount

of loans reached €55,2 billion in December, while in

November the outstanding amount of loans was €53,9

billion, the lowest level since October 2008, when they

stood at € 53,92 billion.

Cyprus residents’ loans have decreased by approximately

€9,09 billion to €45,2 billion, from their highest level

of € 54,29 billion in March 2013. Domestic household

loans fell to € 20,760 billion, a decrease of €3,09 billion,

from their highest historical level of € 23,85 billion in

December 2012.

The average interest rates for new housing loans

(consumer credit, lending for house purchase and other

household lending) have continued their downward trend,

falling to 3,71% in the 3rd Quarter of 2016 compared to

4,02% in the 3rd Quarter of 2015. The average interest

rates on new corporate loans (excluding bank overdrafts)

have also decreased to 3,94% in the 3rd Quarter of 2016

compared to 4,29% in the same period of 2015. With

regards to the average new depository interest rates

(with agreed maturity up to 2 years or redeemable at

notice), they have decreased to 1,45% in the 3rd Quarter

of 2016 compared to 1,51% in the same period of 2015.

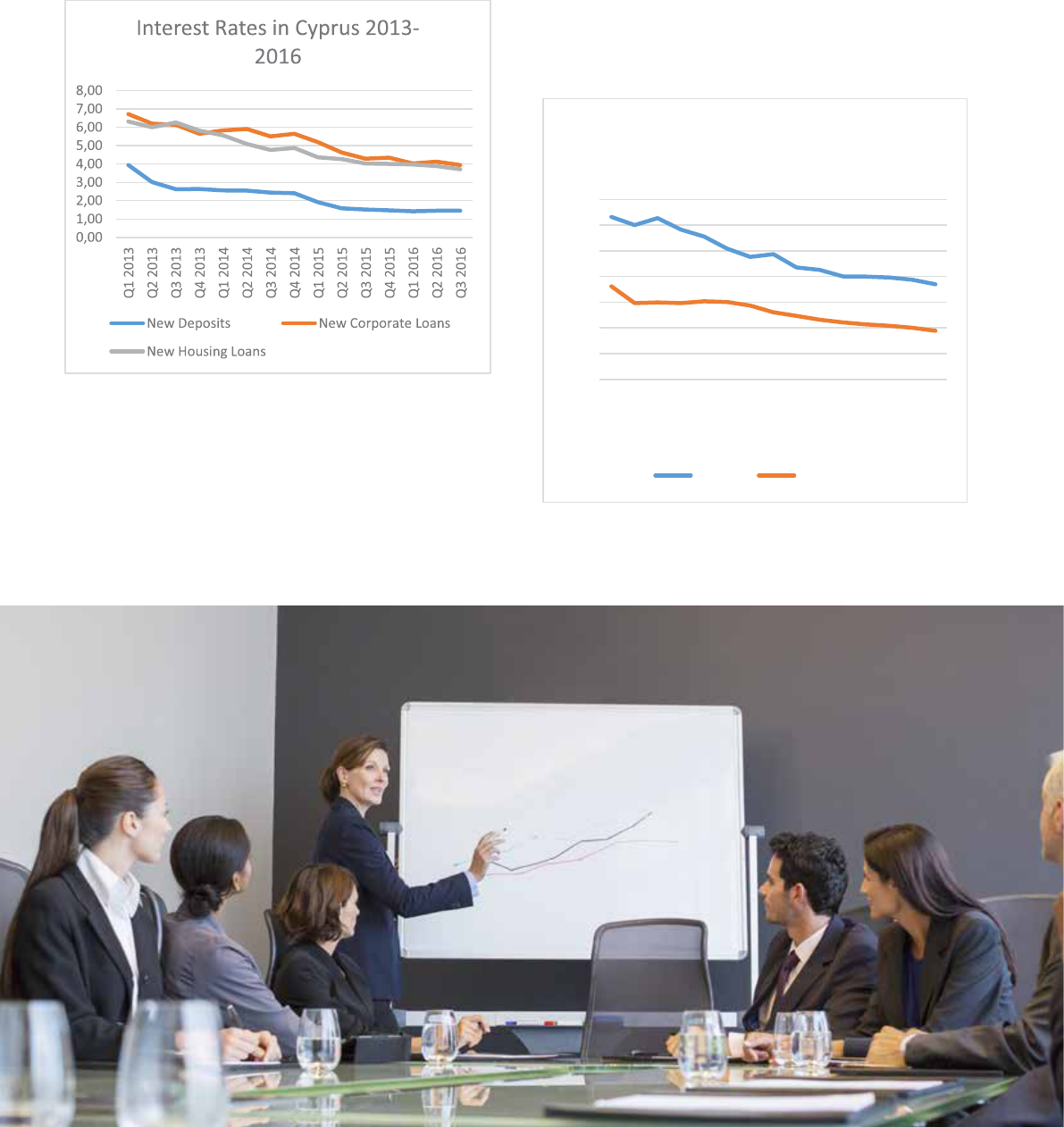

Graph 3

Source: CBC and ECB

Economic indicators

Interest rates

The effect of the decision of the Central Bank of Cyprus

in February 2015 to differentiate the maximum deposit

rate by 1% is reflected in the declining trend of interest

rates in 2015, which continued in 2016, as displayed in

Graph 2 below.

Graph 2

Source: CBC and ECB

%

0,00

1,00

2,00

3,00

4,00

5,00

6,00

7,00

Q1 2013

Q2 2013

Q3 2013

Q4 2013

Q1 2014

Q2 2014

Q3 2014

Q4 2014

Q1 2015

Q2 2015

Q3 2015

Q4 2015

Q1 2016

Q2 2016

Q3 2016

Interest rates on new housing

loans

Cyprus Eurozone

%

9Cyprus Real Estate Market Report | March 2017

The same also applies to new corporate loans interest

rates (Graph 4) and new depository interest rates (Graph

5). In Cyprus, the average interest rate for new corporate

loans in the 3rd Quarter of 2016 was 3,94% in contrast

with 3,08% in the Eurozone.

Graph 5

Source: CBC and ECB

Graph 3 highlights the divergence between interest

rates for new housing loans in Cyprus and the respective

interest rates in the Eurozone, with interest rates in

Cyprus remaining higher in spite of recent declines. For

instance during the 3rd Quarter of 2016, the average

interest rate for new housing loans in Cyprus was 3,71%

compared to 1,90% in the Eurozone.

Graph 4

Source: CBC and ECB

According to data from the Statistical Service of the

Republic of Cyprus (CYSTAT), the number of registered

unemployed in Cyprus increased to 41.852 persons in

December compared to 40.646 in the previous month.

In comparison to December 2015, a decrease of 2.698

persons or 6,1% was recorded in 2016 which was mainly

observed in the sectors of construction, manufacturing,

transportation, trade, public administration and to

newcomers in the labor market.

The average depository interest rate in the 3rd Quarter of

2016 was 1,45% compared to 0,50% in the Eurozone.

Unemployment

It appears that unemployment in Cyprus reached its peak

in December 2013, with 50.467 registered unemployed.

Although a declining trend has been recorded in the last

three years, it must be noted that there is a long way to

go before reaching the low levels of December 2009,

when registered unemployed amounted to 21.530.

Graph 6

Source: CYSTAT

%

0,00

0,50

1,00

1,50

2,00

2,50

3,00

3,50

4,00

4,50

Q1 2013

Q2 2013

Q3 2013

Q4 2013

Q1 2014

Q2 2014

Q3 2014

Q4 2014

Q1 2015

Q2 2015

Q3 2015

Q4 2015

Q1 2016

Q2 2016

Q3 2016

Interest rates on new deposits

Cyprus Eurozone

%

Tourism

The annual number of tourist arrivals has experienced

substantial growth over the last three years, despite a

minor decline in 2013. 2016 is considered as a record

year, as it is the most successful year ever recorded.

Arrivals in 2016 have increased by 19,8% compared to

2015, reaching 3.186.531 (2.659.405 in 2015).

As seen from Table 2 below, the largest increase in the

number of tourists that was recorded in 2016 relates to

tourists from Israel (+50,9%) and Russia (+48,9%).

Table 2

Source: CYSTAT

The strong growth may also be partially attributed

to geopolitical tensions in neighbouring countries.

Bookings from British tourists appear strong despite the

depreciation of the pound. In 2017, growth should gain

further strength.

Tourism revenue has increased steadily year-on-year from

2013. In 2015, revenue from tourism reached €2.112, 1

million, compared to €2.082, million in 2014, recording an

increase of 1,43%. For the period January – November

2016, revenue from tourism is estimated at €2.312,5

million compared to €2.059,5 million in the corresponding

months of 2015, representing an increase of 12,3% as

exhibited in Graph 7.

Graph 7

Source: CYSTAT

The increase in revenue in equivalent periods remain

higher in 2016 compared to 2015, and this may be

attributed to an increase in arrivals by 19,8% (for the

period January-December 2016).

Other developments

Applications for registration of new companies have

increased by 20,4% in 2016 compared to 2015, reaching

13.616. There has been an increase for three consecutive

years, however, the number of applications remains

below the levels exhibited prior to the economic crisis.

With regards to the registrations of saloon cars, they

have increased by 30,3% reaching 27.956 in 2016.

Lastly, in 2016 an increase in consumption was recorded

according to data published by JCC. Credit card use by

Cypriot residents has increased by 4% reaching €2.409

million while credit cards use by Cypriot residents outside

Cyprus increased by 18% reaching €1.427,8 million. Credit

card use by non-Cypriot residents increased by 14%

reaching €777,3 million.

Country

2016

2015

(%

Change

2016/

15)

UK

1.157.978 1.041.208 +11,2%

Russia

781.634 524.853 +48,9%

Sweden

115.019 108.605 +5,9%

Greece

160.254 139.539 +14,8%

Germany

124.030 112.219 +10,5%

Israel

148.739 98.597

+

50,9%

Total (All

Countries)

3.186.531 2.659.405 +19,8%

11Cyprus Real Estate Market Report | March 2017

The Real Estate

Sector

Factors affecting the sector

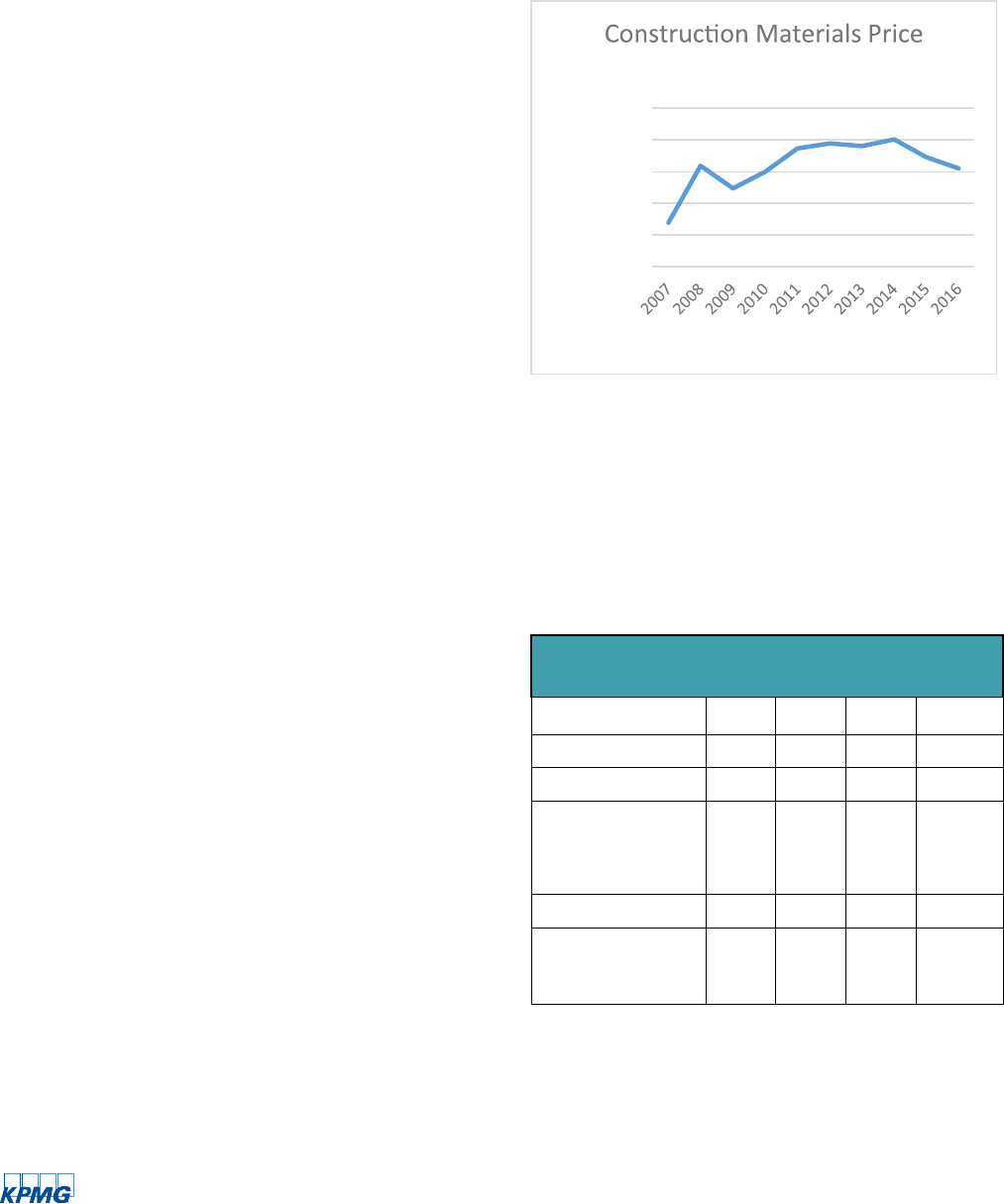

Construction

The latest data regarding the “Indicators of confidence

and economic sentiment” published by the European

Commission in December 2016 shows that the

construction confidence indicator in Cyprus exhibited

an improvement from -28,1 in January 2016 to -27,4 in

December 2016.

The Cyprus real estate market can be divided into two

groups of demand. The major urban centres of Nicosia,

Limassol and Larnaca are mainly supported by local

demand, while Paphos and Famagusta are mainly

supported by foreign demand.

The market is further segmented in three main sectors,

being the residential, retail and office sectors, with the

primary emphasis being upon the residential sector as

the island’s topography and geography appeal largely for

residential utilization.

The construction production index witnessed a 0,3%

increase in 2015 compared to 2014. For 2016, there has

been an increase of 12,0% in Q3 compared to Q3 of

2015. The increase in the Construction Production Index

has continued for the 6th consecutive quarter, reflecting

the general improvement in the construction industry.

The cost of construction materials increased from 2007

onwards. This is depicted in the Construction Materials

Price Index with an increase from 98,9 to 105,09 from

2007 to 2014, as shown in Graph 8. Since 2014 the price

index has been decreasing, falling to 102,27 in 2015. The

Index for 2016 shows a continuation of the declining

trend reaching an average figure of 100,50.

Graph 8

Source: CYSTAT

During 2015 there was a slight decrease in average prices

of all basic materials compared to 2014 and this trend

has continued in 2016. For example, minerals and mineral

products dropped by 2,11% and 2,14% respectively in

2016 compared to 2015. Average prices for 2016 show a

further decrease in all materials (Table 3).

Table 3

Source: CYSTAT

85,00

90,00

95,00

100,00

105,00

110,00

Price Index

Year

Index

Construction Materials Price Index (Basis 2010 = 100)

Construction

Materials

2013 2014 2015 2016

Minerals 105,49 109,89 106,81 104,56

Mineral products 108,10 112,19 108,67 106,34

Products (timber,

insulating materials,

chemicals and

plastics)

98,78 100,27 98,74 98,52

Metal products 104,52 101,19 97,98 95,23

Electromechanical

products

101,80 100,80 98,50 98,29

13Cyprus Real Estate Market Report | March 2017

Building permits

Total building permits from January-November of 2016

amounted to 4.900. This constitutes an increase of

7,0% from the equivalent period of 2015. Residential

building permit numbers increased by 8,3% whereas

nonresidential building permit numbers have remained

unchanged from 2015. Furthermore, civil engineering

project permits increased by 7,3%. The number of

permits in plot division and road construction projects

increased by 11,1% and 19,2% respectively.

As building permits exhibited a 7,0% increase in

numbers, value and area (m

2

) were positively correlated,

increasing 12,3% and 16,8% respectively. This can be

attributed to residential building permits which increased

25,3% in value and 20,2% in area.

Table 4

Source: CYSTAT

Details of Building Permits in 2016 (January - November)

Category Number Area

(m

2

)

Value

(€000)

Residential Buildings

3.350

(+8,3%)

742.154

(+20,2%)

760.395

(+25,3%)

Non-Residential

917

(0%)

185.557

(+7,4%)

210.928

(-3,7%)

Civil Engineering -

Projects

177

(+7,3%)

6.060

(-34,3%)

18.576

(-67,9%)

Division of Plots

369

(+11,1%)

30.844

(+21,4%)

Road Construction

87

(+19,2%)

7.104

(+14,2%)

Total

4.900

(+7,0%)

933.771

(+16,8%)

1.027.847

(+12,3%)

Large Projects

204

(-+3,6%)

415.214

(+20,7%)

459.308

(+7,1%)

Small Projects

4.696

(+7,1%)

518.557

(+13,8%)

568.539

(+16,8%)

Note: % in brackets is the annual change from 2015 to 2016

For the period January-November 2016, Limassol

experienced the biggest increase in value (44,2%)

compared to the corresponding period of 2015. An

increase in value was also exhibited in Nicosia (11,0%).

On the other hand, Famagusta experienced the biggest

reduction in value (-14,8%) between 2016 and 2015,

while a fall in value was also observed in Larnaca and

Paphos with a decrease of 7,6% and 3,7% respectively.

Considering the total areas (m2) for building permits,

Limassol witnessed the biggest increase (45,3%)

compared to the first 11 months of 2015. Area for

building permits in Nicosia, Famagusta and Larnaca

also increased by 9,0%, 3,5% and 20,0% respectively,

whereas Paphos experienced a decrease of 9,2%.

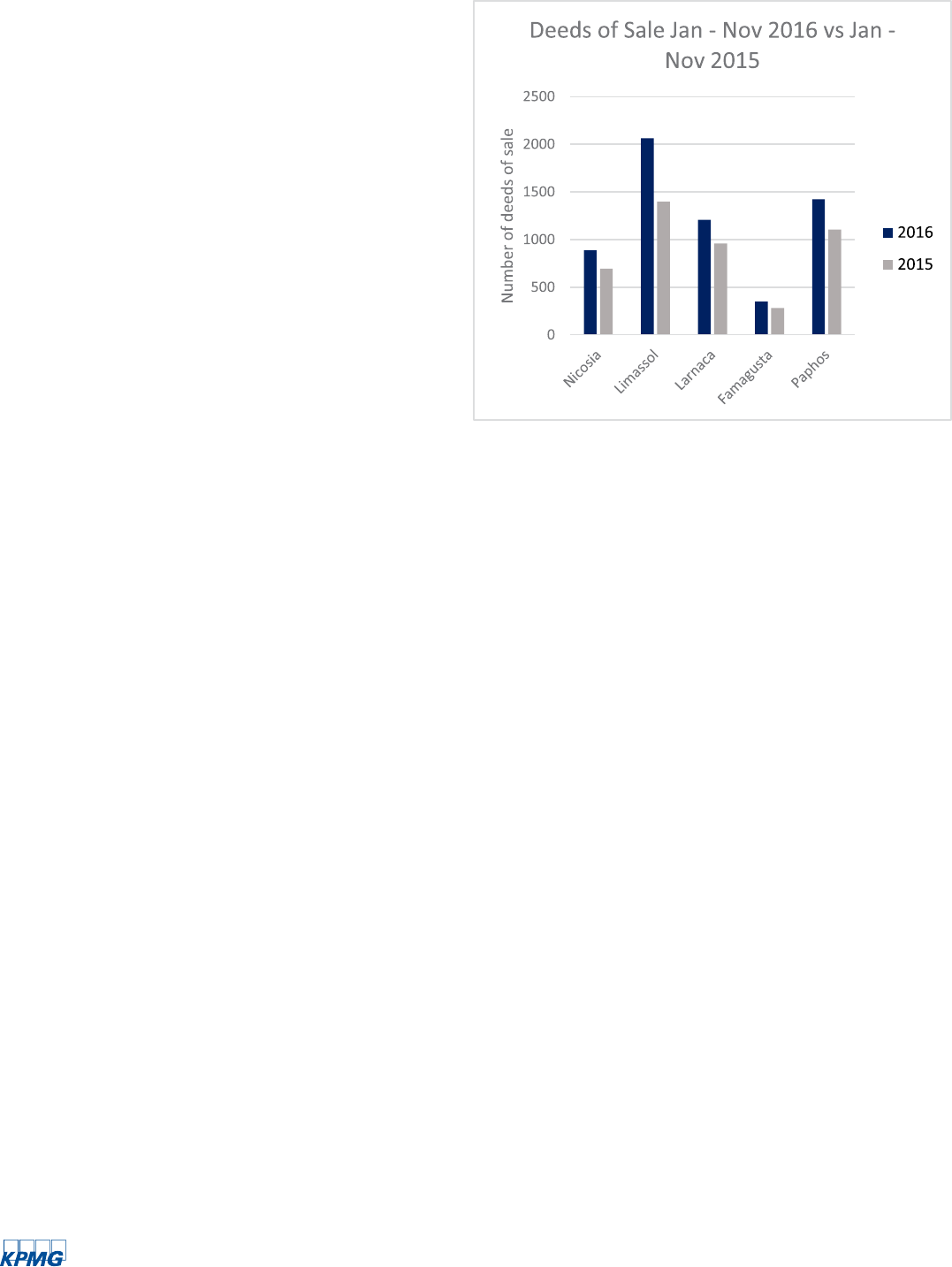

Deeds of sale

In relation to deeds of sale, the 2015 volume of

transactions accumulated to 4.952, a 77% decrease in

comparison to 2007 when the economy and especially

the real estate sector were thriving and transaction

volumes reached a total of 21.245. In light of this, a clear

recovery is taking place as extrapolated when comparing

deeds of sale submitted to the Land Registry in 2016

and 2015. In 2016, deeds of sale transactions amounted

to 7.063. This is a considerable increase in transactions

(43%) compared to 2015.

According to data of the Department of Land and

Surveys, Limassol has had the highest number of

transactions in Cyprus in 2016 representing 35,3% (2.496

transactions) of the total transactions (Graph 9).

Paphos, Larnaca and Nicosia follow second, third and

fourth with 24,6%, 19,3% and 14,6% of the total

number of transactions in 2016 respectively. Famagusta

experienced the lowest number of transactions at

6,2% (436 transactions) in 2016. This may be attributed

to higher seasonal demand for the area, especially

for holiday homes, which are still considered ‘luxury’

purchases after the bail-in period.

Graph 9

Source: Department of Land and Surveys

Of the total deeds of sale submitted to the land registry

for 2016, it is noteworthy that 25,67% (1.813) relate to

sales to foreign buyers. This is a 34,44% increase from

last year’s comparative figure and can be attributed to the

fact that Cyprus has attracted foreign investors via the

scheme for naturalization of investors by exception.

The largest proportion of foreign deeds of sale is

exhibited in Paphos reaching 8,88% of the total deeds

of sale submitted in 2016. Limassol follows with 8,65%,

Larnaca 4,74%, Nicosia 1,85% and finally Famagusta

with 1,54%. It must be noted that foreign interest is

primarily focused on the residential sector in prime

locations with close proximity to the beach.

15Cyprus Real Estate Market Report | March 2017

Property Price Indices

The Royal Institute of Chartered Surveyors (‘RICS’)

Cyprus Property Price Index is published on a quarterly

basis and focuses on both residential and non-residential

property (including retail and offices) and also tracks

trends on rental rates.

The information provided by RICS is based on the

average price and rent of the sub-districts monitored per

urban centre per sector.

While the yearly average comparison for 2015 and 2014

registered a drop in prices of all types of property in the

industry, the first three quarters of 2016 exhibit a reverse

trend as prices seem to be on the rise.

A. Residential Property

Apartment prices and rents according to RICS are based

on 85 m2, two-bedroom apartments of medium quality.

i) Apartments

Sales Prices

The average price for an apartment in Cyprus in 2015 was

€100.659, whilst in 2014 it was €103.104. The average

of the first three quarters in 2016 (€101.461) exhibits an

increase in prices of 0,80% from the 2015 yearly average

(Graph 10). The highest apartment prices for Quarter

3 2016 are found in Larnaca (€116.741). Larnaca also

exhibits the largest increase between Quarter 3 2015 and

Quarter 3 2016 with 5,0%.

Graph 10

Source: Rics

Graph 11

Source: Rics

ii) Houses

Housing prices according to RICS Index relate to

semidetached, three-bedroom houses (250m2) of

medium quality with garden.

Sales prices

The average price for a house in Cyprus in 2015

was €327.027, whilst in 2014 it was €332.848. This

corresponds to a 1,75% fall in prices (Graph 12).

Rental Rates

Average monthly rates in 2015 for all apartments in

Cyprus had dropped 2,07% from €331 in 2014 to €324.

However, when comparing the average of the first three

quarters in 2016 with the 2015 yearly average, an increase

of 4,94% in rates is evident (Graph 11). The highest rental

rates for apartments across Cyprus in the most recent

Quarter 3 2016 data are found in Limassol (€397) while

the largest increase in apartment rents between Quarter

3 2015 and Quarter 3 2016 was exhibited in Famagusta

(10,2%). The only city experiencing a small reduction

in apartment rents between the relative periods was

Larnaca with a decrease of 0,2%.

The average house prices in Cyprus for the first three

quarters in 2016 when compared with the 2015 yearly

average, indicates a 2,0% increase, reaching a value of

€332.155. The highest house prices for Quarter 3 2016

were found in Paphos (€384.644) which also exhibited

the largest increase from Quarter 3 2015 with 9,29%.

The only city experiencing a decrease in house prices in

Quarter 3 2016 compared to Quarter 3 2015 was Nicosia

with 0,05%.

Graph 12

Source: Rics

Rental rates

Average monthly rates for 2015 for all houses in Cyprus

have dropped from €538 in 2014 by 0,93% to €533. The

average house rent in Cyprus for the first three quarters

of 2016 was €556 compared to the yearly average of

€533 for 2015 (4,3% increase). Limassol had the highest

average house rents for Quarter 3 2016 (€677) while

the largest increase from Quarter 3 2015 was found in

Nicosia (15,5% increase). The only city experiencing a

decrease in average house rents was Larnaca (8,8%

decrease) (Graph 13).

B. Retail Property

Sales prices

The average price for retail properties in Cyprus in 2015

was €349.546, whilst in 2014 it was €367.939. This

corresponds to a 5% drop. The average from the first

three quarters of 2016 (€348.263) exhibits a drop of

0,40% in retail sale prices compared to the 2015 yearly

average (€349.546). The highest retail prices for Quarter

3 2016 were found in Nicosia with €506.976 while the

biggest increase from Quarter 3 2015 was found in

Paphos with 5,0% (Graph 14). Meanwhile, Limassol and

Larnaca experienced decreases in retail prices of 1,9%

and 2,1% respectively.

Graph 14

Source: Rics

Graph 13

Source: Rics

17Cyprus Real Estate Market Report | March 2017

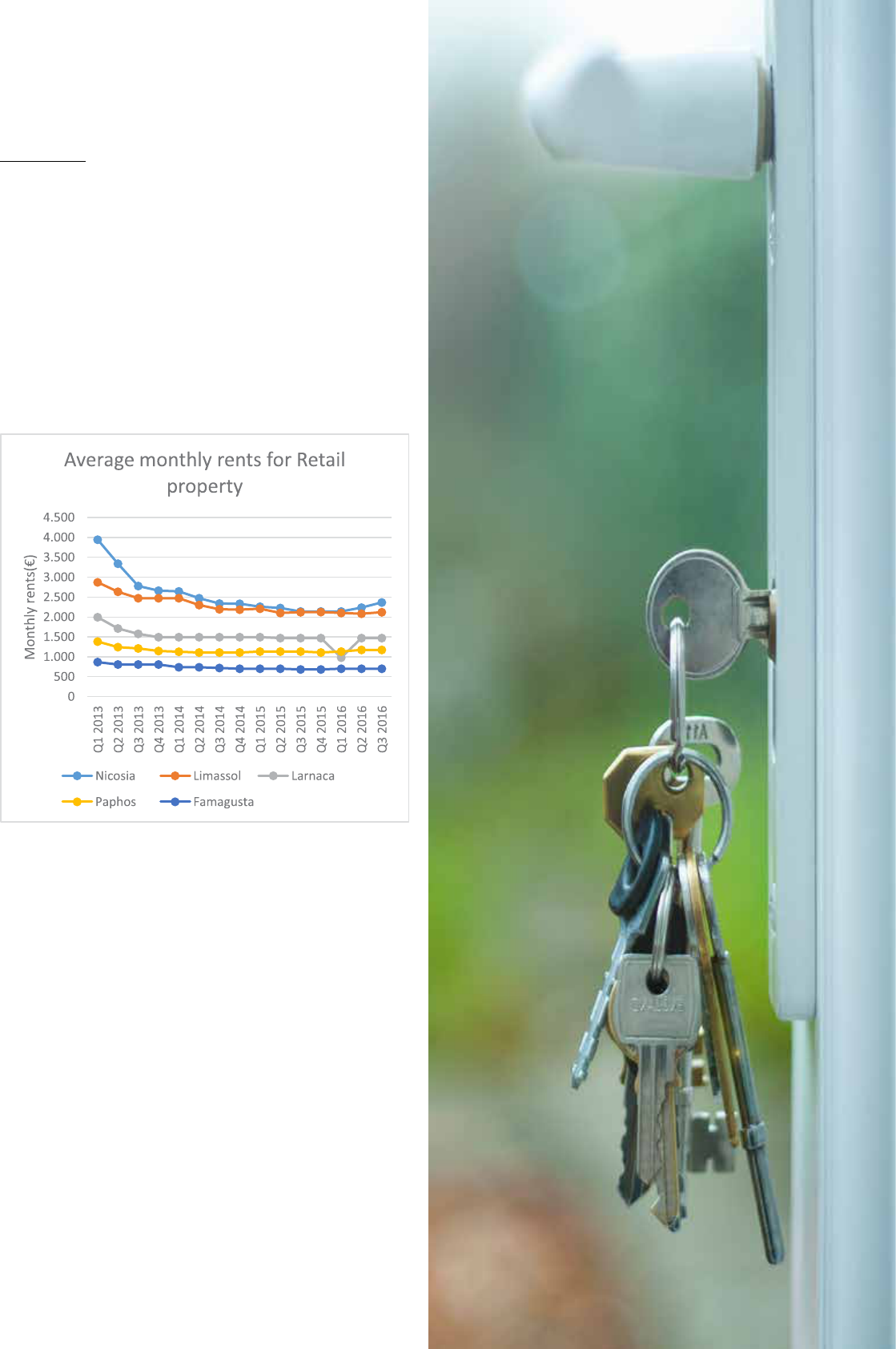

Rental rates

Average monthly rental rates in 2015 for retail properties

in Cyprus have dropped by 5,55% from €1.614 in 2014

to €1.524. During the first three quarters of 2016, the

average was €1.503, a decrease of 1,4% from the

yearly average of 2015. The highest rental rates for retail

property for Quarter 3 2016 were found in Nicosia with

€2.365, also experiencing the largest increase from

Quarter 3 2015 (10,6%). All other cities experienced

an increase in retail property rental rates as well when

comparing Quarter 3 2016 with the corresponding period

of 2015, as shown by Graph 15.

Graph 15

Source: Rics

C. Offices

An average office used by RICS in the preparation of

its Index is a Grade A one with city centre location

comprising 200m

2

.

Sales prices

The average price for office properties in Cyprus in

2015 was €344.134, whilst in 2014 it was €355.211. This

corresponds to a 3,12% drop. The first three quarters

of 2016 average was €352.347 exhibiting an increase of

2,4% in office sale prices compared to the 2015 yearly

average (€344.134). The highest office prices for Quarter

3 2016 were exhibited in Nicosia with €523.964 while

Limassol experienced the largest increase from Quarter 3

2015 with 8,3%.

Graph 16

Source: Rics

Rental rates

Average monthly rental rates for 2015 for office

properties in Cyprus dropped by 1,88% from €1.292 in

2014 to €1.268. For the first three quarters of 2016, the

average rent for offices in Cyprus was €1.310, exhibiting

a 3,3% increase from the 2015 yearly average. Increase

in rates for Quarter 3 2016 compared to Quarter 3 2015

was witnessed in all areas, with the largest exhibited in

Paphos (5,9%). Meanwhile the highest office rents for

Quarter 3 2016 were found in Nicosia with €2.187.

Graph 17

Source: Rics

19Cyprus Real Estate Market Report | March 2017

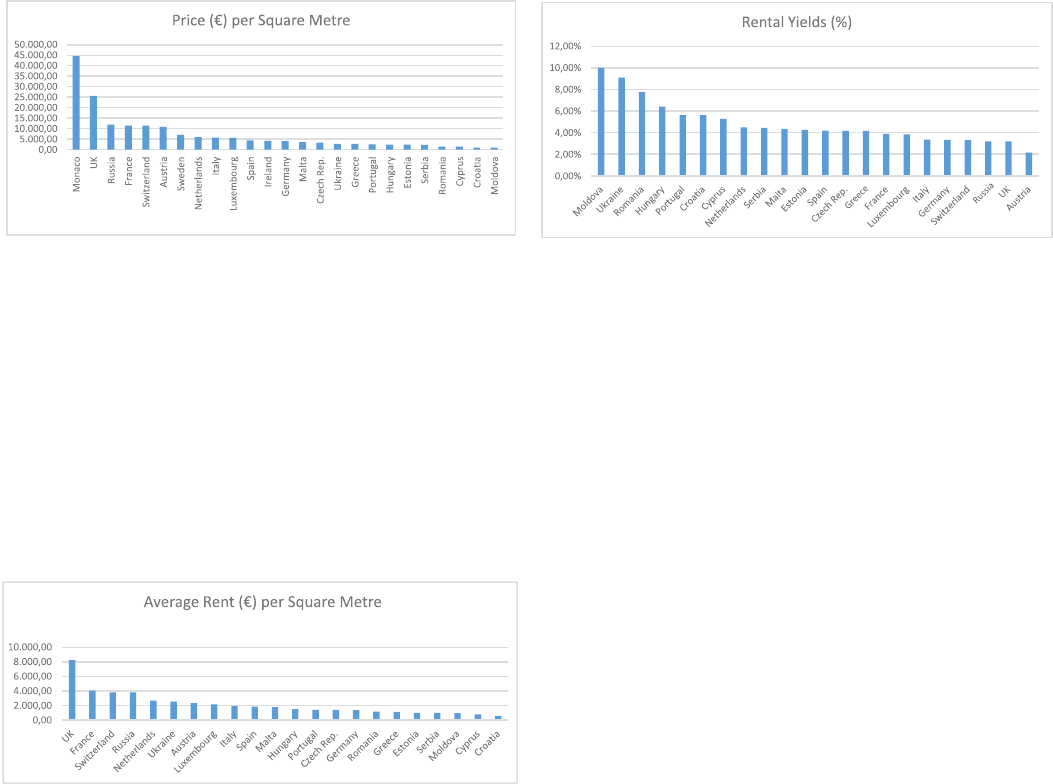

Real Estate Market

Overseas Comparisons

Prices per Square Metre

The majority of European counties are below the €5.000

per square metre mark. Cyprus has an average price

of €1.530 per square metre and currently ranks 33rd

amongst the counties situated in the European continent.

Not surprisingly Monaco ranks 1st with an average

price of €44.522 per square meter, followed by the UK

and Russia with €25.575 and €11.866 per square metre

respectively (Graph 18).

Graph 18

Source:www.globalpropertyguide.com

Average Monthly Rental Rates

The basis for this comparison is a 120 m2 residential

property. The majority of the European countries are

below €2.000 per month. Cyprus ranks 32nd with an

average monthly rental rate of €810 and is therefore

considered as one of the cheapest counties in respect

of rent across Europe. Expectedly UK ranks 1st with an

average monthly rental rate of €8.213 followed by France

and Switzerland with €4.057 and €3.827 respectively

(Graph19).

Graph 19

Source:www.globalpropertyguide.com

Rental Yields

The “yield” of a property depicts the annual return of

the property to the investor/owner. It is calculated by

expressing a year’s rental income as a percentage of

how much the property cost. European counties’ average

rental yield is at 4,83%. Cyprus is above this average

with a yield of 5,29%. Moldova ranks 1st with 10%

followed by Ukraine and Romania with 9,09% and 7,76%

respectively (Graph 20).

Graph 20

Source:www.globalpropertyguide.com

Other Matters

Cyprus Citizenship

The Cypriot Government through the Ministry of Interior,

has approved on the13

th

of September 2016 the revised

criteria for granting the Cypriot Citizenship by investment,

in an effort to further promote foreign direct investments

in Cyprus.

Revised criteria include:

• The applicant must have made an investment of €2,0

million (excluding VAT) in any qualifying investment

category or a combination as described below

(previously it was €5,0 million if applied individually or

€2,5 million if applied through a collective investment

scheme).

• The investment in government bonds of the Republic

of Cyprus is now restricted to €500.000.

• The applicant must be the holder of a Residency

Permit in Cyprus to qualify for receiving the Cyprus

Citizenship. For this purpose, an application for

a residency permit should be submitted to the

Authorities,simultaneously with the filing of the

Citizenship application.

• The investor’s parents are entitled to apply for Cyprus

citizenship by exception, provided that they are

owners of a permanent residence of at least €500.000

excluding VAT. For this purpose, the investor and his/

her parents may acquire one residential property of

a total value of at least €1,0 million, excluding VAT

(€500.000 being allocated to the investor and the

remaining €500.000 being allocated to the parents of

the investor).

Criteria for granting Cypriot Citizenship by exception

1. Real estate and land developing

The applicant should have a direct investment in

Cyprus of at least €2,0 million for the acquisition

or development of real estate projects (residential,

commercial, tourism or other infrastructure). It shall be

noted that investment in land under development is

included in this criterion, provided that an investment

plan for the development of the purchased land will be

included in the application.

2. Purchase or creation or participation in Cypriot

businesses or companies

The applicant must have made an investment of

at least €2,0 million in the purchase, creation, or

participation in businesses or companies, that are

based and operating in Cyprus. These businesses or

companies should evidently have a tangible presence

and substantial activity in Cyprus and employ at least

five (5) Cypriot or EU citizens who have been legally

residing in Cyprus for a continuous period of at least 5

years.

3. Investment in alternative investment funds

(AIFs), financial assets of Cypriot businesses or

organisations which are licensed by the Cyprus

Stock Exchange Commission

The applicant must have purchased financial assets of

at least €2,0 million (units in AIFs, bonds, debentures,

other securities, etc.) registered and issued in the

Republic of Cyprus, in companies or organisations

with substantial economic activity in Cyprus which are

regulated by the Cyprus Stock Exchange Commission.

4. Combination of the aforementioned criteria

The applicant may choose to have a combination of

any of the above criteria amounting to at least €2,0

million. In the context of this criterion (i.e. combination

of investments), the applicant may also purchase

governmental bonds of the Republic of Cyprus of a

maximum amount of €500.000.

Other Conditions

It is noted that in addition to satisfying any one of the

above criteria, the applicant must:

1) Have a clean criminal record; and

2) Acquire a permanent residence in Cyprus valued at

least €500.000 excluding VAT. (This condition does

not apply if the investment under Criterion 1 is solely

in residential property).

21Cyprus Real Estate Market Report | March 2017

In a nutshell: Competitive advantages of the Cyprus

Citizenship Program:

• Investments in a variety of sectors of the Cyprus

economy;

• Combination of investments is available;

• No donation to the Cypriot Governmentis required;

• The investments may be realized after 3 years have

elapsed;

• The amount of investment required is reasonable (as

low as €2 million);

• Once citizenship is granted there is no requirement to

reside in Cyprus.

Immigration permits

The Ministry of the Interior released a revised “fast”

track procedure for granting an immigration permit to

third country nationals that intend to take up permanent

residency in Cyprus, provided that they fulfil certain

criteria.

The application form must be accompanied by a

title deed or a contract of sale that has already been

submitted to the Department of Land and Survey, for

the acquisition of a house, apartment or any other

building situated in Cyprus, of a minimum market value of

€300.000 (plus VAT). Further, the applicant must submit

proof of payment for at least €200.000 (plus VAT) in

respect of the above mentioned property.

Immigration Permit can be granted to the applicant’s wife

and children as long as the children are under the age

of 18. Provided that the applicant’s unmarried children

between the ages of 18 and 25 are students abroad with

a remaining study period of at least 6 months from the

application submission date and are financially dependent

on the applicant, they are also eligible. Immigration

Permit can also be granted to the applicant’s parents.

Transfer of immovable property

Fees on transfer of immovable property are imposed by

the Department of Land and Survey in order to transfer

the ownership of the property to the purchaser. The fees

are payable upon transfer of ownership. The purchaser

is responsible for the payment of transfer fees, except

if other arrangements are made between the purchaser

and the vendor. The rates used for the calculation of fees

on transfer of immovable property are shown in Table 5.

Table 5

As far as transfer fees are concerned, it is pointed out

that incentives provided have become permanent.

This means that there will be no transfer fees for

immovable property purchases subject to VAT, while for

other purchases transfer fees will be reduced to 50%,

as estimated based on the provisions of the current

legislation.

Following the tax reforms of 2015 and 2016 further

reductions of transfer fees on real estate transactions

were introduced. In particular:

i) the transfer fees payable on immovable property from

parent to child have been abolished;

ii) the fees payable in cases of exchange of immovable

property of equal value is abolished;

iii) in cases of family companies, the refunding of fees

on immovable property transfer after the period of

five years will be abolished. As a result the right for

reduced fees for the transfer of immovable property

from a family company to a shareholder thereof is

abolished.

Property taxes

Property tax is imposed on all types of immovable

property in Cyprus.

Immo vable Proper ty Value Rates on Transf er fee s

Up to €85.000 3%

€85.001 - €170.000 5%

€170.001 and over 8%

r8

Immovable property tax rates

According to a law proposal voted by the majority of the

Cyprus Parliament, the immovable property tax for the

remainder of 2016 was reduced to 25% of the total tax

arising using the current rates, and it was fully abolished

from January 2017.

Municipal tax

Proprietors also incur municipal tax on immovable

property (Town Rate). This is an annual tax which is levied

as a result of property ownership within the limits /

boundaries of each municipality, with certain exceptions

included in the relevant legislation.

Inheritance Tax

It must also be noted that there is no inheritance tax in

Cyprus.

Capital Gains Tax

Capital gains tax of 20% is charged on gains upon sale of

immovable property located in Cyprus, which is incurred

during the year in which the property is disposed of.

Depending on the type of property being disposed,

lifetime exemptions applicable to individuals for gains

from the sale of immovable property are as follows:

(a) Disposal of property: up to €17.086;

(b) Disposal of agricultural land: up to €25.629;

(c) Disposal of permanent residence: up to €85.430.

A full exemption from capital gains tax was granted for

the sale of immovable property consisting of land, or

land with a building or buildings, was acquired from an

independent party, at market value, from 16 July 2015

until 31 December 2016. That is, regardless of when

the property will be sold, in essence it is sufficient that

it has been bought up until 31 December 2016 and no

capital gains tax will be payable. The exemption applies to

immovable property that was acquired by purchase or by

purchase agreement but not to immovable property that

was aquired by a donation/gift or by way of an exchange.

Stamp duty

Stamp duty is a tax which is charged on certain types of

instruments/agreements which deal with Cyprus situated

immovable property, irrespective of whether executed

in Cyprus or outside Cyprus. As from 1st March 2013,

the stamp duty levied is 0% for amounts up to €5.000,

0,15% for amounts between €5.000 and €170.000, and

0,2% for amounts over €170.000, up to a maximum

stamp duty of €20.000 per instrument/agreement.

VAT rates

In general, VAT is imposed on the supply of goods and

services in Cyprus, as well as on the acquisition of goods

and services from suppliers established outside Cyprus.

The current standard VAT rate is 19%.

As per the Cyprus VAT Act, the acquisition of land

plots is exempt from VAT. However, the acquisition of

buildings and residential properties is subject to 19%

VAT. Nonetheless, the VAT rate on the acquisition of

residential properties can be reduced to 5% provided that

the following conditions are collectively met:

Condition regarding the use

The qualifying residential property is used or is intended

to be used by the beneficiary as his/her main and

permanent place of residence.

Condition regarding the process

The beneficiary must submit a declaration to the Cyprus

VAT authorities for certification.

Conditions regarding the rightful person

For an applicant to be considered a beneficiary, the

following requirements must be met:

• Be a physical person.

• At the time of submission of the declaration (on a form

specially designed for this purpose), be 18 years of age

or above.

• Be a citizen of the Republic of Cyprus or of any other

Member State and be a permanent resident in the

Republic of Cyprus.

Extension of the reduced VAT rate to citizens from

third countries

With effect from 8th June 2012, the reduced VAT rate of

5% may also be applied on the supply or construction

of residential properties to citizens of third countries

(e.g. Russian Federation, USA, China, etc.) if the said

residences will be used by the applicant as his/her

principal and permanent place of residence whilst in the

Republic.

Conditions regarding the property

• The application for the planning permission or

building permit must have been submitted after the

1

st

May 2004.

• It must be intended for the property to be used after

its purchase or construction as the permanent and

main place of residence.

• The 5% reduced VAT is applied only on the first 200m

2

regardless of the total size of the residence.

Basic requirements for the application of 5% VAT to

non-EU citizens

• The property must be used as the main and

permanent place of residence in the Republic.

• There is no time limit for non-European citizens to

stay in the Republic. Thus, the reduced VAT rate of

5% may be applied even if the non-European buyer

has not completed 183 days of residency in the

Republic, so as to be considered tax resident in the

Republic.

• The reduced rate of 5% cannot be applied if the

property is used for investment or leasing purposes

or to exercise any other economic activity.

Moreover, as of December 4

th

2015 the reduced rate

of 5% applies for renovations and repairs of all private

dwellings, for which at least three years have passed

from the first use, including those that are not used as a

principal and permanent place of residence.

Note that until 3rd December 2015 the reduced rate

covered only houses that were used as “the principal and

permanent place of residence.”

By deleting from the definition of residence, in paragraph

11, the phrase “principal and permanent”, the reduced

rate of 5% now covers holiday houses as well.

The reduced VAT rate of 5% is relevant to work

performed by plumbers, electricians, carpenters, house

painters and construction workers, provided that the

value of the materials does not exceed fifty percent

(50%) of the total value of the renovations or repairs. It is

clarified that the definition of residence covers multiple

property buildings (apartment buildings).

It is noted that in order for the above work to fall within

the reduced rate, they should be carried out within the

scope of renovation or repair of private residence.

23Cyprus Real Estate Market Report | March 2017

Amendment of tax legislation relating to

debt restructurings

According to these amendments any benefit, surplus

or profit which may arise under a restructuring is exempt

from income and corporation tax (i.e. in case where

the borrower’s main activities are construction or land

development). On subsequent disposal of an asset which

was acquired in the context of restructuring, the base

cost is deemed to be the restructuring price, reduced by

any amount refunded to the borrower.

A similar amendment has been made in the Capital Gains

Tax legislation so that any restructurings with borrowers,

whose activity does not include property trading, is also

tax neutral.

Additionally, any Special Contribution for Defence for

deemed dividend distribution on accounting profit which

arises under a restructuring is not payable. This is, in

case where the restructuring price is higher than the

original cost, any deemed profit is not subject to deemed

dividend distribution. It is reminded that the Special

Contribution for Defence Law only applies to Cyprus tax

residents.

Finally, any immovable property repossessed by the

financial institutions during a loan restructuring is neither

subject to transfer fees nor stamp duty.

Abolition of fees and stamp duty in certain cases for loan

transfer.

The law of the Department of Land and Surveys (Fees

and Charges) has been amended in order to provide that

no fee shall be imposed on the amount of the initial loan

facility contract in certain instances when a mortgage is

cancelled and a new mortgage is created, namely:

• Where a mortgage on an immovable property is

cancelled and on the same day a new mortgage

is created on the same property for the

same purpose, regardless of whether it

is in favour of the same or any other mortgagee.

• Where a mortgage on an immovable property is

cancelled and on the same day a new mortgage is

created on the same property for the same purpose

in favour of the same mortgagee and the amount of

the new mortgage, excluding any interest, is less or

equal to the amount of the mortgage that has been

cancelled.

• In the case of transfer of a mortgage (including

transfer from parent to child) for any amount that

remains unpaid on the date of the transfer.

Moreover, the Stamp Duty Law has been amended

so that no stamp duty is payable in cases where the

mortgage on an immovable property is cancelled and a

new mortgage is created on the same property for the

same purpose on the same day, regardless of whether it

is in favour of the same or any other mortgage.

Introducing the Non-Domicile Principle

The current Special Contribution for Defence (SCD)

provisions will exclude dividends, interest and rents (as

well as from deemed dividend distribution provisions),

earned by individuals who are Cyprus tax residents but

are not domiciled in Cyprus (as defined in the SCD Law)

irrespective of the origin of the relevant income (i.e. from

sources within Cyprus or abroad).

The new provisions define domicile in accordance with

the rules of the Wills and Succession Law under which

two main kinds of domicile are identified:

• A domicile of origin (i.e. the domicile received by a

person at birth); and,

• A domicile of choice (i.e. the domicile acquired by

a person by establishing a home with the intention of

a permanent or indefinite residence).

A person who has his domicile of origin in Cyprus will be

treated as “domiciled in Cyprus” for SCD purposes with

the exception of:

• An individual who has obtained and maintained

a domicile of choice outside Cyprus under the

provisions of the Wills and Succession Law, provided

that this individual was not a Cyprus tax resident for a

period of at least 20 consecutive years prior to the tax

year in question; or

• An individual who was not a Cyprus tax resident for a

period of at least 20 consecutive years immediately

prior to the entry into force of the introduced

provisions (i.e. prior to 16 July 2015).

An individual who is tax resident in Cyprus for a period of

at least 17 years out of the last 20 years prior to the tax

year in question shall be deemed as domiciled in Cyprus

for SCD purposes regardless of whether or not he/she

has a domicile of origin in Cyprus.

The above provisions will result to the complete

exemption from SCD of a Cyprus tax resident individual,

who, in adopting the rules above is not a domicile of

Cyprus for SCD purposes.

However, the exemption from SCD will not apply in

the event of any assets that may give rise to SCD have

been transferred from an individual domiciled in Cyprus

to an individual not domiciled in Cyprus where one of

the main reason for the transfer was to benefit from the

exemption. In such a case, SCD will be imposed on the

income derived from such assets and may be collected

either from the transferor or the transferee accordingly.

Notional Interest Deduction

In an attempt to reduce excessive debt financing and

encourage the investing of equity in corporate structures

(hence reducing the overall debt exposure and

deleveraging the economy), the new amendments

provide for a deduction on new equity by way of a

Notional Interest Deduction (NID) as of 1st January 2015.

The NID will be calculated on the basis of a reference

interest rate on new equity held by the company and

used in the business.

Property foreclosure legislation

A new procedure has been introduced to enable the

enforcement of mortgages as security rights against

debtors through foreclosure. The purpose of the

amendment was to minimize the involvement of the

Lands Office in such a manner that the procedure is

driven by the secured creditors instead, in an attempt

to expedite property foreclosures, protect creditors’

rights and offer an alternative more efficient approach

to security realization, thus increasing the credibility of

Cyprus in an area which cause considerable concern in

the past.

One of the most prominent features of the new

procedure, is the imposition of strict deadlines

for adherence in an attempt to reduce the time of

completion of the process, without at the same time

jeopardizing the debtor’s rights to be heard. In particular,

the secured creditor may initiate foreclosure proceedings

once the loan is terminated and the repayments/

instalments are overdue for a period exceeding 120

days. After the relevant notices have been served and

relevant publications are made in the official government

newspaper and daily press, within the timeframes

provided for in the law, the secured creditor can initiate

the proceedings.

Another prominent feature of the new process is the

introduction of a procedure for the valuation of properties

which aims at the participation of both the lender and

the borrower. The valuation process as set out by the

law provides that both the secured creditor and the

borrower shall appoint a valuer each in order to establish

the market value of the asset in question. The borrower

has the right, instead of appointing a valuer, to opt that

the market value of the asset will be considered to

be the value according to the latest general valuation

(currently made on 1 January 2013). The market value

of the asset will be the average of the two estimates,

provided that the difference between the two valuations

does not exceed 25%. In such a case, a third valuer

will be appointed and the market value of the asset

will be considered to be the average of the two closest

valuations.

The new law has come into effect in April 2015. The

first auctions took place within 2016 and related to

commercial buildings and land plots.

Insolvency framework

The adoption of the insolvency framework has

modernised the insolvency legal regime of Cyprus,

through the introduction of five pieces of legislation,

including two new and three amending laws. In

particular:

1. Insolvency of Natural Persons (Personal Repayment

Schemes and Debt Relief Order) Law of 2015

This Law provides for the establishment and operation

of two new mechanisms in relation to natural persons.

The first mechanism provides for the promotion and

agreement of PIA with the assistance and coordination

of an insolvency practitioner appointed for this purpose

of Personal Insolvency Arrangement, in order to facilitate

the restructuring of debt of natural persons, so as to

ensure the repayment of creditors and, where possible,

protect the primary residence. Under strict eligibility

criteria and if the Repayment Scheme is not accepted by

creditors, then the law allows for its enforcement on the

creditors by the court in order to safeguard the primary

residence For the purpose of negotiating the terms

to a PIA the law allows for a moratorium period i.e. a

period of protection over which the debtor is considered

to be under the protection of the court and no legal

proceedings may commence or continue against the

debtor including any proceedings which may be relevant

to an enforcement of a court order against the debtors’.

2. The Bankruptcy (Amending) Law of 2015

The main amendment introduced by the Bankruptcy

(Amending) law, is the introduction of a mechanism

whereby the bankrupt is discharged from certain debts

3 years after the declaration of bankruptcy and provided

that he has acted in good faith and cooperated with

the Official Receiver or the Bankurptcy Administrator for

the colleciton and realisation of the bankruptcy estate.

Moreover, the bankruptcy procedure is now simpler, as

the old two-stage procedure here by the Official receiver

becomes the legal owner of all assets, without further

court involvement.

3. Companies (Amending) Law of 2015, regarding

winding up

The aim of this law is the modernisation of the winding

up legislation. One of the main amendments relates

to the decision-making during creditors’ meetings. The

law introduced decision-making by a majority of value,

whereas under the old system a majority in number

and in value was necessary, which often resulted to

delays.

25Cyprus Real Estate Market Report | March 2017

Moreover, liquidators will now be Insolvency

Practitioners, licensed under the new law and also their

powers are enhanced, for instance to include the power

to sell charged assets.

4. Companies (Amending) Law (No. 2) of 2015,

regarding a appointment of an examiner

This amendment introduces a restructuring procedure for

viable companies which have run into financial difficulties.

In particular, the law provides for the appointment of an

examiner to a company by the court, when the company

has a reasonable prospect of survival as a going concern.

In essence, it provides an opportunity for companies

that are insolvent to explore all options available to

them without the threat of any legal proceedings to be

initiated against the company, including the appointment

of a receiver or the filing for a winding-up order for the

period which the company is placed under the protection

of the court pending the preparation of the Examiners’

proposals for a scheme of arrangement and its approval

by a class of creditors.

5. Insolvency Practitioners Law and Insolvency

Practitioners Regulations of 2015

This law and regulations provide for the authorisation,

licensing and regulation of the profession of Insolvency

Practitioners. These set out the minimum qualification

criteria, as well as the duties of Insolvency Practitioners.

The Sale of Credit Facilities and related

matters Law

In November 2015, the House of Representatives

adopted legislation on the sale of credit. Under the

law, any person with the intention to establish a credit

acquiring company must obtain the prior approval

of the CBC. It is also noted that for all sales of loans

irrespective of the outstanding loan amount, in the case

of a loan sale borrowers maintain all rights provided by

existing legislation and CBC’s directives, including the

code of conduct for arrears management and insolvency

framework.

The scope of the law covers credit facilities granted to:

i. Natural persons who received loans from licensed

credit institutions with a total loan balance at

the time of acquisition of the loan not exceeding

€1.000.000;

ii. Very small and small businesses that received loans

from the licensed credit institutions with a total loan

balance (including the loans granted to the

connected persons, “Group of Companies”) of up to

€1.000.000.

iii. There are exempted credit facilities from the scope

of the law and these include those that are granted

by licensed credit institutions, including their

branches, to a natural person who is not a Cypriot

resident or to a legal person which is not registered

in the Republic of Cyprus; or relate with operations

and/or investments outside the Republic of Cyprus;

or have included as primary security, mortgage and/

or charge on immovable property which is located

outside the Republic of Cyprus; or are governed by

the Law of another country.

According to the law, the legal entities that are allowed to

acquire credit facilities are:

i. A credit acquiring company including an asset

management company, either with private or public

funds, in accordance with the European law on state

aid and taking into account the sustainability of the

public debt, which is incorporated in Cyprus and is

granted prior authorization by the CBC pursuant to

the provisions of the law.

ii. An authorized credit institution in Cyprus.

iii. A credit institution authorized and supervised by the

competent authority in another EU member state

that has the right to provide services or to establish

branches in the Republic of Cyprus;

iv. A financial institution that is a subsidiary of a credit

institution registered in an EU member state and

which has the right to provide services or establish a

branch in the Republic of Cyprus.

Authorisation for the operation of a credit acquiring

company will only be granted to legal persons that have

been incorporated in the Republic of Cyprus,

provided that the CBC is satisfied, inter-alia, that: these

legal persons are in a position to fully comply with the

provisions of the Law; they are able to maintain at all

times a minimum paid up share capital of at least one

hundred thousand euros (€100.000); their shareholders

and directors meet the criteria of fitness and probity; they

have an organisational structure that enables them to

provide services in accordance with the provisions of the

Law; and their planned operations do not raise concerns

regarding financial stability in the Republic of Cyprus.

In order to establish a credit acquiring company

in Cyprus, a legal person may submit to the CBC

an application with the accompanying documents

specified in the Law and in the relevant Directive on the

Authorisations of Credit Acquiring Companies Directive

of 2016 (the “Directive”). The Directive regulates, inter

alia, the procedures for granting an authorisation by virtue

of the provisions of the Law, the criteria for the fitness

and probity of shareholders, directors and key function

holders, the internal organisation and governance of the

CAC and the outsourcing of operational functions to third

parties.

27Cyprus Real Estate Market Report | March 2017

On grounds of national interest the CBC may (i) deny

legal persons the granting of the authorization regarding

the acquisition of credit facilities in the Republic, or (ii) not

permit the acquirement or increase of a special interest

in a credit acquiring-company, and (iii) not permit the

appointment of a director at a governing body of a credit

acquiring-company.

Before the total or partial sale of the credit facilities, the

credit or financial institution must notify its intention to

sell or dispose of all or part of its portfolio, giving the

right to the borrowers and to their guarantors, if they

wish so, within a time period of forty five (45) days,

to submit a proposal for the acquisition of the credit

facility which is under sale. Althernatively, the credit or

financial instituions may invite the borrower involved and

its guarantors, within a period of forty-five (45) days, to

submit a proposal for the acquisition of the credit facility

which is under sale with a letter to the borrower and

its guarantors. The borrower is not required to submit a

proposal for the acquisition of the credit facility which is

under sale; if within the period of forty five (45) days the

proposal is not submitted, then it shall be presumed that

the borrower does not wish to submit a proposal.

Any credit facility transferred by a credit institution,

financial institution or a credit acquiring-company

(hereinafter referred to as “the transferor”) to any

acquirers, is considered to be transferred to the acquirer

at the time of transfer, and all rights and obligations

arising from the credit facility contract of the account

which is in this way transferred, are transferred

automatically and bind the acquirer and the borrower.

The acquirer of credit facilities substitutes the transferor

in respect of all the rights relating to the collateral which

are attached to the credit facility agreement and which

are held for securing repayment of the credit facility

and for the same purpose, the collateral is transferred

to the acquirer. The acquirer of credit facilities has the

same rights, the same priority rankings and is subject

to the same obligations relating to the collateral held

for securing repayment attached to the credit facility

agreements that the transferor had.